Share This Page

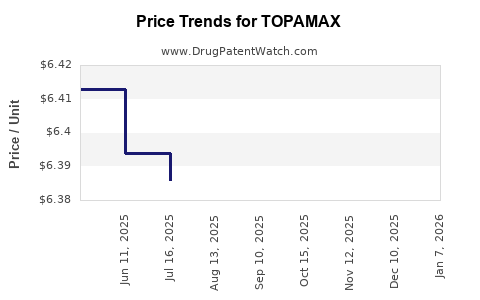

Drug Price Trends for TOPAMAX

✉ Email this page to a colleague

Average Pharmacy Cost for TOPAMAX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TOPAMAX 100 MG TABLET | 50458-0641-65 | 17.41785 | EACH | 2025-12-17 |

| TOPAMAX 25 MG SPRINKLE CAP | 50458-0645-65 | 7.33045 | EACH | 2025-12-17 |

| TOPAMAX 200 MG TABLET | 50458-0642-65 | 20.48649 | EACH | 2025-12-17 |

| TOPAMAX 50 MG TABLET | 50458-0640-65 | 12.72417 | EACH | 2025-12-17 |

| TOPAMAX 25 MG TABLET | 50458-0639-65 | 6.37928 | EACH | 2025-12-17 |

| TOPAMAX 100 MG TABLET | 50458-0641-65 | 17.41260 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Topamax (Topiramate)

Introduction

Topamax (topiramate) remains a prominent anticonvulsant and off-label treatment for migraine prophylaxis. Originally approved by the FDA in 1996 for seizure disorders, it further gained approval in 2004 for migraine prevention. With a well-established safety profile, diverse therapeutic uses, and a broad production base, Topamax continues to influence the neuropharmacology market. This analysis evaluates current market dynamics, competitive positioning, pricing trends, and future price projections for Topamax, providing strategic insights for stakeholders including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Current Market Landscape

Topamax’s global market size was valued at approximately USD 800 million in 2022, reflecting steady growth driven by its dual indication for epilepsy and migraine prevention (MarketResearch.com). North America dominates this market, supported by high prescription rates and reimbursement coverage, accounting for over 60% of global sales. Europe remains the second primary market due to widespread adoption, while emerging markets in Asia-Pacific exhibit growing demand, albeit constrained by pricing and regulatory hurdles.

Key Competitors and Alternatives

Topamax faces direct competition from newer anticonvulsants and migraine-specific medications. Notable alternatives include:

- Valproate and lamotrigine: Older anticonvulsants with similar indications.

- Amitriptyline: Off-label use for migraines, less expensive.

- Emerging CGRP antagonists: Erenumab, fremanezumab, and galcanezumab, offering improved efficacy and tolerability for chronic migraines.

While these newer drugs threaten to displace Topamax in some indications, its established efficacy and cost-effectiveness maintain its market share.

Regulatory and Patent Landscape

Topamax has been off patent since 2012, enabling generic manufacturers to produce and market topiramate at lower prices. This patent expiration has been pivotal in driving price competition, especially outside the U.S., leading to substantial price erosion and increased market penetration for generics [1].

Pricing Dynamics

Brand vs. Generic Pricing

The original branded Topamax typically commanded a premium of 30-50% over generic prices prior to patent expiry. Post-patent, generic topiramate prices plunged by approximately 80-90%, resulting in significant cost savings for payers and patients. As of 2023, the average retail price for a 30-day supply of generic topiramate ranges from USD 10 to USD 25, depending on dosage and pharmacy discounts (GoodRx).

Market-Driven Price Trends

- Post-Patent Decline: The sharp price drop post-2012 significantly increased accessibility.

- Market Saturation: Increased generic availability has minimized pricing volatility, with prices stabilizing at low levels.

- Formulation and Dosage Variations: Higher dosages and extended-release formulations maintain relatively higher prices (~USD 30–USD 50/month), although still less than branded formulations.

Impact of Regulatory Policies

Pharmacoeconomic policies and drug formularies influence pricing. Countries with strong price control measures or negotiation leverage tend to see lower drug prices. Conversely, in the U.S., high insurance co-pays and pharmacy benefit manager negotiations influence actual patient costs, sometimes keeping prices artificially high for certain formulations.

Market Drivers and Challenges

Drivers

- High Prevalence of Epilepsy and Migraines: The World Health Organization estimates over 50 million epilepsy patients globally and 1 billion migraine sufferers, sustaining demand.

- Cost-effectiveness: Generic topiramate remains a cost-effective treatment compared to newer medications.

- Off-label Uses: Expanded off-label applications, including weight loss and mood stabilization, bolstered by ongoing research.

Challenges

- Emergence of Novel Therapies: CGRP inhibitors and other targeted treatments threaten Topamax’s market share.

- Side-effect Profile: Cognitive impairment, weight loss, and paresthesia limit its tolerability in some patients.

- Market Saturation: Established generic market suppresses potential price increases.

Future Price Projections

Short to Medium Term (2023-2026)

Given the fully commoditized generic market, prices are expected to remain stable with slight fluctuations influenced by inflation, supply chain dynamics, and regional regulatory changes. The typical monthly generic topiramate price is likely to hover between USD 8 and USD 20.

Long Term (2026 and beyond)

- Potential Price Stability: As patents remain lapsed, significant price increases are unlikely unless supply disruptions occur.

- Impact of Biosimilars and Competition: While biosimilar development pertains mainly to biologics, any regulatory incentivization for alternative formulations could influence prices indirectly.

- Shift in Market Shares: Increased uptake of newer, potentially more effective therapies with better side-effect profiles might gradually erode Topamax’s market, leading to further price declines.

Pricing Outlook Summary

| Time Frame | Price Trend | Expected Median Price (per month) | Key Factors |

|---|---|---|---|

| 2023-2024 | Stable | USD 10–USD 15 | Post-patent generic saturation, stable demand |

| 2025-2026 | Slight decline | USD 9–USD 12 | Competition from newer treatments, cost sensitivity |

| 2026+ | Plateau | USD 8–USD 10 | Market saturation, minimal price inflation |

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost-efficient production, expansion into emerging markets, and differentiation through quality assurance.

- Healthcare Providers: Prioritize generic formulations to optimize costs without compromising efficacy.

- Regulators: Maintain transparency and regulation to ensure fair pricing, especially in markets with pricing volatility.

- Investors: Recognize the stable, low-margin nature of the generic topiramate market but remain vigilant regarding emerging therapies that could disrupt current dynamics.

Key Takeaways

- The Topamax market is characterized by mature, highly competitive generic segments with stable, low-price points.

- Patent expiration catalyzed price erosion, making Topamax a cost-effective choice particularly in resource-constrained settings.

- Emerging therapies for migraine and epilepsy could gradually diminish demand for Topamax over the next decade.

- Future pricing will likely remain low with minimal fluctuations, contingent on market saturation and evolving therapeutic options.

- Stakeholders should monitor regulatory policies and technological innovations, which could influence the competitive landscape and pricing strategies.

FAQs

1. How has the patent expiration affected Topamax pricing?

Patent expiry in 2012 allowed generic manufacturers to enter the market, causing prices to decline by up to 80-90%, making generic Topamax significantly more affordable.

2. What factors could lead to increased prices for Topamax in the future?

While unlikely due to market saturation, potential supply chain disruptions or regulatory changes could temporarily raise prices. However, new formulations or therapeutics may further suppress prices.

3. How does the competition from newer migraine medications impact Topamax?

CGRP antagonists and other targeted therapies offer better tolerability and efficacy, gradually reducing Topamax’s market share, especially among patients intolerant to side effects.

4. Are there regional differences in Topamax pricing?

Yes. Developed countries with strong negotiating power keep prices low for generics, while prices vary globally depending on healthcare policies, insurance coverage, and market competition.

5. Can the price of Topamax increase due to formulary preferences?

Rarely, as the generic market is saturated; formulary preferences for branded or specialty drugs can influence utilization but not significantly affect established generic prices.

References

[1] Market Research Future. "Topiramate Market Analysis & Forecast to 2030."

[2] GoodRx. "Topiramate Prices & Coupons."

[3] FDA. "Topamax (Topiramate) Drug Label."

[4] IMS Health. "Global Pharmaceutical Market Trends," 2022.

[5] WHO. "Epilepsy and Migraine Epidemiology," 2021.

More… ↓