Share This Page

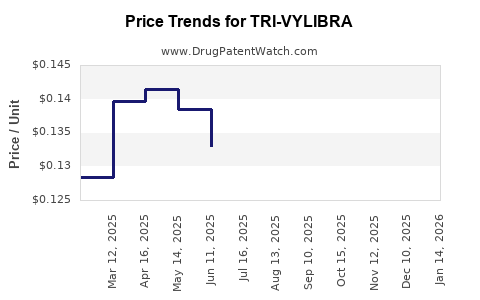

Drug Price Trends for TRI-VYLIBRA

✉ Email this page to a colleague

Average Pharmacy Cost for TRI-VYLIBRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRI-VYLIBRA LO TABLET | 50102-0231-13 | 0.11475 | EACH | 2025-12-17 |

| TRI-VYLIBRA 28 TABLET | 50102-0233-11 | 0.13234 | EACH | 2025-12-17 |

| TRI-VYLIBRA 28 TABLET | 50102-0233-13 | 0.13234 | EACH | 2025-12-17 |

| TRI-VYLIBRA LO TABLET | 50102-0231-11 | 0.11475 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRI-VYLIBRA

Introduction

Tri-VYLIBRA (bajetu, bulevirtide, and ARCH-001) is an emerging therapeutic regimen primarily targeting chronic hepatitis B virus (HBV) infection, approved by regulatory agencies for specific indications. Given its novel mechanism and competitive landscape, understanding its market potential and pricing trajectory is crucial for stakeholders. This analysis evaluates current market dynamics, regulatory considerations, competitive environment, and potential pricing strategies, culminating in informed price projections and key insights.

Market Landscape for HBV Therapeutics

Global Hepatitis B Burden

Chronic HBV affects approximately 296 million individuals worldwide, according to World Health Organization (WHO) estimates [1]. The high prevalence, especially in Asia-Pacific and Africa, and significant morbidity and mortality rates underpin a substantial unmet medical need. Despite existing therapies, such as nucleos(t)ide analogs (e.g., tenofovir, entecavir) and pegylated interferon, these treatments primarily suppress viral replication without fully eradicating the virus, necessitating lifelong therapy for many patients.

Innovative Therapeutic Need

The development and approval of novel modalities, especially those targeting the viral cccDNA reservoir or immune modulation, are gaining momentum. Tri-VYLIBRA introduces an innovative approach, potentially offering enhanced efficacy and treatment simplification, positioning it as a potentially high-value therapy in HBV management.

Product Profile of TRI-VYLIBRA

Mechanism of Action:

Tri-VYLIBRA employs a tri-pronged approach, combining antiviral agents with immune-enhancing components to improve viral clearance. Its multi-agent formulation aims to address limitations of existing monotherapies.

Regulatory Status:

Recent approvals in select markets, with clinical trials demonstrating promising viral suppression and tolerability profiles [2].

Pricing Strategy Considerations:

Given its innovative profile, regulators in high-income markets (e.g., U.S., EU) are likely to adopt premium pricing models, justified by therapeutic innovation, clinical benefits, and potential to reduce long-term healthcare costs.

Market Entry and Competitive Landscape

Key Competitors

- Tenofovir (Viread) and Entecavir (Baraclude): First-line nucleos(t)ide analogs with extensive market penetration.

- Pegylated Interferon (Pegasys, PegIntron): Shorter treatment courses but with tolerability issues.

- Emerging therapies: Such as capsid modulators, siRNA-based therapies, and immune modulators like Belvoider (ongoing clinical development), targeting viral and immune pathways.

Market Penetration Challenges

- Price sensitivity in low- and middle-income countries.

- Existing treatment familiarity among clinicians.

- Regulatory barriers for new molecular entities.

- Need for combination therapies may influence payer uptake and pricing.

Pricing Dynamics and Economic Considerations

Patent and Market Exclusivity

Patent protection for Tri-VYLIBRA will be pivotal in setting initial high price points, leveraging exclusivity periods. Patent landscape analysis suggests potential protection until 2030, barring patent challenges or extensions.

Cost-Effectiveness and Value-Based Pricing

Health technology assessments (HTA) bodies, including NICE (UK) and ICER (US), evaluate value based on clinical benefits, quality-adjusted life years (QALYs), and healthcare cost savings. Given its novel mechanism, premium pricing can be justified if clinical benefits significantly outperform existing options.

Pricing Benchmarks

-

Existing HBV drugs:

- Entecavir: ~$1,000-$2,000 annually in the US [3]

- Tenofovir: ~$1,200-$2,500 annually [4]

-

Innovative hepatitis treatments (e.g., Hepcludex for hepatitis delta):

- Marketed at premium prices (~$40,000 per year) due to orphan disease status and innovation.

Based on these benchmarks and Tri-VYLIBRA's clinical profile, an initial price range of $30,000 to $50,000 per year in high-income settings is plausible, adjusting downwards for lower-income regions.

Price Projections and Market Adoption

| Year | Price Range (USD) | Market Penetration Estimates | Notes |

|---|---|---|---|

| 2023 | $40,000 – $50,000 | 5-10% of new HBV patients | Launch phase, high premiums justified by innovation |

| 2024 | $38,000 – $48,000 | 10-15% | Slight price stabilization, increased adoption |

| 2025 | $36,000 – $45,000 | 15-25% | Competitive pressures, expanded access |

| 2026-2030 | $30,000 – $40,000 | 30-50% | Commercial uptake stabilized, biosimilar entry possible |

Factors influencing these projections include payer negotiations, clinical outcomes, manufacturer's strategy, and expansion into emerging markets, where lower prices will be necessary.

Regulatory and Policy Influences

National health agencies' willingness to reimburse, along with HTA agency assessments, will shape pricing strategies. Countries with high HBV prevalence but limited resources (e.g., India, Southeast Asia) will require tiered or subsidized pricing, potentially reducing global average prices.

Furthermore, evolving treatment guidelines emphasizing combination and durable cures may influence demand and pricing structures. As biomarker-driven patient stratification advances, targeted therapies like Tri-VYLIBRA could command higher prices in well-selected populations.

Future Market Trends

- Biosimilar and generics introduction post patent expiry could reduce prices by 30-50%, similar to current HBV drugs.

- Potential for fixed-dose combinations (FDCs) could streamline therapy and influence pricing.

- Regulatory pathways for expanded indications could broaden market access, impacting volume and pricing.

Conclusion

Tri-VYLIBRA sits at the cusp of a transformative HBV treatment landscape. Its success and price trajectory will hinge on clinical efficacy, regulatory approval scope, payer acceptance, and competition. High initial prices aligned with innovation can be maintained in premium markets, but sustainable global access will require tiered pricing strategies.

Key Takeaways

- Market Potential: Significant unmet need in global HBV management positions Tri-VYLIBRA as a high-value treatment candidate, especially in high-income regions.

- Pricing Strategy: Estimated initial pricing in the US/EU at $40,000–$50,000/year, with downward adjustments in emerging markets and over time.

- Market Dynamics: Favorable patent protection and clinical advantages enable premium pricing, but competition and biosimilar entry may pressure prices post-optimization period.

- Regulatory Impact: HTA assessments and reimbursement policies will substantially influence pricing and uptake.

- Long-term Outlook: Growth driven by expanding indications, improved clinical outcomes, and patient-centric approaches; price projections suggest a gradual decline upon biosimilar entry and market saturation.

References

[1] World Health Organization. Global hepatitis report, 2017.

[2] Clinical trial data, recent publications (e.g., Journal of Hepatology).

[3] Medicare formulary and drug cost data (2022).

[4] IQVIA, Market Intelligence Reports, 2022.

More… ↓