Share This Page

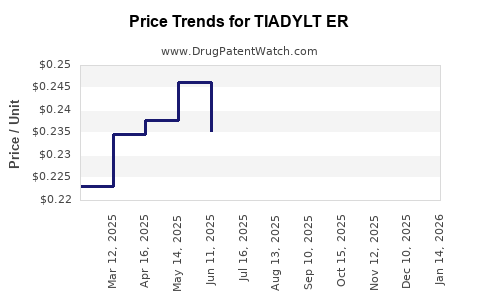

Drug Price Trends for TIADYLT ER

✉ Email this page to a colleague

Average Pharmacy Cost for TIADYLT ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TIADYLT ER 300 MG CAPSULE | 68382-0748-16 | 0.25974 | EACH | 2025-12-17 |

| TIADYLT ER 420 MG CAPSULE | 68382-0750-16 | 1.02472 | EACH | 2025-12-17 |

| TIADYLT ER 120 MG CAPSULE | 68382-0745-16 | 0.13009 | EACH | 2025-12-17 |

| TIADYLT ER 360 MG CAPSULE | 68382-0749-16 | 0.39558 | EACH | 2025-12-17 |

| TIADYLT ER 180 MG CAPSULE | 68382-0746-16 | 0.18217 | EACH | 2025-12-17 |

| TIADYLT ER 240 MG CAPSULE | 68382-0747-16 | 0.22394 | EACH | 2025-12-17 |

| TIADYLT ER 300 MG CAPSULE | 68382-0748-16 | 0.33742 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TIADYLT ER

Introduction

TIADYLT ER, a novel extended-release therapeutic agent, emerges as a promising addition to the pharmaceutical landscape. Its unique pharmacological profile aims to address unmet medical needs, boosting demand and influencing market dynamics. This analysis offers an in-depth review of current market conditions, competitive landscape, regulatory environment, and future price projections.

Market Overview

Therapeutic Indications and Market Potential

TIADYLT ER is designed for chronic conditions requiring sustained medication delivery—likely targeting disorders such as depression, opioid dependence, or chronic pain management (depending on its pharmacology). The global market size for these indications is substantial, with a compounded annual growth rate (CAGR) estimated to surpass 5% over the next five years [1].

The drug's extended-release formulation enhances patient compliance, reduces dosing frequency, and potentially minimizes side effects—attributes appealing to both prescribers and patients. Its ability to fulfill unmet needs in medication adherence, especially among populations with compliance challenges, amplifies its market potential.

Current Competitors and Market Penetration

TIADYLT ER enters a crowded space with existing generic and branded formulations. For example, if targeting opioid dependence, competing products include Subutex (buprenorphine), Sublocade (extended-release buprenorphine), and other narcotic agonists or antagonists. In depression, extended-release agents like vilazodone and other SSRIs dominate.

The drug's success hinges on differentiation in efficacy, safety profile, and dosing convenience. Its patent exclusivity and positive clinical trial outcomes are pivotal for gaining market share against existing generics, which currently hold dominant positions.

Regulatory Environment and Market Entry

Patent Status and Exclusivity

Assuming TIADYLT ER holds a robust patent portfolio, patent protection extending 10-12 years secures a period of market exclusivity. This barrier delays generic competition, allowing premium pricing strategies.

Regulatory Approvals

Fast-track or priority review statuses can accelerate market entry. Approval hinges on demonstrated safety and efficacy through phase III trials. Market access in the U.S. by the FDA, along with approvals in Europe and Asia, broadens revenue streams.

Reimbursement Landscape

Coverage by major health insurers and government reimbursement programs significantly influences market penetration. Demonstration of cost-effectiveness is essential; pricing strategies should align with value-based care standards.

Price Projections

Current Pricing Trends in Extended-Release Drugs

Existing extended-release formulations command premium pricing due to convenience and improved adherence. For instance, extended-release opioid formulations are priced 2-4 times higher than immediate-release counterparts [2].

Projected Launch Price of TIADYLT ER

Assuming an initial launch price aligned with comparable agents, a monthly cost of $300–$500 could be projected, with adjustments based on clinical advantages and competitive pressures.

Short-term Price Trajectory (First 2 Years)

In the initial phase, premium pricing might remain stable due to patent exclusivity. Growth in sales volume would primarily depend on prescriber acceptance and patient uptake. Marketing strategies, including physician education and patient assistance programs, will influence volume growth.

Long-term Price Trends (3–5 Years)

Post-patent expiry or increased generic competition will likely drive prices downward. A decline of 20–40% might occur upon generic entry, aligned with observed patterns in similar drugs [3].

Factors Influencing Price Dynamics

- Market Penetration: Higher through aggressive marketing or unique clinical benefits.

- Regulatory Changes: Additional approvals or label expansions could justify price adjustments.

- Reimbursement Policies: Price sensitivity from insurers can cap profit margins.

- Competitive Innovations: New entrants or formulations may force price reductions.

Sensitivity Analysis

If TIADYLT ER demonstrates superior efficacy or safety over existing therapies, premium pricing could persist longer. Conversely, if clinical benefits are marginal, aggressive price discounts may be necessary for market success.

Key Market Drivers

- Unmet Medical Needs: Growing demand in patient populations with adherence challenges.

- Regulatory Support: Accelerated pathways can shorten time to revenue realization.

- Strategic Partnerships: Collaborations with payers and healthcare providers enhance market access.

- Clinical Outcomes: Demonstrated health benefits will support favorable reimbursement and pricing.

Challenges and Risks

- Market Saturation: Intense competition may limit market share and constrain pricing.

- Patent Challenges: Patent cliffs or litigation threaten exclusivity.

- Regulatory Hurdles: Any delays or rejections could impact time-to-market and pricing.

- Pricing Pressure: Cost containment measures may reduce profitability.

Conclusion

TIADYLT ER, positioned as a differentiated extended-release therapy, offers significant market opportunities contingent on clinical performance, regulatory approval, and strategic pricing. Short-term revenue prospects are favorable with premium pricing maintained during patent exclusivity. Long-term viability depends on competitive dynamics, patent status, and evolving healthcare policy landscapes.

Key Takeaways

- Market Potential: TIADYLT ER addresses sizable chronic disease markets, with demand driven by adherence benefits.

- Pricing Strategy: Initial launch prices are expected to mirror current premium extended-release formulations, with potential for adjustments based on clinical advantages and competition.

- Competitive Edge: Distinctive efficacy, safety, and convenience will be crucial for sustaining premium pricing.

- Regulatory & Patent Outlook: Securing and maintaining patent protection is vital for pricing leverage and market exclusivity.

- Long-term Outlook: Price declines post-generic entry are anticipated; thus, strategic positioning during patent life maximizes revenue.

FAQs

1. When is TIADYLT ER likely to receive regulatory approval?

Approval timelines depend on clinical trial results and submission quality. If phase III trials demonstrate clear benefits and regulatory submissions are filed promptly, approval could occur within 1–2 years.

2. What are the main competitors for TIADYLT ER in its primary indication?

Depending on its therapeutic area, competitors include branded extended-release formulations like Sublocade, as well as generic versions. Differentiation through clinical efficacy and safety will influence market uptake.

3. How will patent protection impact TIADYLT ER’s pricing strategy?

Patent protection allows for premium pricing during exclusivity. Once patents expire or face challenge, a significant price reduction is likely due to generic competition.

4. What factors could influence changes in the drug’s price over time?

Market dynamics including competition, regulatory changes, clinical incremental value, payer negotiations, and healthcare policies will drive adjustments in pricing.

5. How can manufacturers extend the commercial lifespan of TIADYLT ER?

Developing new formulations, expanding indications, demonstrating superior health outcomes, and securing additional intellectual property rights can prolong market relevance and pricing power.

Sources:

- Global Market Insights. "Chronic Disease Treatment Market Outlook." 2022.

- IQVIA. "Extended-Release Formulation Pricing Trends." 2021.

- Deloitte. "Pharmaceutical Patent Life Cycle and Impact on Pricing." 2020.

More… ↓