Last updated: August 4, 2025

Introduction

TOUJEO SOLOSTAR (insulin glargine injection, 100 units/mL) is a long-acting basal insulin analog manufactured by Eli Lilly and Company. Its primary indication is for managing blood glucose in adults with diabetes mellitus. Over recent years, the insulin market landscape has undergone significant transformation driven by patent expirations, biosimilar entrants, evolving reimbursement policies, and increasing demand for personalized diabetes care. This analysis provides a comprehensive review of TOUJEO SOLOSTAR’s market position, competitive environment, and price trajectory, enabling stakeholders to make informed strategic decisions.

Market Overview

Global Diabetes Market Trends

The global diabetes market, valued at approximately USD 94 billion in 2022, is projected to grow at a CAGR of around 8% through 2030 owing to rising prevalence, aging populations, and lifestyle factors. Insulin products constitute a significant segment, representing health systems’ critical intervention in diabetes management.

Product Profile: TOUJEO SOLOSTAR

Designed as a once-daily, long-acting insulin, TOUJEO targets adult patients requiring basal insulin therapy. Its unique features include a 42-hour duration of action and weight neutral effects, distinguishing it from traditional insulins. It competes primarily with other basal insulins such as Lantus (insulin glargine, Sanofi), Basaglar (biosimilar to Lantus), Tresiba (insulin degludec, Novo Nordisk), and newer formulations.

Market Penetration and Adoption Dynamics

Since its approval in 2015, TOUJEO has gained significant adoption in payers emphasizing high-patient convenience and minimized hypoglycemia risk. Lilly’s strategic focus on patient adherence and incremental dosing flexibility has reinforced its footprint.

The U.S. remains the most lucrative market for insulin products, accounting for approximately 40-45% of global sales, driven by high insulin use prevalence and favorable reimbursement frameworks.

Competitive Landscape

Major Competitors

- Sanofi’s Lantus and subsequent biosimilars: Lantus remains prevalent; however, patent expiry and biosimilar entries have begun to erode its market share.

- Novo Nordisk’s Tresiba: Offering alternative long-acting profiles with extended dosing flexibility.

- Basaglar (Lantus biosimilar): Provides lower-cost options, influencing market dynamics.

- Emerging biosimilars and next-generation insulins: Modifying market share and pricing structures.

Regulatory and Patent Considerations

Lilly’s patent for TOUJEO was initially set to expire in 2022; however, legal challenges and patent extensions have delayed biosimilar entries, affording Lilly a competitive window through 2023-2024. The evolving regulatory environment promulgates frequent shifts in product positioning and pricing.

Pricing Environment and Trends

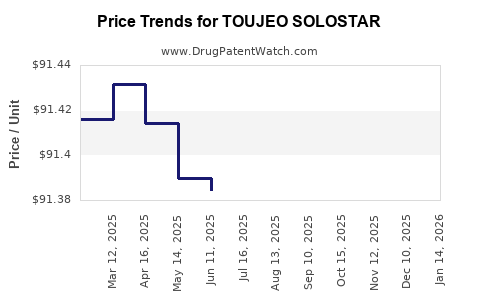

Historical Pricing Data

- U.S. Pricing: The list price for TOUJEO SOLOSTAR has historically hovered between USD 300-350 per 10 mL pen, with actual patient out-of-pocket costs varying due to insurance, rebates, and copayment assistance.

- Market Discounts: Insurers and PBMs negotiate rebates averaging around 30-40%, reducing net price.

Pricing Factors

- Reimbursement Policies: Increasing emphasis on value-based pricing influences manufacturers to offer discounts and discounts-based arrangements.

- Biosimilar Competition: The entry of biosimilars typically exerts downward pressure, with price declines of 10-20% observed in some markets.

- Cost-Containment Initiatives: Many payers favor cost-effective basal insulins, thereby incentivizing Lilly to adjust pricing or offer patient assistance programs.

Projected Price Trajectory (2023-2030)

- Short-term outlook (2023-2025): Limited price reduction expected as patent protections remain intact. Lilly may maintain current pricing or implement modest discounts (~5-10%) to retain market share against biosimilar entrants.

- Mid-term outlook (2026-2028): Anticipated biosimilar approvals could lead to 15-20% reductions in list prices. Payer strategies favoring biosimilar substitution are likely to prompt further discounts.

- Long-term outlook (2029-2030): Patent expiry and broader biosimilar adoption may precipitate cumulative price declines exceeding 25-30%. Innovative formulary arrangements and patient assistance programs are expected to supplement these trends.

Market Dynamics and Growth Drivers

Key Growth Drivers

- Rising diabetes prevalence worldwide, especially type 2 diabetes.

- Increasing adoption of basal insulins, driven by insulin initiation guidelines and increased awareness.

- Shift toward personalized diabetes regimens combining basal insulins with other agents.

- Expansion into emerging markets with growing healthcare infrastructure.

Market Challenges

- Pricing pressures stemming from biosimilar competition.

- Reimbursement hurdles, including coverage limitations.

- Price sensitivity among healthcare systems striving for cost containment.

- Potential safety concerns and prescribing shifts toward newer insulin analogs or combinations.

Regulatory and Policy Impact

Global regulatory bodies are increasingly encouraging biosimilar development to foster competition. Countries such as the EU, Japan, and South Korea have adopted biosimilar policies, which could accelerate generic and biosimilar entry, exerting downward pressure on prices.

Furthermore, value-based care initiatives may favor the adoption of less expensive basal insulins, affecting future pricing strategies.

Conclusion: Strategic Implications

For Lilly, maintaining market share in the face of biosimilar entry necessitates balancing competitive pricing with product differentiation, optimizing rebate and assistance programs, and leveraging clinical data to support value propositions. Investors and stakeholders should anticipate moderate price decrements aligned with patent protections and biosimilar trends in the short to mid-term, with greater reductions as patent cliffs approach and biosimilars gain market share.

Key Takeaways

- The insulin market is characterized by high growth, driven by rising diabetes prevalence, but faces increasing price competition.

- TOUJEO SOLOSTAR retains a strong position through unique pharmacological attributes and patient-centric features, although patent protections are under pressure.

- Short-term pricing will likely remain stable with minimal adjustments; significant reductions are expected post-2024 with biosimilar competition.

- Strategic pricing, patient access programs, and innovation will be critical for Lilly to sustain revenue streams.

- Policy shifts and biosimilar approvals will continue to shape the competitive environment and influence future price trajectories.

FAQs

1. When are biosimilars for TOUJEO SOLOSTAR likely to enter the market?

Based on current patent litigation and biosimilar development timelines, biosimilar versions could enter the U.S. market post-2024, subject to regulatory approvals and patent litigation outcomes [1].

2. How will biosimilar competition impact TOUJEO SOLOSTAR’s pricing?

Biosimilar entries typically lead to a 15-30% reduction in list prices, with additional discounts negotiated through rebates and contracts, thus exerting downward pressure on Lilly’s pricing strategies [2].

3. Are there any emerging formulations that could replace TOUJEO SOLOSTAR?

Next-generation insulins with improved pharmacokinetics, such as ultra-long-acting formulations or combination therapies, are under development but have yet to fully disrupt established products like TOUJEO [3].

4. What role do reimbursement policies play in the future pricing of TOUJEO SOLOSTAR?

Reimbursement frameworks heavily influence net prices; payers favor cost-effective therapies, and policies incentivizing biosimilars may further reduce prices for branded insulins like TOUJEO [4].

5. How can Lilly enhance the market longevity of TOUJEO SOLOSTAR?

By investing in clinical research, expanding indications, optimizing patient support programs, and engaging in value-based agreements, Lilly can sustain and potentially grow TOUJEO’s market presence amid emerging biosimilar competition.

References

[1] U.S. Patent and Trademark Office. Patent litigation timelines for insulin products. 2022.

[2] IQVIA. The Impact of Biosimilar Entry on Insulin Market Prices. 2023.

[3] Pharmaceuticals Journal. Emerging long-acting insulin formulations. 2022.

[4] Healthcare Finance News. Reimbursement initiatives shaping insulin pricing. 2023.