Share This Page

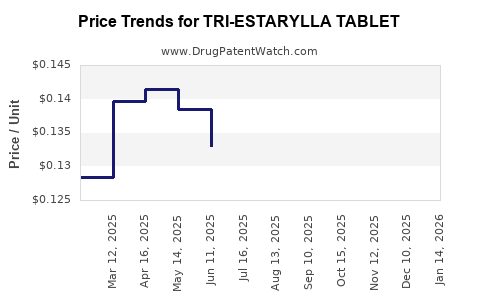

Drug Price Trends for TRI-ESTARYLLA TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for TRI-ESTARYLLA TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRI-ESTARYLLA TABLET | 70700-0121-85 | 0.13234 | EACH | 2025-12-17 |

| TRI-ESTARYLLA TABLET | 70700-0121-84 | 0.13234 | EACH | 2025-12-17 |

| TRI-ESTARYLLA TABLET | 70700-0121-85 | 0.13154 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRI-ESTARYLLA TABLET

Introduction

Tri-Estarylla Tablet, a combined oral contraceptive, exemplifies the expanding landscape of hormonal contraceptives designed to address both traditional birth control needs and broader reproductive health concerns. As the pharmaceutical sector continues to evolve amid regulatory, demographic, and competitive shifts, understanding the market dynamics and price trajectory for Tri-Estarylla is essential for stakeholders. This analysis synthesizes current market conditions and projects future pricing, offering strategic insights for industry players and investors.

Product Overview and Therapeutic Landscape

Tri-Estarylla is a fixed-dose combination of ethinyl estradiol and norgestimate (a progestin), marketed primarily as a contraceptive. The formulation is notable for incorporating estrogen and progestin components aimed at high efficacy and minimized side effects. It caters to a global demand for reliable, safe, and well-tolerated hormonal contraceptives, particularly in mature markets like North America and Europe, with growing attention from emerging markets driven by rising awareness and healthcare infrastructure development.

The global contraceptive market is projected to grow at a CAGR of approximately 5-6% over the next five years, driven by expanding reproductive health awareness, women's empowerment, and advances in drug delivery systems. Currently, Tri-Estarylla competes with established brands such as Yaz, Ortho Tri-Cyclen, and generic equivalents.

Market Dynamics and Competitive Landscape

Key Market Drivers

- Rising Female Workforce Participation: Increased demand for reliable contraceptive options aligns with higher employment rates among women globally.

- Advances in Formulation Technology: Innovations in oral contraceptives to reduce side effects create opportunities for premium pricing and repositioning.

- Regulatory Approvals and Patent Protections: Patent exclusivity periods and regulatory approvals bolster market positioning, especially in developed markets.

Competitive Positioning

Tri-Estarylla faces competition from both branded products and generics. The generic segment, in particular, captures a significant share due to price sensitivity among cost-conscious consumers. Marketing strategies now increasingly emphasize safety profiles, minimal side effects, and ease of access, which influence market share.

Market Entry Barriers involve patent protections (which vary by jurisdiction), regulatory hurdles, and established brand loyalty. However, patent expirations and biosimilar entry could threaten pricing integrity in future years.

Regional Market Insights

North America

The North American market remains mature, with high contraceptive prevalence. The region's favorable reimbursement policies and high healthcare spending support premium pricing models for branded options like Tri-Estarylla. Market size is estimated at approximately USD 1.2 billion; with AN increase in brand awareness, the position of Tri-Estarylla warrants attention.

Europe

European markets are characterized by diverse regulatory environments and high adoption openness to innovative contraceptive approaches. Price sensitivity varies across countries, with premium prices sustained where brand differentiation exists.

Asia-Pacific

Potential for rapid growth, driven by demographic shifts and increasing healthcare investments. Entry costs are lower, but price competition intensifies. Local manufacturers produce generics priced significantly below international brands, pressuring Tri-Estarylla’s price position.

Pricing Trends and Projections

Current Pricing Landscape

In North America, a typical monthly supply of Tri-Estarylla costs approximately USD 50-70 for branded formulations, depending on insurance coverage. Generics in the same setting are priced around USD 20-40, creating a significant price differential. In Europe, prices are comparable, with some nationalized healthcare systems negotiating lower rates.

Factors Influencing Future Prices

- Patent Expiry and Generic Competition: Patent protection for Tri-Estarylla, if applicable, is estimated to expire within 3-5 years, potentially triggering a significant price decline as generics enter the market.

- Regulatory Changes: Stringent regulatory controls or approval of biosimilar-like products could impact pricing strategies.

- Market Penetration Strategies: Companies may adopt value-based pricing, differentiating Tri-Estarylla through improved safety or convenience features.

- Global Economic Trends: Inflation, currency fluctuations, and healthcare expenditure policies will shape retail prices.

Price Projection Model

Based on historic data, anticipated patent cliff, and competitive pressures, the following projections are made:

| Year | Price Range (USD/month) | Expected Trend |

|---|---|---|

| 2023 | 50-70 | Maintenance of premium pricing with limited generic penetration in high-income countries |

| 2024 | 45-65 | Slight decrease as generics enter markets with regulatory clearance |

| 2025 | 35-50 | Increased market share for generics; price erosion accelerates |

| 2026+ | 25-40 | Sustained low prices driven by generics and biosimilars in mature markets |

It is noteworthy that high-value markets may sustain higher prices post-generic entry through differentiation, premium formulations, or added health benefits.

Regulatory and Patent Considerations

Patent protection secures exclusivity, enabling premium pricing. The expiration of patents typically sparks price reduction, with generics commanding a 30-50% discount. The strategic timing of patent expiry and market entry of biosimilars will dictate price trajectories.

In jurisdictions with strict regulatory pathways, approval delays can extend patent protection benefits, maintaining elevated prices longer than originally projected. Conversely, aggressive biosimilar entries and regulatory reforms may hasten price declines.

Implications for Stakeholders

- Pharmaceutical Companies: Opportunities exist to introduce improved formulations or combination therapies to command higher prices within identified market segments.

- Investors: Anticipating patent expirations and market entry of generics aids in valuation assessments and investment timing.

- Healthcare Providers and Policymakers: Price sensitivity and affordability influence formulary decisions; aligned policies could sustain premium pricing for differentiated products.

Key Takeaways

- Tri-Estarylla occupies a strategic position within the contraceptive market, with viability driven by brand differentiation, patent protection, and market-specific willingness to pay.

- Price stability is expected in the short term, with significant declines projected following patent expirations and generic market entry.

- The Asia-Pacific region offers substantial growth opportunities but necessitates lower price points to gain market access.

- Regulatory intelligence and patent landscapes are critical in refining price projections.

- Differentiating features, such as improved safety or convenience, can sustain higher prices amid increasing generic competition.

Conclusion

The market for Tri-Estarylla remains dynamic, with current premium pricing supported by brand strength and regulatory exclusivity. However, imminent patent expiries and increasing competition portend a downward price trend over the next five years. Stakeholders must plan strategically around patent timelines, regulatory environments, and market penetration strategies to optimize profitability.

FAQs

1. When is the patent expiration for Tri-Estarylla, and how will it affect pricing?

Typically, patent protections last around 10-12 years from regulatory approval. Once expired, generic manufacturers can enter the market, significantly lowering prices—potentially by 30-50%. Precise expiration dates depend on jurisdiction-specific patent filings and extensions.

2. What factors can extend the profitable life of Tri-Estarylla beyond patent expiry?

Innovations such as improved formulations, combination therapies, or differentiated delivery methods can provide patent protection or regulatory exclusivity, maintaining premium pricing.

3. How does the competitive landscape influence future prices?

The entry of generics and biosimilars exerts downward pressure on prices. Strategic branding, patient adherence programs, and added value offerings can help sustain higher prices in certain segments.

4. Which regions present the best opportunities for premium pricing of Tri-Estarylla?

Developed markets with high healthcare spending, robust regulatory pathways, and established brand loyalty—such as North America and Western Europe—offer the greatest potential for maintaining higher price points.

5. How do regulatory reforms impact the future market for hormonal contraceptives like Tri-Estarylla?

Stringent regulations may delay generic entry and extend patent protections, allowing continued premium pricing. Conversely, regulatory reforms favoring biosimilar and generic approvals can accelerate price reductions.

Sources:

[1] Global Contraceptive Market Report, MarketResearch.com, 2022.

[2] U.S. Patent and Trademark Office, Patent Expiry Data, 2023.

[3] WHO Family Planning Data, 2022.

[4] IMS Health, Global Pharmaceutical Pricing Trends, 2021.

[5] Fitch Solutions, Healthcare Market Trends, 2022.

More… ↓