Share This Page

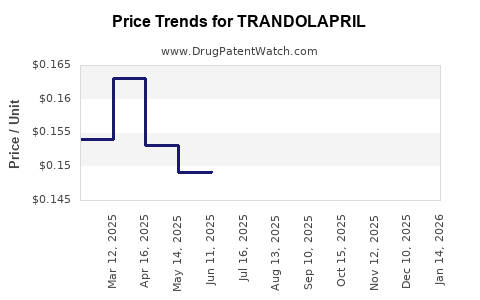

Drug Price Trends for TRANDOLAPRIL

✉ Email this page to a colleague

Average Pharmacy Cost for TRANDOLAPRIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRANDOLAPRIL 1 MG TABLET | 68180-0566-01 | 0.18459 | EACH | 2025-12-17 |

| TRANDOLAPRIL 2 MG TABLET | 68180-0567-01 | 0.18337 | EACH | 2025-12-17 |

| TRANDOLAPRIL 4 MG TABLET | 57237-0091-01 | 0.18298 | EACH | 2025-12-17 |

| TRANDOLAPRIL 2 MG TABLET | 57237-0090-01 | 0.18337 | EACH | 2025-12-17 |

| TRANDOLAPRIL 4 MG TABLET | 68180-0568-01 | 0.18298 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Trandolapril

Introduction

Trandolapril is an angiotensin-converting enzyme (ACE) inhibitor primarily prescribed for hypertension and heart failure management. Since its approval, trandolapril's market dynamics reflect broader trends in cardiovascular disease therapies, regulatory landscapes, and patent activities. This analysis explores the current market environment, competitive positioning, pricing strategies, and future price trajectories for trandolapril, providing actionable insights for industry stakeholders.

Current Market Landscape

Global Market Size and Segmentation

The ACE inhibitor market, valued at approximately USD 4.2 billion in 2022, is projected to grow at a CAGR of 3.2% through 2030. Trandolapril's share remains modest compared to leading agents like enalapril and ramipril, accounting for an estimated 5-8% of the ACE inhibitor segment [1].

Key Geographies

- United States: Dominates demand due to high prevalence of hypertension (>45% among adults), robust healthcare infrastructure, and widespread insurance coverage.

- Europe: Comparable health priorities with incremental growth, influenced by aging populations.

- Asia-Pacific: Anticipated to witness the fastest growth, driven by increasing urbanization, lifestyle changes, and improving healthcare access.

Market Drivers

- Aging demographics globally

- Rising hypertension prevalence

- Growing awareness of cardiovascular risks

- Expanding pharmaceutical formulations and combination therapies

Market Challenges

- Patent expirations of key ACE inhibitors, leading to increased generic competition

- Price-sensitive healthcare markets

- Regulatory hurdles impacting formulation approvals

- Shift towards newer antihypertensives with better safety profiles

Competitive Landscape

Patent Status and Generic Entry

Trandolapril was initially approved in the late 1990s. As of 2022, patent exclusivity has largely expired in major markets, resulting in widespread generic availability [2].

Manufacturers

- Major pharmaceutical companies such as Teva, Mylan, and Sandoz produce generic trandolapril.

- Limited branded formulations due to generic competition, leading to price competitiveness.

Therapeutic Substitutes

- Other ACE inhibitors (enalapril, ramipril, lisinopril)

- Angiotensin receptor blockers (ARBs) like losartan and valsartan, which increasingly capture market share due to perceived safety advantages [3].

Market Penetration and Formulation Innovations

- Limited innovation post-patent expiry.

- Focus on combination therapies (e.g., trandolapril with verapamil) to enhance adherence and therapeutic efficacy.

Pricing Dynamics

Historical Pricing Trends

Post-patent expiry, prices for trandolapril generics decreased markedly. Wholesale acquisition costs (WAC) for a standard 2 mg tablet have declined from approximately USD 0.50 in 2000 to below USD 0.10 in 2022 in the U.S. [4].

Current Price Points

- United States: Average retail price approximately USD 0.10-0.15 per tablet.

- Europe: Similar price range, influenced by national drug pricing regulations.

- Asia-Pacific: Significantly lower, with prices often under USD 0.05 per tablet.

Pricing Strategies

In mature markets, competition drives aggressive price reductions. Manufacturers leverage high-volume sales, especially in generics, where profit margins are thin but turnover is high.

Future Price Projections

Factors Influencing Future Pricing

- Market Maturity: As the market matures, prices are expected to stabilize at low levels.

- Regulatory Changes: Price control policies, especially in Europe and Asia, may cap prices further.

- Patent and Exclusivity Scenarios: No significant patent protections are anticipated, reinforcing price compression.

- Emerging Combination Formulations: Will potentially command premium prices but are unlikely for standalone trandolapril.

Projected Price Trajectory (Next 5 Years)

- United States: Expected to remain within USD 0.08-0.12 per tablet range due to market saturation.

- Europe: Stable at similar levels, subject to national drug pricing regulations.

- Asia-Pacific: Potential minor price reductions or stabilization, depending on local policies.

Premium Segment Outlook

Limited scope for premium pricing unless novel formulations or combination therapies emerge. Existing price points will remain low in the context of generic competition.

Market Opportunities and Risks

Opportunities

- Expansion into niche indications (e.g., diabetic nephropathy)

- Development of combination products to improve adherence

- Differentiation via manufacturing cost efficiencies

Risks

- Price erosion due to generics

- Regulatory barriers

- Competition from ARBs with perceived safety advantages

- Implementation of price caps in major markets

Conclusion

The trandolapril market is predominantly characterized by intense price competition following patent expirations, with no significant catalysts for price elevation in the immediate future. Market saturation in high-income nations and low-cost generics in emerging economies will sustain low pricing. Stakeholders aiming for profitability should focus on operational efficiencies, niche therapeutic applications, or innovative combination products.

Key Takeaways

- Market size remains modest, heavily reliant on mature markets with high hypertension prevalence.

- Generic competition drives sustained price declines, limiting the potential for premium pricing.

- Price stability is anticipated in the foreseeable future, with slight downward pressure expected in certain regions.

- Innovation opportunities lie in combination therapies and niche indications rather than standalone formulations.

- Regulatory and policy shifts continue to influence pricing landscapes, especially in price-sensitive countries.

FAQs

1. What is the main driver for trandolapril's market decline?

Patent expiry and the widespread availability of generic formulations have led to significant price reductions and market saturation.

2. How does trandolapril compare price-wise to other ACE inhibitors?

Prices are comparable; in most markets, generics of ACE inhibitors, including trandolapril, sell for approximately USD 0.10-0.15 per tablet.

3. Are there prospects for premium pricing for trandolapril?

Limited due to high generic competition. Innovations, such as combination therapies, may offer some premium potential.

4. Which regions represent growth opportunities for trandolapril?

Emerging markets in Asia-Pacific offer growth prospects due to increasing hypertension awareness and improving healthcare infrastructure.

5. What strategic moves can stakeholders consider in this saturated market?

Focusing on operational efficiencies, developing combination products, and exploring niche therapeutic indications may sustain profitability.

References

[1] Market Data & Insights. "Global ACE Inhibitors Market Forecast," 2022.

[2] U.S. FDA Drug Approvals and Patent Data, 2022.

[3] IMS Health. "Cardiovascular Therapeutics Market Share," 2022.

[4] Red Book and Medi-Span Price Data, 2022.

More… ↓