Last updated: July 28, 2025

Introduction

Tizanidine hydrochloride (HCl), a centrally acting alpha-2 adrenergic agonist, is primarily prescribed as a muscle relaxant for spasticity associated with multiple sclerosis, spinal cord injuries, and other neurological conditions. Its patent status, market dynamics, competitive landscape, and evolving regulatory environment significantly influence its pricing and market potential. As a widely used generic medication, understanding these factors is crucial for stakeholders aiming to optimize revenue strategies and anticipate future valuations.

Market Overview

Global Market Size and Growth

The global muscle relaxant market, valued approximately at USD 3.4 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 4.8% through 2030 ([1]). Tizanidine constitutes a significant segment, driven by increased prevalence of neurological disorders, aging populations, and rising awareness of muscle spasticity management.

Epidemiological Drivers

The U.S. alone reports over 1 million individuals with multiple sclerosis, many of whom rely on muscle relaxants like Tizanidine. Spinal cord injury incidence in developed nations approximates 54 cases per million annually, translating into high medication utilization rates ([2]). As neurological disease prevalence rises globally, demand for Tizanidine is expected to sustain or increase, provided regulatory and competitive barriers remain constant.

Regulatory Environment

Tizanidine was approved by the FDA in 1996. Being a generic drug, the patent protections are minimal, with exclusivity mainly due to market entry barriers rather than patent protections. The absence of new formulations or patent life extensions limits innovation-driven price premiums.

Market Players and Competition

Generic Competition

The market is characterized by multiple generic manufacturers, including Mylan, Teva, and Sandoz. Their widespread presence fosters price competition, effectively capping potential price increases. The average wholesale price (AWP) for Tizanidine 4 mg ranges from USD 0.10 to USD 0.15 per tablet, depending on the manufacturer and purchase volume ([3]).

Brand vs. Generic Dynamics

Although Tizanidine was initially marketed under brand names like Zanaflex, widespread generic availability has diminished its premium pricing. Generic competition reduces profitability margins but ensures broader accessibility.

Emerging Market Dynamics

Emerging markets are experiencing increased adoption due to expanding healthcare infrastructure; however, price sensitivity remains high, limiting revenue growth potential. Local manufacturing and regulatory hurdles slow market entry, resulting in regional price variances.

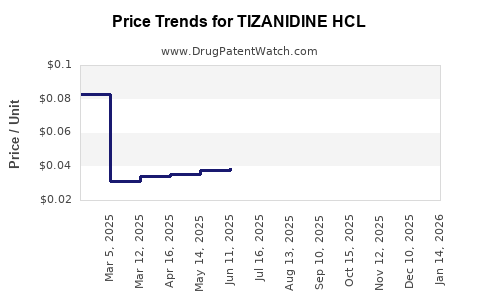

Pricing Trends and Projections

Current Pricing Snapshot

In the U.S., the retail price for branded Tizanidine (Zanaflex) stands at approximately USD 8–10 per tablet, whereas generics hover around USD 0.10–0.15 per tablet. Insurance coverage and formulary placements substantially influence net prices, with discounts, rebates, and pharmacy benefit negotiations impacting actual revenue.

Factors Influencing Future Pricing

- Patent Expiry and Generic Penetration: Patent expiry, which occurred in early 2000s for the original formulation, has resulted in abundant generic options, stabilizing prices downward.

- Manufacturing Costs: Raw material prices for active pharmaceutical ingredients (APIs) and manufacturing efficiencies impact pricing.

- Regulatory Changes: Approval of biosimilar or alternative formulations could alter the competitive landscape.

- Market Demand: An increase in indications or off-label uses may exert upward pressure on prices temporarily but are unlikely to overshadow generic competitiveness.

Projection Models (2023-2030)

Global Tizanidine HCl market revenues are projected to grow modestly at a CAGR of approximately 2.5%–3% due to increased demand juxtaposed against stable or declining unit prices resulting from intense generic competition.

- United States: Prices for generics are expected to remain stable due to market saturation, with minor reductions attributable to manufacturing efficiencies.

- Emerging Markets: Slight price increases possible owing to logistical costs and regulatory compliance, though overall affordability may moderate growth.

Scenario Analysis

- Optimistic Scenario: Introduction of innovative formulations or delivery systems (e.g., extended-release or transdermal patches) could command higher prices, boosting revenue by 10–15% annually in select markets.

- Pessimistic Scenario: Further patent challenges or regulatory restrictions could precipitate price erosion and market share declines over the next 3–5 years.

Strategic Considerations for Stakeholders

- Market Penetration: Focus on emerging markets with expanding healthcare infrastructure.

- Product Differentiation: Explore new formulations, delivery systems, or combination therapies to escape commoditization.

- Pricing Strategies: Leverage formulary negotiations and tiered pricing to optimize margins.

- Regulatory Pathways: Engage early with regulatory agencies for expedited approval of biosimilars or novel delivery methods.

Conclusion

Tizanidine HCl remains a mature, low-margin commodity within the muscle relaxant segment due to its extensive generic competition and stable demand. Future growth hinges on market expansion into emerging economies and innovation in formulation and delivery methods. Price stability is expected, with slight downward pressures from generics, balanced by incremental demand growth.

Key Takeaways

- The global market for Tizanidine HCl is driven by increasing neurological disorder prevalence, but aggressive generic competition caps pricing.

- Current prices for generics are approximately USD 0.10–0.15 per tablet, with branded versions commanding higher prices but limited by patent expiries.

- Future revenue growth depends on expanding into underserved markets and developing innovative formulations.

- Margins will likely remain thin, emphasizing the importance of cost efficiency and strategic market positioning.

- Industry stakeholders must continuously monitor regulatory changes and patent landscapes to adapt pricing and market strategies effectively.

FAQs

Q1: How does patent expiry influence Tizanidine HCl pricing?

Patent expiry allows multiple generic manufacturers to enter, increasing competition and significantly reducing prices, thereby limiting profit margins for brand-name versions.

Q2: What is the primary driver for Tizanidine HCl market growth?

The rising prevalence of neurological conditions like multiple sclerosis and spinal cord injuries, particularly in aging populations, drives demand.

Q3: Are there any upcoming regulatory hurdles that could affect the Tizanidine market?

Potential biosimilar or new formulation approvals could introduce competition, but currently, no significant regulatory barriers threaten the existing market.

Q4: How can manufacturers differentiate in a mature, commoditized market?

Innovation in delivery methods, expanding indications, or forming strategic partnerships to access emerging markets offers differentiation potential.

Q5: What is the outlook for Tizanidine prices over the next decade?

Prices are expected to remain relatively stable for generics, with marginal declines due to market saturation, but targeted innovations could provide opportunities for price premiums.

References

- Markets and Markets. "Muscle Relaxants Market by Type, Application, and Region," 2022.

- National Spinal Cord Injury Statistical Center, 2022.

- GoodRx. "Tizanidine (Zanaflex) Prices," 2023.