Last updated: July 28, 2025

Introduction

TOBRADEX ST, a combination ophthalmic medication, combines tobramycin (an aminoglycoside antibiotic) with dexamethasone (a corticosteroid), primarily used to treat inflammatory ocular conditions susceptible to bacterial infection. Its unique formulation, designed for sustained delivery, positions it as a critical therapeutic option in ophthalmic practice. This analysis examines the current market landscape, competitive dynamics, regulatory environment, manufacturing considerations, and projective pricing strategies for TOBRADEX ST over the coming years to aid stakeholders in strategic decision-making.

Market Overview

Therapeutic Segment and Patient Demographics

The global ophthalmic drug market is expanding, driven by increasing prevalence of ocular surface diseases, such as conjunctivitis, keratitis, and postoperative infections, notably following cataract surgeries. According to Market Scope (2022), the ophthalmic segment is expected to grow at a CAGR of approximately 4.8% from 2022 to 2028, with antibiotics and anti-inflammatory agents representing a significant share.

TOBRADEX ST's primary adopters include ophthalmologists, optometrists, and surgical centers overseeing post-operative care. The drug's targeted application in managing bacterial infections with inflammation, often post-surgery, makes it a staple in specialized ophthalmic settings, particularly in developed markets like North America, Europe, and Asia-Pacific.

Current Market Penetration

While TOBRADEX ST has gained a notable market position since its approval, its penetration varies regionally, attributed to factors such as healthcare infrastructure, reimbursement policies, and local prescribing practices. In North America, the drug benefits from robust marketing channels and high surgical volumes, especially cataract and refractive surgeries. Conversely, in emerging markets, off-label use and local generics dilute its market share.

Competitive Landscape

Key Players and Alternatives

The ophthalmic antibiotic and anti-inflammatory space is highly competitive. Notable competitors include:

- Prednisolone acetate formulations combined with antibiotics (e.g., PredForte with antibiotics)

- Other fixed-dose combinations, such as Tobradex (the predecessor to TOBRADEX ST), which uses an alternative delivery mechanism

- Generic versions of tobramycin and dexamethasone in separate formulations, often at lower prices

In recent years, biosimilar and generic market entries have intensified competition, exerting downward pressure on prices. Manufacturers with established distribution channels and proven bioequivalence can capture significant market segments.

Regulatory Barriers and Patent Cliffs

While TOBRADEX ST itself benefits from patent exclusivity, patent challenges and expiry of related formulations introduce potential competition. Regulatory hurdles, including approval of generic equivalents, can influence market dynamics, especially in jurisdictions with strong patent protections like the US and Europe.

Regulatory Environment

Approval Status and Market Entry Barriers

TOBRADEX ST is approved by major agencies such as the FDA and EMA, with clear guidelines on indications, usage, and safety. Maintaining compliance through pharmacovigilance post-approval is crucial for continued market access. Regulatory delays or rejections of generics and biosimilars could temporarily limit competition but may also push manufacturers to seek alternative formulations.

Reimbursement and Coverage Policies

Coverage varies across countries. In the US, prescription drug reimbursement policies and formulary placements significantly impact the drug's accessibility and pricing power. Favorable reimbursement enhances market size, while stricter policies or prior authorization requirements can dampen sales.

Manufacturing and Supply Chain Considerations

Production Scalability and Cost Structure

The drug's manufacturing involves sterile compounding, precise formulation, and stability considerations. Scale-up capabilities and efficient supply chains are vital for meeting global demand, especially amid surges in ophthalmic surgeries. Cost efficiencies attained via automation and optimized logistics could reduce per-unit costs, enabling flexible pricing strategies.

Supply Disruptions and Market Impact

Supply chain disruptions—whether from raw material shortages or geopolitical factors—can impact pricing and availability. A resilient supply chain and diversified sourcing are essential to maintain market presence and avoid price volatility.

Price Projections for TOBRADEX ST

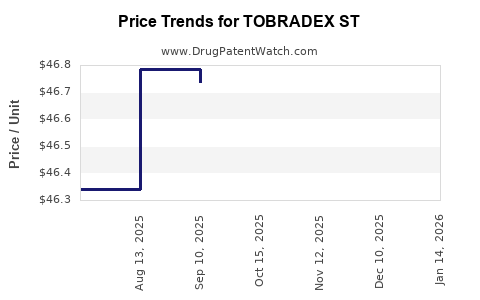

Historical Pricing Trends

Historically, combination ophthalmic drugs like TOBRADEX ST have commanded premium prices due to their specialized use, formulation complexity, and competitive advantages. In the US, the average wholesale price (AWP) for branded ophthalmics ranges from $80 to $150 per unit (treatment course).

Prices have remained relatively stable but show signs of gradual decline due to increased generic competition. The launch of generic equivalents often results in a 30-50% reduction in pricing within the first year.

Future Price Strategy Outlook

Projections suggest a staged pricing erosion over the next 3-5 years, influenced by:

- Entry of generics and biosimilars

- Market penetration in emerging regions

- Negotiation power of payers and healthcare providers

- Potential for value-based pricing linked to clinical outcomes

Short-term (1-2 years): Brand-name TOBRADEX ST could maintain premiums at approximately 20-30% above generics, averaging around $100-$130 per course, assuming no immediate surge in generic competition.

Mid-term (3-5 years): With increased generic penetration, prices could decline to roughly $50-$70 per course, aligning with the typical price range for generic combination ophthalmics in mature markets.

Long-term (beyond 5 years): Market maturity and price compression may push prices further down, especially if biosimilars or alternative fixed-dose combinations enter the market.

Influencing Factors

- Regulatory approvals of generics: A pivotal factor potentially accelerating price declines.

- Market adoption rates: Higher usage in post-surgical care sustains pricing; slow uptake reduces price stability.

- Reimbursement policies: Favorable coverage maintains premium pricing; strict policies exert pressure.

- Innovative formulations: Extended-release or preservative-free variants could command premium prices, offsetting generic competition temporarily.

Key Market Drivers and Risks

Drivers

- Increasing ophthalmic surgery volume, notably in aging populations

- Rising burden of ocular infections and inflammations

- Growing adoption in emerging markets with expanding healthcare infrastructure

- Advancements in drug delivery technologies enhancing efficacy and convenience

Risks

- Rapid emergence of cheaper generics and biosimilars

- Regulatory delays or rejections

- Pricing pressures from payers and healthcare systems

- Market saturation in key regions

Key Takeaways

- Market potential remains robust in surgical and post-infection ophthalmology, especially in developed nations.

- Competitive dynamics favor significant price erosion within the next 3-5 years due to rising generic entries.

- Pricing strategies should prioritize differentiation through clinical efficacy, delivery innovations, and reimbursement negotiations.

- Manufacturing scalability and supply chain robustness are crucial in maintaining margins and market share.

- Regulatory trajectories and healthcare policy shifts could substantially influence pricing and market size.

FAQs

1. What factors influence the pricing of TOBRADEX ST?

Pricing is shaped by competition from generic equivalents, regulatory approvals, manufacturing costs, reimbursement policies, and market demand from surgical centers and ophthalmologists.

2. How does the entry of generics impact TOBRADEX ST prices?

Generic entries typically lead to substantial price reductions—often 30-50% within the first year—thus pressuring branded formulations to adjust pricing and marketing strategies.

3. What markets present the greatest growth opportunity for TOBRADEX ST?

Emerging economies with increasing ophthalmic surgeries, rising prevalence of ocular infections, and improving healthcare infrastructure offer significant growth prospects.

4. Are there future innovations that could affect the pricing of TOBRADEX ST?

Yes, novel formulations such as sustained-release implants or preservative-free variants could command premium prices, potentially offsetting competition and maintaining revenue streams.

5. What regulatory challenges could influence the market for TOBRADEX ST?

Approval delays or denials for generic versions, as well as changes in patent law or regulatory standards, could impact market entry timing and pricing dynamics.

References

[1] Market Scope. (2022). Global Ophthalmic Drugs Market Report.

[2] IQVIA. (2022). Ophthalmic Drug Sales and Market Trends.

[3] FDA. (2021). Guidance on Ophthalmic Drug Approvals.

[4] Deloitte. (2022). Impact of Generics on Ophthalmic Pharmaceuticals.

[5] WHO. (2022). Global Eye Health and Surgery Statistics.