Last updated: July 27, 2025

Introduction

Tropicamide, a muscarinic receptor antagonist used primarily as a mydriatic and cycloplegic agent in ophthalmology, has carved a niche within eye care treatments. Its rapid onset and short duration make it a preferred choice for eye examinations, but its market dynamics are influenced by evolving ophthalmic practices, regulatory pathways, and competitive innovations. This report provides a comprehensive market analysis and forecasts the price trajectory for Tropicamide, integrating current market trends, patent landscapes, manufacturing factors, and regulatory considerations crucial for industry stakeholders.

Market Overview

Pharmacological Profile and Therapeutic Indications

Tropicamide operates as a parasympatholytic agent demonstrating rapid onset (within 15–30 minutes) and short duration (approximately 4–6 hours), optimizing ophthalmic examination protocols. Its main indications include pupil dilation during diagnostic procedures and anterior segment surgeries. The compound’s safety profile, ease of administration, and cost-efficiency sustain its widespread utilization globally.

Current Market Landscape

The global ophthalmic diagnostic market, estimated at USD 6.2 billion in 2022, encompasses a broad spectrum of agents including Tropicamide, phenylephrine, and cyclopentolate. Tropicamide’s share remains significant owing to its rapid action and favorable safety data, especially in developed markets such as North America, Europe, and parts of Asia-Pacific.

Major pharmaceutical firms such as Alcon, Bausch + Lomb, and Akorn manufacture Tropicamide formulations—either as proprietary branded products or generic equivalents. Patent expirations in numerous regions have led to a proliferation of generic options, intensifying price competition.

Manufacturing and Supply Chain Considerations

Tropicamide synthesis involves well-established chemical routes, with raw material availability and manufacturing scale impacting overall production costs. The drug’s simple chemical structure and stable formulation facilitate manufacturing at scale, supporting price competitiveness. Supply chain stability across North America and Europe remains robust, although emerging markets face logistical challenges impacting affordability and access.

Competitive Landscape and Patent Dynamics

Most patents protecting Tropicamide formulations have expired or are nearing expiration, particularly in developed markets. This patent landscape fosters generic entry, exerting downward pressure on prices. Companies innovating on formulation delivery systems, such as preservative-free drops or sustained-release formulations, may claim new patents, potentially commanding premium pricing temporarily.

Emerging biosimilar or alternative agents targeting mydriatic and cycloplegic functions could challenge Tropicamide’s market positioning once approved, influencing future pricing strategies.

Regulatory Environment

Regulatory agencies, including the FDA and EMA, classify Tropicamide as a marketed drug with longstanding approval histories. While no major regulatory barriers currently impede generic replication, future changes—such as new safety data or approval of novel agents—could alter market dynamics and influence pricing.

Price Trends and Forecasts

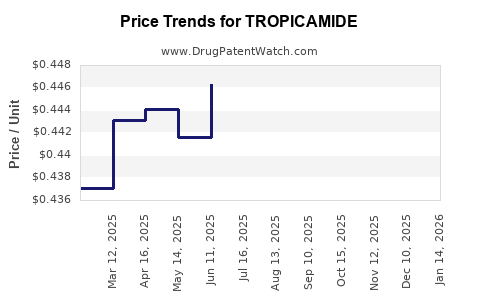

Historical Price Trends

Data indicate that the average wholesale price (AWP) per unit for Tropicamide 1% ophthalmic drops in the U.S. has declined by approximately 25% over the past five years, driven by generic competition and increased manufacturing efficiency. Similar trends are observed across European markets, with pricing stabilizing after initial significant drops post-generic entry.

Projected Price Trajectory (2023–2028)

Given current market forces, the following projections are anticipated:

- Short-term (1–2 years): Prices are expected to stabilize with minimal fluctuations as current generics saturate the market. Slight decreases of 5–8% annually are plausible due to economies of scale and increased production volume.

- Medium-term (3–5 years): Prices may decline further by an additional 10–15%, reaching a plateau limited by production costs and minimal profit margins for manufacturers.

- Long-term (beyond 5 years): Market saturation and the potential emergence of alternative agents may constrain pricing further. However, niche formulations or patent-protected delivery systems could sustain higher prices for select products.

Emerging Factors Influencing Future Valuations

- Innovative Formulations: Development of preservative-free, sustained-release Tropicamide formulations could command premium pricing and extend patent protection.

- Regulatory Approvals in Emerging Markets: Approvals in rapidly growing Asian markets such as India and China will diversify revenue streams and influence global pricing.

- Market Consolidation: Mergers and acquisitions among generic producers may impact pricing strategies, either stabilizing or further driving prices down.

Conclusion

Tropicamide’s market remains predominantly characterized by generic proliferation, exerting downward pressure on prices. While current forecasts suggest continued stabilization and modest declines in pricing, innovations in formulation and regulatory advances could introduce upward pricing pressures for specialized products. Industry stakeholders should monitor patent landscapes and emerging competition to identify opportunities for premium offerings and optimize market entry strategies.

Key Takeaways

- Market stability is evident due to widespread generic availability, with prices declining gradually.

- Innovation-driven formulations hold potential to command higher margins and extend product lifecycle.

- Regulatory and patent landscapes are critical determinants of pricing and market exclusivity.

- Emerging markets present growth opportunities, with potential to influence global pricing trends.

- Global supply chain stability remains vital for consistent pricing and availability.

FAQs

1. What factors are primarily driving the price decline of Tropicamide globally?

The expiration of key patents and the proliferation of generic manufacturers have intensified price competition, leading to consistent price declines across mature markets.

2. How might novel formulations impact the pricing of Tropicamide?

Innovative, patent-protected formulations such as preservative-free drops or sustained-release systems could command higher prices and create niche markets, temporarily lifting pricing trends.

3. Are regulatory barriers likely to influence Tropicamide’s market in the near future?

Given its long-standing approval, regulatory barriers are minimal. However, safety updates or new agent approvals could reshape the competitive landscape and influence pricing strategies.

4. Which regions offer the most growth potential for Tropicamide sales?

Emerging markets like India and China exhibit significant growth potential owing to expanding ophthalmic services and improving healthcare infrastructure, potentially affecting global supply and pricing.

5. What is the outlook for new entrants aiming to disrupt the Tropicamide market?

While challenging due to existing widespread generic options, innovative delivery platforms or combination drugs could offer differentiation, creating opportunities for new entrants in specialized segments.

References

[1] Market research reports, Ophthalmic Pharmaceuticals Industry Overview, 2022.

[2] Patent status and healthcare regulations for ophthalmic drugs, FDA and EMA databases, 2022.

[3] Industry analysis on generics and biosimilars, IQVIA, 2023.

[4] Supply chain and manufacturing insights, Global Pharma Supply Chain Review, 2022.

[5] Pricing trends and forecasts, MedTech Insight, 2022.