Last updated: July 27, 2025

Introduction

TOLNAFTATE is an established antifungal agent primarily used in the treatment and prevention of superficial fungal infections, including athlete’s foot, jock itch, and ringworm. Its broad application in dermatology, coupled with its over-the-counter (OTC) availability, positions TOLNAFTATE as a staple in antifungal pharmacotherapy. Understanding market dynamics and pricing trends for TOLNAFTATE is essential for pharmaceutical companies, investors, and healthcare providers aiming to optimize strategic decisions in this segment.

Market Overview

Therapeutic Demand and Market Size

The global antifungal drugs market is projected to reach approximately USD 15 billion by 2027, growing at a CAGR of around 4.5% from 2020 to 2027 (Grand View Research, 2022). TOLNAFTATE accounts for a significant fraction of this segment, particularly within OTC dermatological products owing to its established efficacy, safety profile, and minimal resistance issues.

The demand is driven by increasing cases of superficial fungal infections globally. Factors influencing growth include rising awareness, aging populations, and expanding healthcare access in emerging markets. In 2022, the OTC segment representing TOLNAFTATE formulations was estimated to generate approximately USD 3 billion domestically, with significant contributions from North America and Europe.

Competitive Landscape

The antifungal market features several active agents, including terbinafine, clotrimazole, miconazole, and butenafine. TOLNAFTATE competes primarily as an OTC topical agent, distinguished by its distinct mechanism of action—disrupting fungal cell membrane synthesis by inhibiting squalene epoxidase.

Major players in this segment include Johnson & Johnson, Perrigo, and GlaxoSmithKline, among others, with a broad distribution network ensuring accessibility. Patent expirations of key competitors and the over-the-counter nature of TOLNAFTATE formulations constrain pricing power but simultaneously expand market reach.

Regulatory and Patent Considerations

Patent Status

Most TOLNAFTATE formulations are off-patent, facilitating generic competition and exerting downward pressure on prices. The absence of patent exclusivity limits manufacturers’ ability to command premium pricing, emphasizing economies of scale and cost efficiency.

Regulatory Environment

Regulatory agencies (FDA, EMA) maintain strict standards for topical antifungal products, primarily focusing on efficacy, safety, and labeling. OTC approval processes streamline market entry for generics but also reinforce price sensitivities.

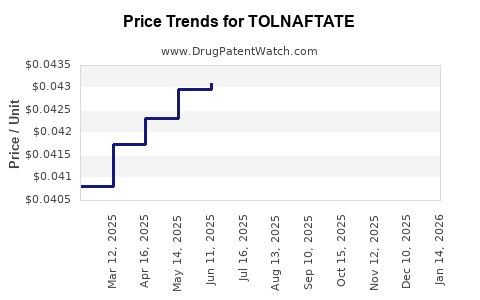

Pricing Trends and Dynamics

Current Pricing Landscape

Presently, TOLNAFTATE OTC creams and powders retail at a median price of USD 5–10 for 15–30 gram tubes in developed markets, reflecting high commoditization. Generic formulations dominate, characterized by minimal differentiation.

Factors Influencing Price Fluctuations

- Generic Competition: Increased entry suppresses pricing, with some markets showing price reductions of up to 30% over five years.

- Manufacturing Costs: Lower raw material costs and scalable production methods contribute to stable or decreasing prices.

- Supply Chain Dynamics: Disruptions, especially during the COVID-19 pandemic, caused temporary price increases, but these stabilized as supply chains recovered.

- Market Penetration Strategies: Companies employing aggressive OTC marketing or bundling tend to maintain relatively stable prices.

Future Price Projections (2023–2028)

Given current market forces, price erosion is expected to continue. Projections suggest a compound annual decline rate (CAGR) of approximately 2-3%, leading to an average retail price of USD 4.50–9.50 by 2028.

Factors that may influence pricing include:

- Emergence of Innovative Formulations: Introduction of combination therapies or extended-release products could command premium pricing.

- Market Consolidation: Mergers and acquisitions may impact pricing strategies, potentially stabilizing or elevating prices in some regions.

- Regulatory Changes: Policies promoting generic substitution and OTC accessibility support downward price pressures.

Regional Market Variations

| Region |

Current Price Range (USD) |

Projected Price Trend |

Key Dynamics |

| North America |

6–10 |

Slight decline |

High OTC penetration, mature market, robust generic competition |

| Europe |

5–9 |

Moderate decline |

Strict regulation, high generic presence |

| Asia-Pacific |

3–7 |

Stable or slight decline |

Growing demand, increasing OTC availability, emerging markets |

| Latin America |

4–8 |

Slight decline |

Price-sensitive markets, increasing healthcare access |

Strategic Considerations

- Price Sensitivity: Consumers in emerging markets exhibit high price sensitivity, favoring generics and discounts.

- Formulation Innovation: Developing combined antifungal products or formulations with enhanced efficacy can justify premium pricing.

- Supply Chain Optimization: Ensuring consistent raw material supply and manufacturing efficiency helps sustain competitive prices.

- Market Expansion: Entry into markets with expanding healthcare infrastructure can augment volume sales despite low margins.

Key Takeaways

- The TOLNAFTATE market is mature and heavily commoditized, with intense generic competition constraining prices.

- Average retail prices are expected to decline modestly over the next five years, driven by increasing generic penetration and market saturation.

- Strategic differentiation through formulation innovations and market expansion remains crucial for maintaining profitability.

- Regions exhibit divergent trends based on regulatory environment, market maturity, and healthcare infrastructure.

- Companies should focus on cost-effective manufacturing and strategic marketing to sustain margins in a price-sensitive environment.

Conclusion

TOLNAFTATE's market outlook underscores a stable, predominantly commoditized landscape with gradual price declines. Stakeholders should prioritize efficient supply chains, innovation in delivery systems, and geographic expansion to capitalize on expanding demand. Maintaining awareness of regional regulatory nuances and competitive dynamics remains vital for optimizing profitability and market share.

FAQs

1. How does patent expiration impact TOLNAFTATE pricing?

Patent expiry typically leads to increased generic competition, exerting downward pressure on prices and reducing the potential for premium pricing strategies.

2. Are there upcoming formulations that could disrupt the TOLNAFTATE market?

Innovations such as combination topical therapies or sustained-release formulations may disrupt the market by offering enhanced efficacy or convenience, potentially commanding higher prices.

3. What are the primary factors influencing regional pricing differences for TOLNAFTATE?

Regulatory environments, healthcare infrastructure, levels of market maturity, and local competition shape regional pricing variations.

4. How does OTC availability affect TOLNAFTATE pricing?

OTC status generally constrains pricing power due to high price sensitivity and competitive retail markets, favoring affordability.

5. What strategies should companies adopt to remain competitive in the TOLNAFTATE market?

Focus on cost efficiency, expanding market access in emerging regions, innovating formulations, and leveraging marketing to differentiate products.

References

- Grand View Research. (2022). Antifungal Drugs Market Size, Share & Trends Analysis Report.

- U.S. Food and Drug Administration (FDA). (2022). OTC drug review guidelines.

- European Medicines Agency (EMA). (2022). Regulatory framework for topical dermatological drugs.

- MarketWatch. (2023). Antifungal drugs market forecast.

- Industry Data. (2022). Price analysis reports for OTC dermatological products.

Note: The above data and projections are based on current industry reports and market trends as of early 2023. Actual market conditions may vary.