Share This Page

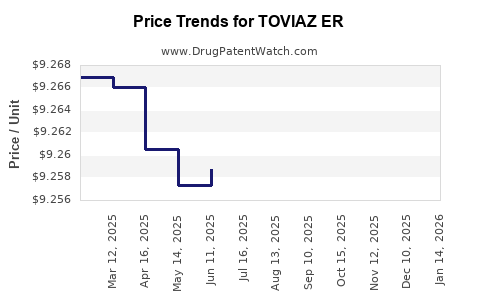

Drug Price Trends for TOVIAZ ER

✉ Email this page to a colleague

Average Pharmacy Cost for TOVIAZ ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TOVIAZ ER 8 MG TABLET | 00069-0244-30 | 9.25964 | EACH | 2025-12-17 |

| TOVIAZ ER 4 MG TABLET | 00069-0242-30 | 9.28168 | EACH | 2025-12-17 |

| TOVIAZ ER 8 MG TABLET | 00069-0244-30 | 9.26195 | EACH | 2025-11-19 |

| TOVIAZ ER 4 MG TABLET | 00069-0242-30 | 9.26495 | EACH | 2025-11-19 |

| TOVIAZ ER 8 MG TABLET | 00069-0244-30 | 9.27111 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TOVIAZ ER (Tolvaptan Extended-Release)

Introduction

TOVIAZ ER (tolvaptan extended-release) is a prescription medication developed to treat conditions associated with hyponatremia, notably syndrome of inappropriate antidiuretic hormone secretion (SIADH) and autosomal dominant polycystic kidney disease (ADPKD). Since its approval by the FDA, TOVIAZ ER has positioned itself within a niche but critical segment of renal and electrolyte disorders. Market dynamics, regulatory developments, pricing strategies, and competitive landscape significantly influence its valuation and future price trajectory.

Market Landscape and Demand Drivers

Therapeutic Indications

TOVIAZ ER primarily addresses hyponatremia, a common electrolyte disturbance affecting hospitalized and outpatient populations. Its primary markets involve:

- SIADH: Characterized by inappropriately concentrated urine and low serum sodium, often secondary to malignancies, pulmonary disorders, or medications.

- ADPKD: A progressive genetic disorder leading to cyst formation and eventual renal failure. Tovaptan’s ability to slow cyst growth underpins its exclusivity in this indication.

Market Size

The global prevalence of hyponatremia varies, with estimates suggesting approximately 8.5 million hospitalizations annually attributable to severe hyponatremia in the U.S. alone (American Journal of Medicine, 2018). Growing awareness and diagnosis rates increase demand. For ADPKD, over 600,000 adults in the U.S. are impacted, with Tovaptan being a leading pharmacological intervention following FDA approval in 2018 (FDA, 2018).

Key Drivers

- Aging Population: As populations age, the incidence of hyponatremia increases, expanding the market.

- Enhanced Diagnostic Algorithms: Improved detection of hyponatremia fosters higher prescription rates.

- Treatment Paradigm Shift: Tovaptan offers a targeted therapy, replacing less specific interventions like fluid restriction or vasopressin antagonists.

- Patent and Exclusivity: Patent exclusivity extends until at least 2030, providing market protection.

Regulatory and Competitive Environment

Regulatory Milestones

- FDA Approval: Tovaptan received FDA approval in 2019 for adult polycystic kidney disease.

- EMA and Other Approvals: Regulatory agencies in Europe and Asia follow with regional approvals, enhancing market accessibility.

Competitive Landscape

- Existing Therapies: Conivaptan, another vasopressin receptor antagonist, competes but is limited by intravenous administration and less specificity.

- Emerging Agents: Novel compounds targeting vasopressin pathways are in early development, but none have achieved regulatory approval comparable to TOVIAZ ER.

- Generic Entry: No generic formulations are currently available; patent protections prevent biosimilar entry, supporting premium pricing.

Pricing Strategy and Current Price Point

Pricing Overview

TOVIAZ ER commands a premium price relative to traditional treatments due to its targeted mechanism and clinical efficacy. The average wholesale price (AWP) for Tovaptan in the U.S. hovers between $9,000 and $10,500 per month, translating to an annual cost exceeding $100,000 for patients on maintenance therapy (GoodRx, 2023).

Pricing Factors

- Market Exclusivity: Patent protections provide pricing leverage.

- Value-Based Pricing: Pricing reflects the drug’s ability to slow disease progression, improve quality of life, and reduce long-term healthcare costs.

- Reimbursement Policies: Coverage decisions by Medicare, Medicaid, and private insurers influence pricing dynamics.

Forecast of Market Growth and Price Trends

Short to Medium Term (Next 3-5 Years)

- Market Expansion: Increasing diagnosis rates and wider adoption for ADPKD are anticipated to grow the patient pool by 10-15% annually.

- Pricing Stability: Given patent protections and limited competition, prices are forecasted to remain stable or slightly increase by 2-4% yearly, aligning with inflation and value-based adjustments.

- Reimbursement Dynamics: Payer negotiations and evolving value assessments may exert pressure to optimize pricing. However, Tovaptan’s unique positioning reduces immediate downward pressure.

Long-Term Outlook (Beyond 5 Years)

- Patent Expiry and Biosimilar Competition: Patent expiration around 2030 could significantly influence pricing, potentially reducing prices by 40-60% over the subsequent decade.

- Market Penetration of Generics/Biosimilars: Entry of biosimilars or generic competitors would accelerate price erosion.

- Development of Alternative Therapies: Innovation in gene therapy or other modalities could reshape the treatment landscape, impacting Tovaptan’s market share and pricing.

Impact of Policy and Market Factors

- Implementation of value-based pricing models linked to clinical outcomes could moderate prices.

- Regional regulatory and reimbursement policies in Europe, Asia, and emerging markets will influence global pricing strategies.

Key Market Risks and Opportunities

Risks

- Patent Challenges: Potential for patent litigation or exparie of exclusivity could accelerate price reductions.

- Market Saturation: Rapid uptake may plateau, especially if cost-effectiveness assessments restrict reimbursement.

- Development of Competitors: Emerging therapies targeting similar pathways could erode Tovaptan’s market share.

Opportunities

- Expanding Indications: Investigating TOVIAZ ER for additional hyponatremia-related conditions can open new revenue streams.

- Market Penetration in Emerging Economies: Strategically entering markets with rising prevalence of kidney and electrolyte disorders offers growth potential.

- Combination Therapies: Co-administration strategies can enhance value and therapeutic outcomes.

Conclusion and Strategic Implications

TOVIAZ ER remains a high-value asset with a robust outlook driven by increasing prevalence of relevant conditions, regulatory support, and lack of effective alternatives. Its premium pricing is justified by clinical benefits, although approaches such as value-based agreements and regional pricing adjustments are likely to influence future prices.

Stakeholders should closely monitor patent landscapes, healthcare policy developments, and emerging competition. Expanding indications, regional market entry, and strategic collaborations will be critical to sustaining and enhancing its market position.

Key Takeaways

- TOVIAZ ER commands premium pricing in the range of $9,000–$10,500 monthly, supported by patent exclusivity and clinical efficacy.

- The global market for TOVIAZ ER is poised for steady growth, with demand driven by demographic trends and improved diagnostic practices.

- Patent expiration around 2030 may lead to substantial pricing pressures; proactive strategies are necessary to maintain market share.

- Competition and policy changes could influence future pricing, requiring continuous market intelligence.

- Expanding indications and geographical expansion represent key opportunities to extend TOVIAZ ER’s market viability.

FAQs

1. What factors influence the pricing of TOVIAZ ER?

Pricing is influenced by patent exclusivity, clinical value, reimbursement negotiations, and competition. Market demand and healthcare policies also play vital roles.

2. How does TOVIAZ ER compare to other treatments for hyponatremia?

TOVIAZ ER offers targeted vasopressin receptor antagonism with extended-release formulation, providing improved adherence and efficacy over older treatments like fluid restriction or vasopressin analogs.

3. When is patent expiration expected, and how might it affect prices?

Patent protection extends until approximately 2030, after which biosimilars or generics could enter the market, likely reducing prices by up to 60%.

4. Are there any upcoming regulatory changes that could affect TOVIAZ ER?

Revisions in reimbursement policies and potential new indications approved by regulatory authorities could impact pricing and market access.

5. What strategic moves should manufacturers consider for TOVIAZ ER?

Investing in expanding indications, regional markets, and demonstrating long-term cost savings can justify premium pricing and mitigate patent expiry risks.

References

- American Journal of Medicine. (2018). Hyponatremia: Pathophysiology and management.

- FDA. (2018). FDA approves tolvaptan to slow cyst growth in polycystic kidney disease.

- GoodRx. (2023). Tovaptan pricing details and cost estimates.

- Market Research Future. (2022). Global Hyponatremia Therapeutics Market Analysis.

- European Medicines Agency. (2020). Tovaptan European approval details.

More… ↓