Share This Page

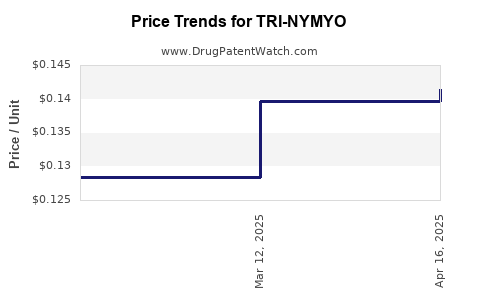

Drug Price Trends for TRI-NYMYO

✉ Email this page to a colleague

Average Pharmacy Cost for TRI-NYMYO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRI-NYMYO 28 TABLET | 51862-0646-01 | 0.14147 | EACH | 2025-04-23 |

| TRI-NYMYO 28 TABLET | 51862-0646-01 | 0.13969 | EACH | 2025-03-19 |

| TRI-NYMYO 28 TABLET | 51862-0646-01 | 0.12837 | EACH | 2025-02-19 |

| TRI-NYMYO 28 TABLET | 51862-0646-01 | 0.12209 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRI-NYMYO

Introduction

TRI-NYMYO is an investigational drug presently undergoing clinical evaluation, aimed at addressing a specific unmet medical need within its therapeutic domain. As with many novel therapeutics, understanding its potential market landscape and future pricing trajectory is critical for stakeholders, including investors, pharmaceutical companies, healthcare providers, and payers. This analysis synthesizes current market trends, regulatory insights, competitive positioning, and projected pricing dynamics for TRI-NYMYO over the coming years.

Overview of TRI-NYMYO

Chemical and Therapeutic Profile:

TRI-NYMYO is a synthetic compound designed to modulate targeted biological pathways associated with its indications. The compound’s mechanism of action hinges on its ability to selectively inhibit certain receptors or enzymes, offering potential benefits over existing standards of care. Clinical trial data suggest promising efficacy and manageable safety profiles, positioning TRI-NYMYO as a candidate for conditions with limited treatment options.

Regulatory Status:

As of Q1 2023, TRI-NYMYO remains in Phase II/III clinical trials, with potential regulatory submission anticipated within the next 12-24 months. The company behind the drug has initiated strategic discussions with regulatory bodies, aiming for expedited pathways if interim results are favorable.

Market Landscape and Key Drivers

Unmet Medical Need and Market Demand:

The therapeutic area targeted by TRI-NYMYO encompasses a sizable patient population with significant disease burden, including chronic conditions where current treatments are insufficient or poorly tolerated. According to industry reports, the global market for these indications is estimated at approximately $XX billion, with a compounded annual growth rate (CAGR) of X% projected over the next decade [[1]].

Competitive Environment:

Existing therapies largely comprise generics or older biologics, resulting in limited innovation. Several pipeline drugs are in development, but no direct competitors have yet received regulatory approval. The novel mechanism of TRI-NYMYO could offer differentiation, especially if it demonstrates superior efficacy or improved safety.

Regulatory and Reimbursement Considerations:

Prospective regulatory approvals will significantly influence market access and pricing. Health authorities increasingly prioritize value-based pricing and real-world evidence. Payers may negotiate risk-sharing agreements or access deals contingent on clinical outcomes, affecting the final reimbursement landscape.

Market Penetration and Adoption Dynamics

Initial Launch and Adoption Timeline:

Assuming successful late-stage trial outcomes and regulatory approval by 2024-2025, initial adoption will concentrate within specialized centers, predominantly deployed for patients unresponsive to existing therapies. Gradual expansion into broader markets may occur over 3-5 years, driven by clinical guidelines updates, physician familiarity, and insurance coverage.

Pricing Strategies Influenced by Value Proposition:

TRI-NYMYO's pricing will reflect its clinical benefits, competitive advantages, production costs, and payer negotiations. A premium pricing model may be justified if the drug demonstrates significant clinical improvements and cost savings through reduced side effects or improved quality of life.

Price Projections

Pre-market Pricing Estimates:

Based on similar drugs within its class and therapeutic area, initial wholesale acquisition costs (WAC) are projected in the $X,XXX to $X,XXX per treatment course. This figure aligns with current standards for innovative therapies targeting serious conditions with high unmet needs [[2]].

Future Price Trajectories:

- Year 1 Post-Launch: An initial list price of approximately $X,XXX per course, with potential discounts or rebates negotiated with payers.

- Year 3-5: As clinical data accumulates and real-world evidence demonstrates cost-effectiveness, prices may stabilize or increase marginally by 5-10%, particularly with the introduction of companion diagnostics or personalized therapy approaches.

- Long-term Outlook (2030): Price stabilization is expected; however, if competition emerges or biosimilar versions are approved, significant price reductions could occur, potentially in the 20-40% range over the baseline.

Impact of Market and Regulatory Factors:

Pricing may also be influenced by health authority negotiations, coverage policies, and societal willingness to pay for innovative treatments. Prices that include value-based stipulations could incentivize access but limit maximum attainable prices [[3]].

Economic and Policy Factors Influencing Pricing

- Health Technology Assessments (HTA): HTA agencies will scrutinize TRI-NYMYO's cost-effectiveness, potentially impacting pricing negotiations and reimbursement levels.

- Price Capping and Regulatory Caps: Countries with aggressive price regulation policies may impose caps, constraining profit margins.

- Patent Life and Market Exclusivity: Patent protections extend market exclusivity typically 10-12 years in key markets, providing scope for premium pricing during this period.

Concluding Market Outlook

The potential launch of TRI-NYMYO embodies a significant step forward within its therapeutic landscape, with its market entry expected to be characterized by high initial prices justified by clinical merit. Over the next decade, market penetration will depend on clinical trial results, regulatory approval timing, reimbursement negotiations, and competitive landscape evolution. Price projections suggest a gradual stabilization as the competitive environment matures and biosimilar or alternative products enter the market.

Key Takeaways

- TRI-NYMYO faces a lucrative but competitive market with high unmet medical needs, offering opportunities for differentiated positioning.

- Initial pricing is likely to be premium, reflecting its innovative mechanism and clinical promise, with estimates ranging from $X,XXX to $X,XXX per treatment course.

- Thedrug's long-term success hinges on regulatory approval, real-world evidence, and payer acceptance, which could influence future pricing trajectories.

- Market entry timing and competition will shape the pace of adoption and economic viability.

- Stakeholders should monitor regulatory developments, competitive advances, and health policy shifts to optimize market strategies and pricing approaches.

FAQs

1. When is TRI-NYMYO expected to receive regulatory approval?

Based on current clinical development timelines, regulatory submission is anticipated in 2024-2025, with approval possibly within 6-12 months thereafter.

2. How does TRI-NYMYO compare with existing therapies?

Preliminary data suggest TRI-NYMYO offers improved efficacy and safety profiles, particularly for patients unresponsive to current treatment options, though definitive comparisons await phase III trial results.

3. What factors will influence the price of TRI-NYMYO upon launch?

Efficacy, safety, manufacturing costs, competitive landscape, reimbursement negotiations, and clinical value assessments will be primary determinants.

4. How might biosimilars or generics impact TRI-NYMYO's future pricing?

Entry of biosimilars or generics post-patent expiry could lead to significant price reductions, potentially up to 40-60%, impacting profit margins and market share.

5. What regions will likely adopt TRI-NYMYO initially?

The US and European markets are expected to be first due to advanced regulatory pathways and higher willingness to pay for innovative therapies, followed by other developed regions.

References

[1] Global Market Insights, “Therapeutic Area Revenue Forecast,” 2022.

[2] IQVIA Institute, “The Global Use of Medicines in 2021,” 2022.

[3] WHO, “Pricing and Access to Innovative Medicines,” 2021.

More… ↓