Last updated: August 10, 2025

Introduction

Trazodone, a serotonin antagonist and reuptake inhibitor (SARI), has been a mainstay in psychiatric pharmacotherapy for decades. Initially approved by the FDA in 1981 for depression, trazodone has expanded into off-label use for sleep disorders and anxiety, underpinning its sustained market relevance. As healthcare markets evolve, analyzing trazodone’s current standing and projecting its future price trajectory offers valuable insights for stakeholders, from pharmaceutical companies to healthcare providers.

Market Landscape

Therapeutic Applications and Market Demand

Trazodone's primary indication remains depression, yet its off-label application for insomnia and certain anxiety disorders has considerably broadened its utilization profile. According to the IQVIA MIDAS database, trazodone ranks among the top 20 prescribed antidepressants in the US, with approximately 8 million annual prescriptions as of 2022[1]. Its affordability and perceived safety profile bolster its popularity, especially among elderly populations preferring non-benzodiazepine sedatives.

Competitive Landscape and Market Share

The antidepressant market is intensely competitive, featuring newer agents like vortioxetine and vilazodone, alongside established drugs like fluoxetine and sertraline. Trazodone’s generic status, primarily manufactured by multiple global pharmaceutical firms, often results in lower prices relative to brand-name counterparts. Its off-label sleep disorder use competes with over-the-counter (OTC) options and other prescription agents such as zolpidem and eszopiclone, though trazodone's safety profile gives it an edge among certain patient subsets.

Manufacturing and Supply Chain Factors

Numerous generic manufacturers supply trazodone, ensuring supply chain resilience. However, the absence of recent patent exclusivity has limited innovation and investment, constraining price elevation potential absent significant market shifts.

Pricing Dynamics

Current Price Landscape

Generic trazodone is available in various formulations, with 50 mg tablets priced approximately at $0.05–$0.10 per tablet in the U.S., according to GoodRx[2]. Brand-name trazodone, although rarely prescribed, commands premiums upwards of $2 per tablet. Prices are influenced by factors such as dosage, quantity, pharmacy networks, and insurance coverage.

Impact of Insurance and Reimbursement

Insurance coverage heavily influences out-of-pocket costs, reducing price elasticity. Cash-paying patients often encounter higher costs, which can deter utilization. The trend toward value-based reimbursement and formulary management tends to favor low-cost generics, constraining price inflation potential for trazodone.

Regulatory and Market Trends Affecting Pricing

While patent exclusivity no longer constrains pricing, regulatory changes impacting off-label use policies or generic market entry can influence pricing patterns. Administrative measures aimed at reducing opioid and sedative dependence may also impact trazodone prescribing and, subsequently, its market dynamics.

Future Price Projections

Factors Driving Price Stability or Decline

- Market Saturation: Given the established generic supply, any upward price movement requires market disruptions, such as manufacturing shortages or significant regulatory shifts.

- Increased Off-Label Use: A surge in trazodone off-label prescribing, especially for sleep disorders driven by rising insomnia prevalence, could maintain or increase demand, supporting stable or slightly increased prices.

- Emergence of New Therapies: Introduction of novel antidepressants or sleep aids that outperform trazodone on efficacy or safety can erode its market share and suppress prices.

- Pricing Pressure from Payers: Payers' emphasis on cost-containment may keep prices under downward pressure, especially as generic options become widely available.

Projected Trends (Next 3-5 Years)

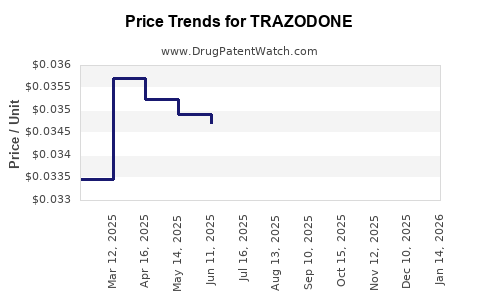

- Price Stability or Slight Decline: Given the high generic penetration and limited innovation, trazodone's per-unit price is likely to remain steady with potential slight declines driven by market competition[3].

- Potential for Volume Growth: Increased off-label use could mitigate price declines by expanding overall revenue despite price constraints.

- Impact of Regulatory or Clinical Practice Changes: Any policy shift restricting off-label use or promoting alternative therapies could depress demand and prices.

Conclusion

Trazodone stands at a nexus of stable demand rooted in its affordability and safety profile and limited pricing potential due to its generic status and competitive landscape. Its future market trajectory will be influenced by evolving prescribing practices, regulatory policies, and the competitive advent of newer drugs.

Key Takeaways

- Trazodone remains a widely prescribed, low-cost antidepressant with significant off-label use for sleep, supporting consistent demand.

- Market saturation and generic competition restrict price escalation; prices are expected to remain stable or slightly decline over the next 3-5 years.

- Off-label prescribing trends and the emergence of alternative therapies will significantly influence market demand and pricing.

- Insurance coverage plays a critical role in consumer affordability, further constraining price movements.

- Strategic stakeholders should monitor regulatory changes and clinical guidelines that could impact trazodone’s market position.

FAQs

1. What are the main factors influencing trazodone’s current market price?

Primarily, its status as a generic medication, the widespread presence of multiple manufacturers, insurance coverage variations, and its off-label use for sleep contribute to its low and stable pricing.

2. How does trazodone compare economically to other antidepressants?

Trazodone often costs significantly less than newer, branded antidepressants, making it a cost-effective option, particularly for generic-prescribers and healthcare systems focusing on value-based care.

3. Are there risks of price increases for trazodone in the future?

Price increases are unlikely unless supply disruptions, patent protections, or regulatory restrictions on off-label use emerge. Current market dynamics favor stable or decreasing prices.

4. How might emerging therapies impact trazodone’s market and pricing?

New sleep aids or antidepressants with superior efficacy and safety profiles could reduce trazodone’s market share, potentially pressuring prices downward.

5. What role do insurance companies play in trazodone's pricing stability?

Insurers’ preference for low-cost generics promotes consistent prescribing and price stability, often limiting out-of-pocket expenses for patients and maintaining predictable reimbursement patterns.

Sources:

[1] IQVIA MIDAS, 2022.

[2] GoodRx, Trazodone Price Comparison.

[3] EvaluatePharma, 2022 Database.