Share This Page

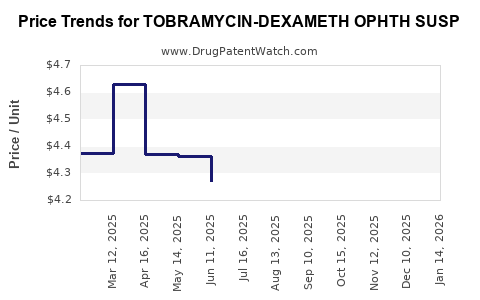

Drug Price Trends for TOBRAMYCIN-DEXAMETH OPHTH SUSP

✉ Email this page to a colleague

Average Pharmacy Cost for TOBRAMYCIN-DEXAMETH OPHTH SUSP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TOBRAMYCIN-DEXAMETH OPHTH SUSP | 00574-4031-10 | 4.55191 | ML | 2025-12-17 |

| TOBRAMYCIN-DEXAMETH OPHTH SUSP | 24208-0295-05 | 4.26767 | ML | 2025-12-17 |

| TOBRAMYCIN-DEXAMETH OPHTH SUSP | 24208-0295-10 | 4.55191 | ML | 2025-12-17 |

| TOBRAMYCIN-DEXAMETH OPHTH SUSP | 00574-4031-25 | 4.40886 | ML | 2025-12-17 |

| TOBRAMYCIN-DEXAMETH OPHTH SUSP | 61314-0647-25 | 4.40886 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Tobramycin-Dexamethasone Ophthalmic Suspension

Introduction

Tobramycin-Dexamethasone ophthalmic suspension remains a pivotal combination in managing bacterial ocular infections with inflammatory components. Its unique formulation, integrating an aminoglycoside antibiotic with a corticosteroid, offers dual-action therapeutic benefits, positioning it within a competitive ophthalmic pharmacopoeia. This analysis explores its current market landscape, key drivers, competitive dynamics, regulatory factors, and future price trajectories.

Current Market Landscape

Product Overview

Tobramycin-Dexamethasone ophthalmic suspension combines the broad-spectrum antibiotic tobramycin with the anti-inflammatory corticosteroid dexamethasone. It is primarily indicated for bacterial conjunctivitis, keratitis, and postoperative ocular inflammation with bacterial involvement. Marketed under various brand names internationally, notably Tobradex (by Alcon), the formulation has cemented its role in ophthalmic therapeutics.

Market Size & Regional Dynamics

The global ophthalmic anti-infective market is projected to reach approximately $4.2 billion by 2026, with a compound annual growth rate (CAGR) of around 4.5%.[1] Tobramycin-based formulations constitute a significant share, particularly in North America and Europe, where established healthcare infrastructures and high prevalence of postoperative ocular procedures are prevalent.

In these regions, Tobramycin-Dexamethasone products benefit from high prescription volumes, driven by:

- Postoperative care following cataract and refractive surgeries.

- Increased prevalence of bacterial conjunctivitis, particularly during seasonal outbreaks.

- Growing awareness and access to combination therapies that streamline treatment regimens.

Emerging markets in Asia-Pacific and Latin America display increasing adoption rates, accelerated by expanding healthcare access and rising incidence rates of ocular infections.

Market Players and Competition

Apart from the branded formulations like Tobradex, generic versions have entered multiple markets, intensifying price competition. The competitive landscape features several players:

- Alcon: Market leader with extensive distribution and strong brand equity.

- Santen, Bausch & Lomb, and other regional manufacturers: Offering generic and branded alternatives.

- Generic manufacturers: Capitalizing on patents' expiration and biosimilar development.

Recent innovations include preservative-free formulations and combination drugs targeting specific clinical needs, further fragmenting the market.

Regulatory and Patent Considerations

Patent expirations for key formulations typically occur between 2021 and 2025, enabling generic competition that exerts downward pressure on prices. Regulatory approval for generics hinges on demonstrating bioequivalence, with diligent pathways in major markets like the US and EU.

Manufacturers must navigate regulatory frameworks, including:

- FDA approval processes for generics.

- EMA regulations within the European Union.

- Regional variations in labeling and clinical trial requirements.

The expiration of patents, coupled with biosimilar developments, is expected to reshape market shares and pricing dynamics in the near term.

Price Trends and Projections

Historical Pricing Patterns

Over the past five years, the pricing of Tobramycin-Dexamethasone ophthalmic suspension has demonstrated typical drug market trends:

- Premium pricing for branded products, with retail prices averaging $50-$70 per 5 mL vial.

- Generic versions offering price reductions of 25-50%, increasing affordability and prescription volume.

- Insurance coverage and healthcare policies significantly influence patient out-of-pocket costs.

Forecasted Price Trends (2023-2028)

Based on current patent landscapes, market competition, and regulatory developments, the following projections are reasonable:

- Post-patent expiration (2022–2024): Expect significant price erosion—up to 30-40%—as generics enter the market, consolidating around $25-$40 per unit.

- Biosimilar/portfolio diversification: Anticipated to further reduce prices by an additional 10-15%, especially in markets where reimbursement policies favor cost-effective options.

- Market penetration and volume growth: Increased adoption due to favorable reimbursement policies and awareness campaigns will offset slight decreases in per-unit price, maintaining total market revenues.

- Premium formulations (e.g., preservative-free): Will command higher prices, potentially $60-$80, catering to niche segments with specific needs.

Influencing Factors

- Regulatory approvals of generics and biosimilars.

- Healthcare policy changes favoring cost-effective treatments.

- Patent litigations and exclusivity periods.

- Technological advances leading to improved formulations with better compliance and efficacy.

Strategic Implications for Stakeholders

- Pharmaceutical manufacturers should strategize around patent expirations by accelerating generic development and securing regulatory approval.

- Healthcare providers need to balance cost considerations with drug efficacy and safety, especially when choosing between branded and generic formulations.

- Investors should monitor patent landscapes, regulatory shifts, and emerging biosimilar developments to assess market entry risks and opportunities.

Future Outlook

The Ophthalmic anti-infective sector, including Tobramycin-Dexamethasone suspensions, will likely see sustained growth driven by demographic shifts—aging populations susceptible to ocular infections—and increasing surgical volumes. Price reductions following patent expirations will improve accessibility but may exert pressure on incumbent manufacturers to innovate or diversify.

Emerging formulations—such as sustained-release implants or preservative-free options—could reshape the market further, offering premium pricing prospects and enhanced patient compliance. Conversely, aggressive generic penetration will continue to influence downward price movements, fostering a more competitive landscape.

Key Takeaways

- Market dynamics favor significant price reductions post-patent expiration, with generics gaining market share and reducing costs.

- Regional variations in healthcare infrastructure and regulatory environments influence market size and pricing strategies.

- Regulatory pathways for biosimilars and generics will be critical in shaping future price trends.

- Innovations in formulation and delivery may sustain premium pricing segments, especially for niche or patient-specific markets.

- Stakeholders must proactively anticipate patent expiries and regulatory shifts to optimize pricing strategies and market positioning.

FAQs

1. When will generic versions of Tobramycin-Dexamethasone ophthalmic suspension enter the market?

Most patents related to branded formulations are expected to expire between 2022 and 2024, paving the way for generic entries shortly thereafter, contingent upon regulatory approval.

2. How will patent expirations impact drug pricing?

Patent expirations typically lead to substantial price reductions—often 25-50%—for generic competitors, significantly lowering patient costs and expanding market access.

3. Are there ongoing innovations that could maintain higher price points?

Yes. Preservative-free formulations, sustained-release delivery systems, and combination therapies designed for specific clinical niches are likely to command premium prices.

4. How do regional regulatory environments influence market entry and pricing?

Stringent regulatory requirements can delay generic approvals, maintaining higher prices for longer periods. Conversely, regions with accelerated approval pathways may see faster price declines.

5. What role do healthcare policies play in the pricing of ophthalmic drugs?

Policies encouraging cost containment and generic substitution—such as reimbursement reforms and drug formulary preferences—drive prices downward, making treatments more affordable.

Sources

[1] MarketWatch, "Global Ophthalmic Anti-Infective Market Size, Share & Trends Analysis Report," 2022.

More… ↓