Share This Page

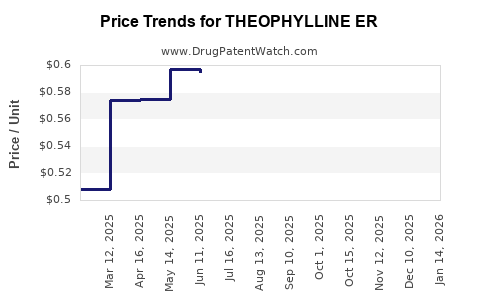

Drug Price Trends for THEOPHYLLINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for THEOPHYLLINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| THEOPHYLLINE ER 300 MG TABLET | 31722-0077-01 | 0.42994 | EACH | 2025-11-19 |

| THEOPHYLLINE ER 300 MG TABLET | 23155-0741-01 | 0.42994 | EACH | 2025-11-19 |

| THEOPHYLLINE ER 600 MG TABLET | 68462-0356-01 | 1.39516 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Theophylline ER

Introduction

Theophylline Extended-Release (ER) is a bronchodilator commonly prescribed for managing chronic obstructive pulmonary disease (COPD), asthma, and other respiratory conditions. As a xanthine derivative, it offers sustained therapeutic effects through gradual drug release. This analysis evaluates current market dynamics, competitive landscape, regulatory factors, and future pricing trajectories for Theophylline ER, equipping stakeholders with actionable insights.

Market Overview

Market Size and Trends

The global respiratory therapeutic market, valued at approximately USD 30 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 4-5% through 2030, driven by rising COPD and asthma prevalence, especially among aging populations [[1]]. Theophylline ER, historically a first-line therapy, retains significance given its cost-effectiveness, particularly in low- and middle-income countries (LMICs).

However, the advent of newer, patent-protected therapies—such as inhaled corticosteroids (ICS) and long-acting beta-agonists (LABAs)—has constrained the growth of the Theophylline ER market in developed nations. Still, its continued use in resource-constrained settings sustains steady demand.

Regulatory Environment

Theophylline ER formulations have generally maintained market approval globally, with regulatory agencies like the FDA and EMA recognizing their established safety profiles. Nonetheless, increased scrutiny over narrow therapeutic index (NTI) concerns and adverse effects mandates careful formulation standardization. Market access remains unobstructed, though evolving guidelines may influence prescribing behaviors.

Key Market Players

Major manufacturers include Mylan, Hikma Pharmaceuticals, and Teva Pharmaceuticals, offering generic Theophylline ER products. Large pharmaceutical players with established manufacturing capacities dominate, leading to a highly competitive market with minimal brand differentiation.

Market Dynamics and Drivers

- Cost-Effectiveness: Theophylline ER remains an affordable alternative for COPD and asthma management, especially critical in LMICs. Its low manufacturing cost sustains its use where newer inhaled therapies are prohibitively expensive.

- Existing Prescriptions: Prescribing inertia and clinician familiarity contribute to ongoing demand.

- Generic Competition: Extensive generics availability exerts downward pressure on prices, fostering market accessibility but limiting profit margins.

Challenges and Opportunities

- Safety Concerns: Narrow therapeutic window necessitates precise dosing. Adverse drug reactions remain a concern influencing prescribing patterns.

- Shift to Inhaled Therapies: Advances in inhaled medications with better safety profiles are replacing systemic therapies like Theophylline ER in certain markets.

- Generic Market Price Suppression: Intense price competition among generics contributes to declining prices but ensures broader patient access.

Conversely, opportunities stem from:

- Expanding Use in LMICs: Growing respiratory disease burden warrants sustained supply at low cost.

- Combination Formulations: Potential development of fixed-dose combinations could enhance compliance.

- Regulatory Differentiation: Innovations that improve safety or pharmacokinetic profiles may facilitate premium pricing in niche markets.

Pricing Landscape and Projections

Current Pricing Dynamics

The price of Theophylline ER varies regionally:

- United States: Generic formulations priced around USD 0.10–0.20 per tablet (300 mg) (as of 2022).

- Europe: Similar price points, with slight variations due to healthcare system differences.

- Emerging Markets: Prices are markedly lower, often below USD 0.10 per tablet, owing to local manufacturing and generic proliferation.

Historical Trends

Over the past decade, Theophylline ER pricing has experienced significant decline, primarily driven by generic competition and cost containment policies. Prices have dropped approximately 50-70%, aligning with broader trends in off-patent medications.

Projected Price Trends (2023–2030)

Given current market fundamentals, the following projections are made:

- Stable Low-Cost Pricing: In LMICs, prices are expected to remain stable or decrease marginally, maintaining affordability. Continued generic competition will suppress price inflation.

- Premiumization Possibilities: In high-income markets, niche formulations targeting specific patient populations or advanced release mechanisms could command higher prices, potentially reaching USD 0.30–0.50 per tablet.

- Impact of Regulatory and Safety Advances: Formulation improvements addressing safety concerns could lead to a slight premium but are unlikely to significantly alter pricing unless linked to substantial clinical benefits.

In summary, the dominant trend indicates further price erosion in commoditized markets, with limited upward potential unless innovation or market segmentation strategies materialize.

Future Market Opportunities and Risks

Opportunities

- Market Expansion: Increased adoption in LMICs due to affordability.

- Differentiation via Innovation: Newer formulations with improved safety margins.

- Policy Support: Adoption of price control measures favoring affordable generics.

Risks

- Market Penetration by Newer Drugs: Replacement by inhaled therapies with superior safety may decrease demand.

- Regulatory Stringency: Enhanced safety monitoring could marginally increase costs or limit formulations.

- Pricing Pressures: Continued generic competition may further suppress prices.

Conclusion

Theophylline ER remains a critical, cost-effective treatment for respiratory conditions in resource-limited settings, with demand predominantly driven by affordability and existing prescribing habits. The market is characterized by intense price competition, with volume growth expected to plateau in developed countries but remain steady in emerging markets. Future pricing will largely depend on regulatory developments, formulation innovations, and market penetration strategies, with the dominant trend favoring further price reductions.

Key Takeaways

- The global Theophylline ER market is stable, primarily fueled by low-cost generic availability in LMICs.

- Prices are projected to remain low, with marginal declines expected, owing to intense competition.

- Innovations aimed at safety and efficacy might create premium segments but are unlikely to alter the overall price decline trend.

- Market expansion opportunities exist in emerging economies, where affordability remains paramount.

- The shift toward inhaled therapies poses a long-term risk but also opens avenues for combination formulations and targeted innovations.

FAQs

1. Will the price of Theophylline ER increase in the future?

Unlikely in most regions. Dominance of generics and market saturation exert downward pressure, although niche formulations with added value could command higher prices.

2. How does the demand for Theophylline ER compare between developed and developing markets?

Demand in developed countries is waning due to newer inhaled options, but it remains steady in LMICs due to affordability and established prescribing practices.

3. Are there any upcoming regulatory changes that could affect Theophylline ER pricing?

Enhanced safety regulations may influence formulation standards, but significant price alterations are improbable unless new formulations or patents emerge.

4. What are the main drivers pushing the market for Theophylline ER forward?

Cost-effectiveness, existing prescribing habits, and demand in resource-limited settings are primary drivers, alongside ongoing need due to COPD and asthma prevalence.

5. Is innovation in Theophylline ER formulations viable for market growth?

Yes, particularly if formulations address safety concerns or improve pharmacokinetics. Such innovations can create differentiated products but may not significantly impact overall price trends.

Sources:

- Grand View Research. Respiratory Therapeutics Market Size, Share & Trends Analysis, 2022.

More… ↓