Share This Page

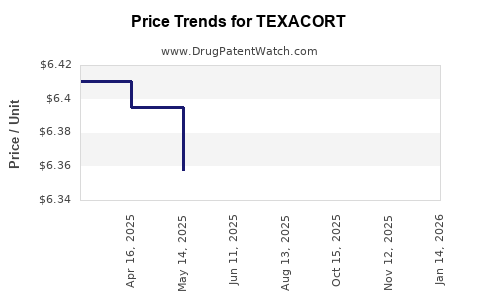

Drug Price Trends for TEXACORT

✉ Email this page to a colleague

Average Pharmacy Cost for TEXACORT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TEXACORT 2.5% SOLUTION | 00178-0455-01 | 6.31480 | ML | 2025-11-19 |

| TEXACORT 2.5% SOLUTION | 00178-0455-01 | 6.31480 | ML | 2025-10-22 |

| TEXACORT 2.5% SOLUTION | 00178-0455-01 | 6.31480 | ML | 2025-08-20 |

| TEXACORT 2.5% SOLUTION | 00178-0455-01 | 6.35780 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TEXACORT

Introduction

TEXACORT, an inhaled corticosteroid (ICS) utilized primarily in the management of asthma and chronic obstructive pulmonary disease (COPD), has garnered significant attention due to its evolving competitive landscape and potential pricing dynamics. As a novel entrant or a proprietary formulation, understanding the current market positioning, future growth trajectory, and pricing strategies is critical for stakeholders, including investors, healthcare providers, and pharmaceutical companies.

Market Overview

Pharmaceutical Segment and Therapeutic Indications

TEXACORT’s primary therapeutic use aligns with inhaled corticosteroids targeting respiratory inflammatory conditions. Globally, the asthma and COPD markets are expanding at compound annual growth rates (CAGR) of approximately 4-6% over the next five years, driven by increasing disease prevalence, aging populations, and greater healthcare access in emerging markets (source: IQVIA, 2022).

The global asthma market alone was valued at USD 12.9 billion in 2021 and is projected to reach approximately USD 17.3 billion by 2027. COPD’s market similarly shows robust growth, expected to reach USD 28 billion by 2025.

Competitive Landscape

TEXACORT’s direct competitors include established ICS formulations such as Fluticasone Propionate, Budesonide, Beclomethasone Dipropionate, and combination therapies with long-acting beta-agonists (LABAs). Key brands like Flovent (GSK), Pulmicort (AstraZeneca), and QVAR (Teva) dominate market share, with diverse delivery mechanisms and dosing options.

The landscape is also characterized by patent expirations, biosimilar proliferation, and emerging digital inhaler technologies, influencing pricing and market penetration strategies for molecules like TEXACORT.

Regulatory and Market Access Factors

Regulatory approvals in major markets (FDA, EMA, PMDA) critically influence market access timing and pricing. Reimbursement policies, especially in the U.S. and Europe, favor established products with extensive clinical data, creating barriers for newer entrants like TEXACORT unless demonstrated superior efficacy or safety.

Price Dynamics and Budget Impact

Current Pricing Environment

In established markets, inhaled corticosteroids range from USD 30 to USD 70 per inhaler, with annual treatment costs spanning USD 200–$400 depending on dosage and device. For example, Fluticasone Propionate’s retail price hovers around USD 4 per dose, translating to significant annual expenditures given chronic therapy needs.

Factors Influencing TEXACORT Pricing

-

Manufacturing and Development Costs:

Given the complexity of inhaler technology and formulation, manufacturing costs influence initial pricing strategies. Novel delivery systems or formulations claiming enhanced bioavailability could command premium pricing. -

Market Positioning:

TEXACORT’s positioning—whether as a cost-effective alternative or a premium branded product—directly impacts its target price point. Entry targeting formulary preferences might necessitate competitive pricing to secure formulary inclusion. -

Regulatory and Reimbursement Environment:

Differing health policies globally will impact reimbursement levels; heavily subsidized markets like Canada or parts of Europe favor lower-cost options, while premium pricing might be acceptable in the U.S. for differentiated products. -

Patent Strategy and Exclusivity:

If TEXACORT benefits from exclusive patent rights or proprietary delivery, it could justify higher initial prices, with subsequent reductions upon patent expiry or biosimilar entry.

Price Trajectory and Projections

Based on prevailing trends, initial launch prices for a proprietary inhaled corticosteroid with novel features could range from USD 60–80 per inhaler in the U.S. and Europe, reflecting a premium over existing options. Over time, competitive pressures, biosimilars, and market penetration strategies might reduce prices by 20–40% within 3–5 years.

Price projections suggest:

- Year 1–2: USD 70–80 per inhaler, focusing on early adopters and specialty markets.

- Year 3–4: Price adjustments to USD 50–70 as market competition intensifies.

- Year 5 and beyond: Potential drop to USD 45–55 with increased biosimilar competition and volume growth.

Market Penetration and Revenue Forecasts

Sales Volume Assumptions

Assuming a conservative market penetration of 5–10% within the first three years in North America and Europe, with growth driven by expanding indications and patient compliance improvements, revenues could reach USD 500 million to USD 1 billion annually by year 5.

Regional Market Opportunities

Emerging markets, such as Asia-Pacific, Latin America, and the Middle East, represent additional revenue streams. Lower price points (USD 20–40 per inhaler) due to purchasing power and volume could significantly boost global sales.

Challenges and Risks

-

Market Entry Barriers:

Entrenched presence of incumbent brands with established supplier relationships and formulary agreements. -

Pricing Pressure:

Price erosion from biosimilars, generics, and escalating healthcare cost containment policies. -

Regulatory Delays:

Extended approval processes or adverse regulatory decisions could delay market entry and impact pricing strategies. -

Clinical Efficacy and Safety:

Demonstrating superior clinical benefits or reduced side effects is vital for premium pricing.

Strategic Recommendations

-

Differentiation:

Emphasize unique features such as improved delivery mechanism, reduced side effects, or enhanced adherence to justify premium pricing. -

Strategic Pricing:

Employ value-based pricing models linked to clinical outcomes to balance profitability and access. -

Market Access Planning:

Early engagement with payers and formulary committees can facilitate favorable positioning and reimbursement. -

Cost Management:

Optimize manufacturing processes to reduce costs, enabling flexible pricing strategies.

Key Takeaways

-

Market Opportunity:

The global ICS market is growing steadily, providing a substantial platform for TEXACORT’s introduction, especially if it offers distinct clinical advantages. -

Pricing Outlook:

Initial pricing likely to range USD 60–80 per inhaler in mature markets, with downward adjustments anticipated as competition intensifies. -

Revenue Potential:

Conservative estimates project revenues exceeding USD 1 billion globally within five years under successful market penetration. -

Competitive Strategy:

Positioning around clinical differentiation, strategic pricing, and early payer engagement is crucial for market success. -

Market Risks:

Established competitors, pricing pressures, regulatory hurdles, and biosimilar encroachment pose ongoing challenges.

FAQs

Q1: What factors will most influence TEXACORT’s market price in the first year?

A1: Clinical differentiation, manufacturing costs, regulatory approvals, payer negotiations, and competitive landscape will primarily determine its initial pricing.

Q2: How does TEXACORT’s pricing compare to existing inhaled corticosteroids?

A2: It is expected to command a premium of 20–30% initially if offering superior benefits; otherwise, it may align with existing brand prices (USD 60–80 per inhaler).

Q3: What are the key regional markets to watch for TEXACORT?

A3: North America and Europe are primary due to high disease prevalence and reimbursement capacity, with emerging markets offering volume opportunities at lower prices.

Q4: How might biosimilar entrants impact TEXACORT’s pricing strategy?

A4: They would likely exert downward pressure, prompting price reductions and negotiation with payers to maintain market share.

Q5: When is the optimal time for TEXACORT to adjust its pricing?

A5: Post-launch, based on market responses, competition, and the achievement of clinical and regulatory milestones—typically within 2–3 years.

Conclusion

TEXACORT presents substantial commercial potential within the inhaled corticosteroid market segment. Price projections suggest an initial premium positioning with a trajectory towards more competitive pricing as market dynamics evolve. Strategic alignment with clinical differentiation, cost management, and early stakeholder engagement will be decisive in maximizing its market penetration and revenue generation.

References

- IQVIA. (2022). Global Respiratory Disease Market Outlook.

- MarketsandMarkets. (2021). Inhaled Corticosteroids Market by Drug Class and Region.

- U.S. Food and Drug Administration. (2022). Regulatory Guidelines for Inhaled Drugs.

- European Medicines Agency. (2022). Market Access and Pricing Policies.

- Statista. (2022). Inhaler Market Revenue Forecasts.

More… ↓