Share This Page

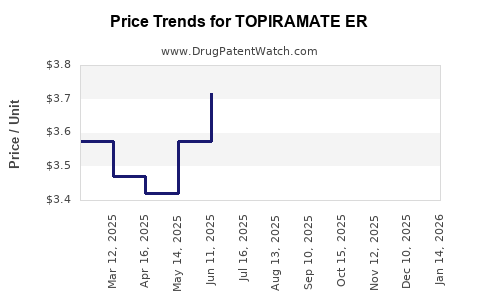

Drug Price Trends for TOPIRAMATE ER

✉ Email this page to a colleague

Average Pharmacy Cost for TOPIRAMATE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TOPIRAMATE ER 50 MG SPRINKL CAP | 72603-0121-01 | 5.54626 | EACH | 2025-12-17 |

| TOPIRAMATE ER 100 MG CAPSULE | 00480-2358-01 | 13.06161 | EACH | 2025-12-17 |

| TOPIRAMATE ER 100 MG CAPSULE | 00480-2358-56 | 13.06161 | EACH | 2025-12-17 |

| TOPIRAMATE ER 100 MG CAPSULE | 10370-0367-11 | 13.06161 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Topiramate ER

Introduction

Topiramate ER (Extended Release), a prominent anticonvulsant and migraine prophylactic, has experienced evolving market dynamics driven by clinical efficacy, formulations, regulatory shifts, and competitive landscape. This report provides an in-depth market analysis and forecasts future pricing trends for Topiramate ER, aiming to equip pharmaceutical stakeholders, investors, and healthcare professionals with strategic insights.

Pharmacological Profile and Market Position

Topiramate, marketed as Topamax among other brand names, was approved by the FDA in 1996 for partial seizures and migraine prevention (1). The extended-release formulation was introduced to improve patient compliance and reduce side effects associated with immediate-release versions. By delivering a controlled dosage over 24 hours, Topiramate ER aims to optimize therapeutic outcomes.

Its versatility extends beyond epilepsy and migraines, with emerging off-label uses including neuropathic pain, weight management, and bipolar disorder adjunct therapy. These broad indications underpin its resilient market presence.

Market Dynamics

Global Demand and Therapeutic Adoption

The global epilepsy treatment market was valued at approximately USD 5.2 billion in 2021, with topiramate accounting for a significant share owing to its efficacy and tolerability (2). The migraine prophylaxis segment, propelled by increasing migraine prevalence—estimated at over 1 billion globally—further supports demand (3).

In specific regions, adoption rates are influenced by regulatory approvals, insurance coverage, and physician prescribing habits. The shift from immediate-release to ER formulations is being driven by patient preference for ease of use and fewer side effects.

Competitive Landscape

Topiramate’s primary competitors encompass other antiepileptic drugs, such as levetiracetam, lamotrigine, and valproate. Notably, newer agents like perampanel and brivaracetam are gaining market traction, intensifying competition.

Generics dominate the topiramate ER market, especially in mature regions. The expiration of patents has facilitated widespread availability of affordable generic versions, impacting branded pricing innovation and margins (4).

Regulatory and Market Access Factors

Recent regulatory considerations include:

- FDA's REMS Program: Ensuring safe use due to side effects like cognitive impairment.

- European Approvals: Adhering to EMA guidelines influences dosing and labeling.

- Market Access Disparities: Reimbursement policies influence prescribing patterns, especially in Medicaid and Medicare in the U.S.

Patent and Patent Expirations

The primary patent for Topamax expired around 2012, leading to a surge in generic versions. The absence of recent patents for ER formulations has cemented generics' market dominance, exerting downward pressure on prices (5).

Pricing Trends and Projections

Historical Pricing Movements

Since patent expiration, the average wholesale price (AWP) of Topiramate ER has declined sharply:

- 2012: Branded Topamax priced at approximately USD 300 per month.

- 2015: Generic versions available for USD 50–100/month.

- 2020: Average prices hovered around USD 30–60/month for generics.

The market instability caused by the proliferation of generics has led to a volatile but generally downward price trend.

Current Pricing Landscape (2023)

The current median wholesale acquisition cost (WAC) for Topiramate ER—primarily in generic form—is approximately USD 20–30 per month, with significant regional variation. Branded formulations are largely phased out in favor of generics, though specialty formulations may retain premium pricing.

Projected Future Prices (2024–2028)

Forecasts for the next five years indicate a continued decline in generic prices, driven by competitive pressures, procurement efficiencies, and potential biosimilar entries for related compounds. However, several factors will influence future pricing:

- Market Penetration of Biosimilars and New Formulations: Introduction of new delivery systems or combination therapies could disrupt existing price points.

- Regulatory and Policy Changes: Tightening of drug pricing regulations, especially in the U.S. and Europe, could stabilize prices or reduce margins.

- Manufacturing and Raw Material Costs: Fluctuations here could exert upward pressure temporarily.

Based on current trends and market factors, average prices for Topiramate ER are projected to decrease by 10–15% annually through 2028, with generic monthly costs declining to approximately USD 10–20.

Impact of Healthcare Policy and Market Access

Perpetual enhancements in cost-effectiveness and reimbursement criteria may accelerate price declines. Conversely, supply chain disruptions or raw material shortages—particularly organic synthesis intermediates—could temporarily prop up prices.

Market Opportunities and Risks

Opportunities

- Growth in Off-label Uses: Expanding indications, such as weight management, could boost demand.

- Emerging Markets: Increased healthcare infrastructure in Asia, Africa, and Latin America offers new revenue streams.

- Combination Therapies: Fixed-dose combinations with other CNS agents could command premium pricing.

Risks

- Market Saturation: High generic penetration limits pricing power.

- Regulatory Hurdles: Future restrictions on off-label markets could dampen growth.

- Patent Landscapes: Patent challenges or exclusivity extensions for new formulations may influence pricing strategies.

Conclusion

The market for Topiramate ER remains robust owing to widespread clinical use and off-label application flexibility. However, patent expirations and generic proliferation have driven prices down significantly, with forecasts indicating a further decline in the coming years. Strategic positioning should focus on differentiating formulations, exploring emerging markets, and aligning with evolving healthcare policies to optimize revenue streams.

Key Takeaways

- Market saturation of generics has led to substantial price erosion for Topiramate ER, with prices expected to decline further by 10–15% annually through 2028.

- Competitive pressures from newer antiepileptics and emerging biosimilars will influence pricing strategies and market share.

- Global expansion and off-label use growth present opportunities for incremental revenue but require careful regulatory navigation.

- Healthcare policy shifts, particularly regarding drug pricing and reimbursement, are pivotal in shaping future pricing landscapes.

- Innovation in formulations and combination therapies could mitigate price pressures and sustain profitability.

FAQs

1. What factors primarily influence the pricing of Topiramate ER?

Drug pricing is driven by patent status, generic competition, manufacturing costs, regulatory policies, healthcare reimbursement frameworks, and market demand.

2. How have generic versions impacted the pricing of Topiramate ER?

The introduction of generics post-patent expiry has driven down prices substantially, leading to increased accessibility but reducing margins for branded formulations.

3. Are there notable regulatory developments that could alter the market for Topiramate ER?

Yes. Tightening of drug pricing regulations, approval of biosimilars, and changes in off-label prescribing policies could influence market dynamics and pricing.

4. What emerging markets offer growth potential for Topiramate ER?

Countries in Asia, Latin America, and Africa—with expanding healthcare infrastructure—represent promising growth avenues, contingent upon local regulatory and reimbursement conditions.

5. What strategic considerations should pharmaceutical companies adopt regarding Topiramate ER?

Focus on innovation in delivery systems, explore combination therapies, engage in markets with regulatory ease, and adapt to policy changes to sustain competitive advantage.

References

- U.S. Food and Drug Administration. (1996). FDA Approval for Topiramate.

- MarketsandMarkets. (2021). Epilepsy Drugs Market Size and Forecast.

- World Health Organization. (2021). Global Burden of Migraine.

- FDA Patent Expiry Data. (2022).

- IMS Health. (2019). Generic Drug Market Impact Analysis.

More… ↓