Last updated: August 1, 2025

Introduction

TIMOPTIC, the trade name for timolol maleate ophthalmic solution, is a longstanding medication primarily used to treat open-angle glaucoma and ocular hypertension by reducing intraocular pressure. With a patent expiry date nearing or having passed in various markets, the drug’s market landscape is evolving, influenced by generic competition and emerging treatment options. This report provides a comprehensive market analysis of TIMOPTIC, assesses factors affecting its pricing, and offers future price projections grounded in industry trends.

Market Overview

Historical Market Dynamics

TIMOPTIC has been a mainstay in glaucoma therapy since its approval, owing to its efficacy and relatively low cost. Its initial patent protection in the 1970s allowed for a period of exclusive marketing, which supported robust pricing and profit margins. After patent expiration, the entry of generic versions significantly eroded brand-name pricing, leading to a decline in revenue for the original manufacturer.

Current Market Landscape

The current market landscape is characterized by:

- Generic Competition: Multiple generic formulations are now available worldwide, intensifying price competition (e.g., in the US, the FDA approved several generic timolol products post-patent expiry [1]).

- Market Segments: TIMOPTIC and its generics are primarily prescribed for managing glaucoma and ocular hypertension, which collectively impact millions globally.

- Regional Variability: Pricing strategies vary across regions due to differing regulatory environments, healthcare reimbursement policies, and market penetration levels.

Competitive Environment

The glaucoma medication market has diversified considerably, including prostaglandin analogs (latanoprost, bimatoprost), beta-blockers (timolol formulations), and combination therapies. The increased adoption of prostaglandins due to superior efficacy and once-daily dosing has diminished TIMOPTIC’s market share, especially in high-income markets.

Key Market Drivers

- Prevalence of Glaucoma: Globally, glaucoma affects over 76 million people, with projections exceeding 111 million by 2040 [2]

- Aging Population: Increasing elderly demographics elevate the demand for intraocular pressure-lowering agents.

- Cost-Effectiveness: As a longstanding, generic medication, TIMOPTIC remains attractive in cost-sensitive healthcare systems.

- Regulatory Approvals: Ongoing approvals of generics and biosimilars further catalyze price competition.

Pricing Analysis

Pre-Patent Expiry Pricing

While specific historical prices are manufacturer confidential, typical pricing for brand-name TIMOPTIC in the US was approximately $50–$70 per bottle (~15 mL) during patent exclusivity, reflecting the brand’s premium positioning.

Post-Patent Expiry Dynamics

Once patents expired, the market experienced an influx of generics, leading to dramatic price reductions:

- Generic Pricing: In the US, generic timolol ophthalmic solutions have been priced as low as $10–$20 per bottle, depending on manufacturer and purchasing volume.

- Regional Variations: In Europe, pricing remains relatively higher (~€15–€30), influenced by healthcare reimbursement schemes and regional drug pricing policies.

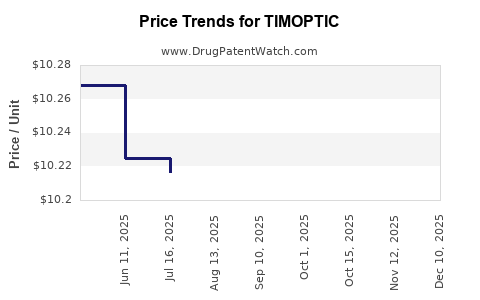

Factors Influencing Current Price Trends

- Manufacturing Costs: Low manufacturing costs for generics lead to competitive pricing.

- Market Penetration: Extensive distribution networks and physician familiarity reinforce stable demand, indirectly supporting a baseline pricing plateau.

- Competitive Pressures: The prevalence of generic availability keeps prices at or near minimal sustainable levels for manufacturers.

Future Price Projections

Short-Term Outlook (1-2 Years)

In mature markets like the US and Europe, the price of TIMOPTIC generics is expected to stabilize around $10–$15 per bottle, largely dependent on supply chain dynamics and wholesale/patient negotiations. Brand-name pricing will likely decline further, approaching $40–$50 if manufacturers attempt to maintain a premium positioning.

Long-Term Trends (3-5 Years)

- Market Saturation: With most patent-protected formulations converted to generics, further price reductions are unlikely unless new competition emerges.

- Biosimilars and Novel Formulations: Introduction of biosimilar or innovative sustained-release formulations could influence pricing by disrupting current market dynamics.

- Emerging Markets: In low- and middle-income countries, prices could range as low as $5–$10, owing to different reimbursement policies and procurement practices.

Impact of Regulatory and Policy Changes

Potential changes, such as drug price caps or promoting biosimilars, could accelerate price declines. Conversely, supply chain disruptions or manufacturing bottlenecks could temporarily increase prices.

Market Opportunities and Challenges

Opportunities

- Expansion in Developing Countries: Growing glaucoma prevalence necessitates affordable treatment options.

- Combination Therapies: Co-formulations with other ocular agents could sustain demand and justify marginal price premiums.

- Generic Penetration: Continued competition could stabilize prices at very low levels, maintaining profitability through high volume sales.

Challenges

- Market Decline: Competition from higher-efficacy agents like prostaglandins reduces TIMOPTIC’s relevance.

- Pricing Pressure: Regulatory initiatives aimed at lowering drug costs may further commoditize TIMOPTIC generics.

- Limited Differentiation: Lack of product differentiation limits the potential for premium pricing.

Conclusion

TIMOPTIC’s market is firmly established as a low-cost, generic ophthalmic therapeutic for glaucoma management. Following patent expiry, prices have declined significantly, driven by an influx of generic competitors and regional reimbursement policies. Future pricing will predominantly be dictated by generic supply, regional market sizes, and healthcare policies. We project that in mature markets, prices will remain in the $10–$15 range for generics over the next 2-3 years, with potential for further decline in response to policy-driven cost containment initiatives.

Key Takeaways

- TIMOPTIC’s patent expiry led to sharp price reductions due to generic competition, with current prices stabilized in the low double digits.

- Market dynamics favor volume over premium pricing, especially in regions with aggressive price controls.

- The growing global burden of glaucoma sustains demand but shifts market share toward newer agents, underscoring the importance of price competitiveness.

- Emerging policies and innovative formulations could influence future pricing trends.

- Companies should explore opportunities in secondary markets and value-added formulations to preserve margins as traditional pricing pressures persist.

FAQs

1. What are the main factors driving the current low prices of TIMOPTIC generics?

Generic competition, low manufacturing costs, and regional price regulation collectively drive down prices, making TIMOPTIC formulations highly affordable.

2. Will the price of TIMOPTIC ever return to pre-patent levels?

Unlikely, as patent protections expired decades ago, and market forces favor low-cost generics. Future improvements would likely involve new formulations rather than price increases.

3. How does regional variation affect TIMOPTIC pricing?

Pricing varies based on regional healthcare policies, reimbursement models, and market competition, with developing countries generally experiencing lower prices.

4. Are there any emerging therapies that threaten TIMOPTIC’s market share?

Yes, prostaglandin analogs and other ocular hypotensives with superior efficacy, dosing convenience, or safety profiles are gradually replacing timolol in some regions.

5. Can TIMOPTIC’s price be significantly influenced by new regulations?

Regulatory measures like price caps, reimbursement policies, and biosimilar promotion can further compress prices, especially in health systems aiming to contain costs.

Sources

- U.S. Food and Drug Administration. "Abbreviated New Drug Applications (ANDA) Approvals."

- Tham Y-C, et al. "Global Prevalence of Glaucoma and Projections of the Future Burden." Ophthalmology. 2014.