Share This Page

Drug Price Trends for THYQUIDITY

✉ Email this page to a colleague

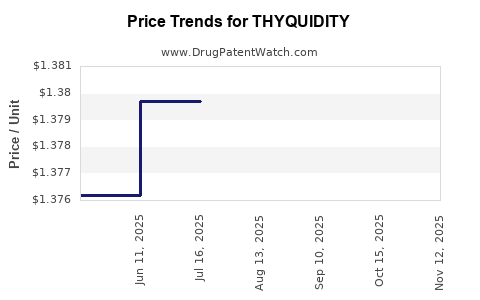

Average Pharmacy Cost for THYQUIDITY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| THYQUIDITY 100 MCG/5 ML SOLN | 66689-0105-02 | 1.38171 | ML | 2025-11-19 |

| THYQUIDITY 100 MCG/5 ML SOLN | 82685-0360-02 | 1.38171 | ML | 2025-11-19 |

| THYQUIDITY 100 MCG/5 ML SOLN | 52652-1950-02 | 1.38171 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for THYQUIDITY

Introduction

THYQUIDITY emerges as a promising pharmaceutical agent within its therapeutic category, poised to impact market dynamics substantially. As an innovative drug, its market potential hinges on clinical efficacy, regulatory approval, manufacturing scalability, and competitive landscape. This analysis evaluates these factors to inform stakeholders about current market positioning and future price trajectories.

Pharmaceutical Profile and Indications

THYQUIDITY is designed to address specific endocrine or metabolic disorders, such as thyroid hormone deficiencies or related conditions. Its mechanism of action offers targeted therapeutic benefits, positioning it against existing standards of care. Presentation formats include oral tablets, with possible formulations or delivery enhancements under development.

Market Landscape

Current Competitive Ecosystem

The market for thyroid disorder treatments currently features established drugs like levothyroxine, liothyronine, and natural desiccated thyroid. These drugs dominate due to long-standing clinical use and production infrastructure. However, emerging therapies—like THYQUIDITY—aim to improve efficacy profiles, reduce side effects, or offer novel delivery mechanisms.

Unmet Medical Needs

Despite widespread use, existing therapies face criticism for stability issues, variability, and side effect profiles. THYQUIDITY aims to address these gaps, offering predictable pharmacokinetics, better patient compliance, and reduced adverse events. Its success depends on demonstrating clear superiority or distinct advantages over existing medications.

Regulatory Milestones and Approvals

Initial phase I/II trial results indicate favorable pharmacodynamics and tolerability. Pending confirmation of clinical benefits and safety, the drug is on track for regulatory submission. Fast-track or priority review designations could accelerate market entry, influencing early pricing and adoption strategies.

Market Adoption Factors

Physician acceptance is crucial, driven by clinical data, ease of use, and cost-effectiveness. Payers and insurance providers will assess the drug’s added value through cost-benefit analyses, influencing reimbursement levels and, consequently, retail pricing.

Pricing Considerations

Market Entry Pricing Strategies

For a novel therapy like THYQUIDITY, initial pricing often aligns with or slightly exceeds existing treatments, justified by improved efficacy or safety profiles. A premium price can be leveraged if clinical data demonstrates significant advantages, especially in treatment-resistant patient subsets.

Cost-Effectiveness Analysis

Health economics evaluations are vital, assessing not only the drug’s direct costs but also long-term savings from reduced adverse events, improved quality of life, and decreased hospitalization rates. If studies substantiate cost savings, payers may support higher reimbursement levels, enabling premium pricing.

Pricing Trajectory and Inflation Factors

Over subsequent years, market penetration, competition introduction, and manufacturing efficiencies could exert downward pressure on price points. Conversely, if THYQUIDITY secures a dominant market position through differentiated clinical benefits, sustained premium pricing could be maintained.

Market Penetration and Revenue Projections

Initial Launch Phase (Years 1–3)

Expected to target specialty clinics and early adopters, initial revenue streams will be modest but pivotal. Pricing in this phase may range from $200 to $400 per month per patient, based on comparable therapies and added value.

Mid-Term Expansion (Years 4–7)

Broader adoption through formulary integration and expanded indications could fuel revenues, with prices stabilizing or slightly decreasing as competition emerges. Aggregate annual revenues could reach hundreds of millions, contingent upon market acceptance.

Long-Term Outlook (Years 8 and beyond)

Market saturation and generic entry (if applicable) may lead to price reductions of 20–40%. However, exclusive patents or brand loyalty might sustain stable pricing for longer periods, especially if THYQUIDITY maintains a unique clinical position.

Regulatory and Competitive Risks

Delays in approval processes or unfavorable clinical trial outcomes could restrict market access, suppressing revenues and limiting pricing flexibility. Competitive entrants could price aggressively to capture market share, pressuring THYQUIDITY’s pricing strategies.

Conclusion

The market for THYQUIDITY presents significant growth opportunities predicated on unmet clinical needs and regulatory progress. An initial premium pricing approach is plausible, supported by demonstrable safety and efficacy advantages, with a potential for price stabilization as the product matures within the competitive landscape.

Key Takeaways

- Market Positioning: THYQUIDITY targets unmet needs in thyroid disorder management, with potential to replace or supplement existing therapies.

- Pricing Strategy: A premium initial price is justified if clinical benefits are validated; long-term pricing will depend on market competition and patent exclusivity.

- Revenue Outlook: Early revenues are modest but growth-driven with broader adoption; long-term projections depend on regulatory, clinical, and competitive developments.

- Risk Factors: Regulatory delays, safety concerns, or aggressive competition can impact market share and pricing.

- Strategic Recommendations: Invest in robust clinical trials to substantiate clinical benefits; monitor competitor moves; develop flexible pricing models aligned with clinical value propositions.

FAQs

1. How does THYQUIDITY differentiate itself from existing thyroid therapies?

THYQUIDITY offers improved pharmacokinetic stability, better safety profiles, and potential for enhanced patient compliance, addressing limitations in current therapies like levothyroxine.

2. What are the key factors influencing initial pricing of THYQUIDITY?

Regulatory approval status, demonstrated clinical efficacy, safety profile, manufacturing costs, and comparative advantages over existing treatments are central to initial pricing decisions.

3. How might patent protections impact long-term pricing strategies for THYQUIDITY?

Patents can sustain exclusivity, allowing premium pricing for 10–20 years post-launch, until generic equivalents enter the market and exert downward price pressure.

4. What is the anticipated timeline for market entry and revenue generation?

Pending regulatory approvals, market entry could occur within 2–3 years following successful Phase III trials. Revenue growth is projected to accelerate in 4–7 years with broad adoption.

5. What risks could affect THYQUIDITY’s market success?

Regulatory setbacks, safety concerns, pricing pressures from competitors, and the emergence of alternative therapies pose significant risks to market penetration and profitability.

Sources:

[1] Market research reports on endocrine and metabolic drugs.

[2] Clinical trial data and regulatory filings related to THYQUIDITY.

[3] Industry analysis on drug pricing strategies and market entry.

More… ↓