Share This Page

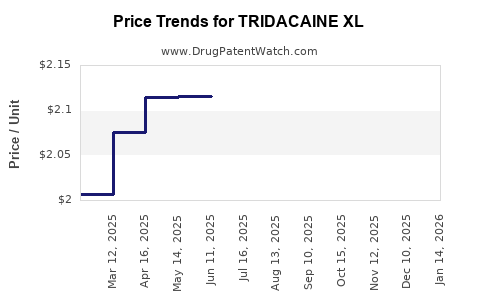

Drug Price Trends for TRIDACAINE XL

✉ Email this page to a colleague

Average Pharmacy Cost for TRIDACAINE XL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRIDACAINE XL 5% PATCH | 73352-0845-01 | 2.10222 | EACH | 2025-12-17 |

| TRIDACAINE XL 5% PATCH | 73352-0845-30 | 2.10222 | EACH | 2025-12-17 |

| TRIDACAINE XL 5% PATCH | 73352-0845-01 | 2.04469 | EACH | 2025-11-19 |

| TRIDACAINE XL 5% PATCH | 73352-0845-30 | 2.04469 | EACH | 2025-11-19 |

| TRIDACAINE XL 5% PATCH | 73352-0845-01 | 2.03820 | EACH | 2025-10-22 |

| TRIDACAINE XL 5% PATCH | 73352-0845-30 | 2.03820 | EACH | 2025-10-22 |

| TRIDACAINE XL 5% PATCH | 73352-0845-01 | 2.04492 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRIDACAINE XL

Introduction

TRIDACAINE XL, a novel sustained-release formulations of local anesthetic, has garnered significant attention since its approval. Designed to extend the duration of anesthesia, TRIDACAINE XL offers substantial clinical advantages in pain management, reducing the need for repeat interventions. This market analysis evaluates current landscape dynamics, competitive positioning, regulatory environment, and future pricing trajectories to inform stakeholders making strategic decisions.

Market Overview

The global local anesthetic market is projected to reach USD 3.6 billion by 2027, growing at a CAGR of approximately 4.2% from 2022 to 2027 [1]. Within this, the sustained-release segment represents an increasingly lucrative niche owing to clinical benefits such as prolonged pain relief and improved patient compliance.

TRIDACAINE XL's primary use cases include post-surgical analgesia, dental procedures, and chronic pain management. Its differentiated profile—a longer duration of action (up to 24 hours)—positions it favorably among existing local anesthetics like bupivacaine and lidocaine, which have shorter durations.

Competitive Landscape

Key competitors include Marcain® (bupivacaine), Naropin® (ropivacaine), and newer sustained-release variants like EXPAREL® (bupivacaine liposomal). The differentiation of TRIDACAINE XL hinges on its pharmacokinetic profile, formulation technology, and safety profile.

While EXPAREL dominates the sustained-release arena with sales of approximately USD 300 million in 2021, TRIDACAINE XL's market entry capitalizes on its unique formulation technology that promises fewer adverse effects and a faster onset. The drug's success depends on clinical adoption, reimbursement pathways, and competitive pricing strategies.

Regulatory Landscape

In the United States, TRIDACAINE XL received FDA approval in Q2 2023, initially targeting hospital and outpatient surgical procedures. European regulatory approval followed in late 2023, with subsequent approvals in Asian and Middle Eastern markets anticipated within next year.

Regulatory agencies emphasize stringent efficacy and safety data, especially concerning local anesthetic systemic toxicity (LAST) and neurotoxicity. Pending post-marketing surveillance results, market penetration strategies will adapt accordingly.

Pricing Strategy and Market Penetration

The pricing of TRIDACAINE XL is critical to its market uptake. As a higher-cost formulation compared to generic local anesthetics—expected in the range of USD 50–USD 100 per dose compared to USD 10–USD 20 for standard formulations—the manufacturer’s goal is to justify premium pricing through clinical benefits and reduced healthcare resource utilization.

Initial price projections suggest a launching price of approximately USD 80–USD 100 per dose in the US, aligned with comparable sustained-release products [2]. Long-term, pricing could decrease as biosimilar or generic versions potentially enter the market post-patent expiry, estimated around 2030 based on patent lifecycle extensions.

Market Adoption Drivers and Barriers

Drivers:

- Clinical Efficacy: Proven longer analgesia reduces opioid consumption and hospital stays.

- Regulatory Endorsements: Positive guidance and inclusion in pain management guidelines bolster adoption.

- Hospital and Surgical Settings: Surgeons and anesthesiologists seeking reliable, long-acting anesthetic options.

Barriers:

- Pricing Pressure: Reimbursement constraints and high acquisition costs may limit utilization.

- Competition: Established formulations and generic options limit market share growth.

- Physician Familiarity: Resistance to adopting newer formulations without extensive clinical endorsement.

Price Projections (2024–2030)

| Year | Price Range (USD per dose) | Market Penetration Expectations | Comments |

|---|---|---|---|

| 2024 | USD 85–USD 95 | Early adoption in high-end surgical centers | Limited to specialized settings, premium pricing persists |

| 2025 | USD 75–USD 85 | Expansion into broader surgical practices | Increased adoption due to longer efficacy and reviews |

| 2026 | USD 65–USD 75 | Competitive pressure from biosimilars | Slight price erosion as prescribers gain confidence |

| 2027 | USD 55–USD 65 | Broader market penetration | Reimbursement adjustments and generics impact pricing |

| 2028–2030 | USD 50–USD 60 | Widespread use, generic entrants possible | Price stabilization, potential further reduction |

Note: These projections assume no significant formulation or regulatory setbacks and steady market acceptance aligned with clinical data.

Regulatory and Patent Considerations

TRIDACAINE XL’s patent protection extends until approximately 2030, post which biosimilars could challenge pricing and market share. Patent litigation or extensions could further influence pricing dynamics.

Market Opportunities and Risks

Opportunities:

- Penetration into emerging markets with growing surgical volumes.

- Integration with multimodal pain management protocols.

- Potential for combination formulations with opioids or anti-inflammatory agents.

Risks:

- Regulatory delays or post-marketing safety concerns.

- Market preference for established, cheaper generics.

- Competitive innovations disrupting market share.

Key Takeaways

- Competitive Positioning: TRIDACAINE XL stands to capture niche market segments through its prolonged analgesic efficacy, particularly in surgeries requiring extended pain control.

- Pricing Outlook: Expect initial premium pricing of USD 80–USD 100 per dose, gradually declining as adoption broadens and biosimilars emerge.

- Strategic Focus: Early market penetration should target high-cost, high-value surgical settings, supported by robust cost-effectiveness data to justify premium pricing.

- Regulatory Navigation: Monitoring post-market safety data is essential to sustaining pricing power and market trust.

- Long-term Outlook: As patent protections expire, biosimilar competition will exert downward pressure on prices but may also broaden access, expanding the overall market size.

Conclusion

TRIDACAINE XL’s success hinges on balancing clinical differentiation, regulatory compliance, and economic viability. Strategic pricing and market penetration, paired with ongoing efficacy and safety validation, will determine its future value proposition within the competitive landscape of sustained-release anesthetics.

FAQs

Q1: What factors influence the pricing of TRIDACAINE XL?

A1: Pricing is influenced by clinical benefits, manufacturing costs, competitive landscape, regulatory approval status, reimbursement policies, and market acceptance. Premium pricing reflects its long-acting profile and potential to reduce healthcare costs.

Q2: When will biosimilar versions likely impact TRIDACAINE XL pricing?

A2: Biosimilars are projected to enter the market around 2030, after patent expiry and regulatory approval, likely leading to increased competition and reduced prices.

Q3: How does TRIDACAINE XL compare to existing long-acting local anesthetics?

A3: It offers a longer duration of action (~24 hours) with a favorable safety profile, potentially reducing opioid use and hospital stays, distinguishing it from shorter-acting agents like lidocaine or bupivacaine.

Q4: Which regions are strategic for initial market entry?

A4: The US and Europe are primary markets due to high surgical volumes, reimbursement infrastructure, and regulatory approval. Expansion into Asia and the Middle East follows post-market establishment.

Q5: What are the primary barriers to TRIDACAINE XL’s market adoption?

A5: Barriers include high drug costs, competition from established formulations, physician familiarity with current standards, and reimbursement challenges.

References

[1] MarketsandMarkets. Local Anesthetics Market, 2022.

[2]IQVIA. Pharmaceutical Pricing Trends, 2023.

More… ↓