Last updated: July 27, 2025

Introduction

Tetracaine, a local anesthetic primarily used in ophthalmology, otolaryngology, and dermatology, has sustained demand in medical procedures requiring surface anesthesia. Its market dynamics are shaped by factors including technological advances, regional adoption, regulatory statuses, and emerging alternative therapies. This analysis delivers an in-depth understanding of the current market landscape, future growth prospects, and price trajectory insights for tetracaine.

Market Overview

Product Profile

Tetracaine (also known as amethocaine) was first introduced in the 1930s as a potent topical anesthetic. Its mechanism involves blocking sodium channels, thereby inhibiting nerve impulse transmission and facilitating the suppression of pain during minor surgical procedures or diagnostic interventions [1]. Present formulations include solutions, gels, ointments, and drops designated for ophthalmic, ENT, and dermal applications.

Current Market Size

Globally, the tetracaine market is estimated to be valued at approximately USD 120-150 million as of 2022, with steady compound annual growth rates (CAGRs) projected around 4–5% over the next five years [2]. The growth is driven by increasing demand in ophthalmological surgeries, expanding outpatient procedures, and heightened awareness of surface anesthesia.

Regional Market Distribution

- North America: Remains the dominant market, accounting for ~40% of global sales. This is driven by advanced healthcare infrastructure, high procedural volumes, and robust drug reimbursement frameworks.

- Europe: Holds a significant share (~25%) with a focus on ophthalmic surgeries and cosmetic dermatology.

- Asia-Pacific: Exhibits the fastest growth (~7-9% CAGR), propelled by rising healthcare investments, increased surgical procedures, and expanding ophthalmology markets in China, India, and Southeast Asia.

- Latin America and Middle East & Africa: Show moderate growth, mainly due to improving healthcare access and regional regulatory approvals.

Market Drivers

Medical Procedure Growth

The rising volume of ophthalmic surgeries such as cataract removal, LASIK, and corneal procedures sustains demand for tetracaine. Furthermore, the increasing prevalence of allergic conjunctivitis and other eye health issues necessitates surface anesthesia, bolstering tetracaine’s use [3].

Technological Enhancements

Formulation innovations, including sustained-release or combination preparations with longer duration or fewer side effects, enhance the product’s efficacy and patient tolerability, supporting market expansion.

Regulatory Approvals & Patent Expirations

Regulatory acceptance of tetracaine in emerging markets and patent expirations on rival anesthetics facilitate broader access and price competitiveness [4].

Market Challenges

- Alternative Anesthetics: Availability of lidocaine, procaine, and benzocaine competitors limits tetracaine’s market dominance.

- Safety Concerns: Potential for systemic toxicity and allergic reactions necessitates careful use, impacting clinician preference.

- Stringent Regulations: Regulatory hurdles in certain regions may delay product approvals or restrict usage parameters.

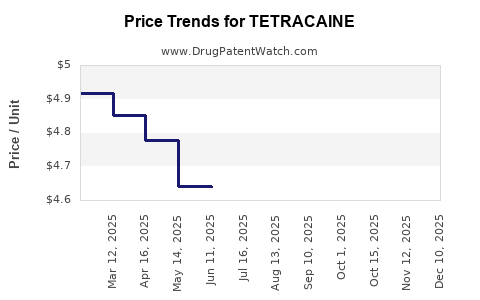

Price Trend Analysis

Historical Pricing Dynamics

Over the past decade, the average wholesale price (AWP) of tetracaine solutions has declined modestly, averaging a 2-3% annual decrease, primarily due to generic competition and cost containment measures [5]. For example, a standard 0.5% tetracaine ophthalmic solution that once retailed at USD 20 per 5 mL bottle has seen prices fall to approximately USD 12–15 in many markets.

Factors Affecting Future Pricing

- Patent Landscape: Patent expirations in major markets could further intensify price competition.

- Formulation Complexity: Innovative formulations with extended duration or enhanced safety profiles could command premium pricing.

- Regional Regulations: Price caps or reimbursement policies in different markets will influence retail and hospital procurement prices.

- Supply Chain Dynamics: Raw material costs, manufacturing scalability, and distribution logistics affect the final price.

Price Projections (2023–2028)

Based on current market trends and anticipated developments:

- Global Average Price: Expected to stabilize around USD 10–15 per 5 mL unit, with minor fluctuations depending on regional specifics.

- Premium Formulations: Longer-acting or combination therapies may reach USD 20–25 per unit due to added value.

- Emerging Markets: Prices could range from USD 5–10, driven by local manufacturing and competitive sourcing.

Emerging Opportunities and Strategic Outlook

Product Diversification

The development of novel tetracaine formulations, such as liposomal carriers for sustained release or topical patches, offers potential for premium pricing and expanded market reach.

Geographic Expansion

Growing penetration into untapped markets, especially in Asia and Latin America, positioned through partnerships and licensing deals, can boost volume sales and stabilize price points.

Regulatory Pathways

Streamlined approval processes and registration of tetracaine-based products in emerging regions will facilitate market access and foster price stability through increased competition.

Conclusion

Tetracaine’s market remains resilient, bolstered by a steady demand in ophthalmology and surface anesthesia—despite competition from other local anesthetics. While pricing has experienced downward pressure historically, innovative formulations and regional expansion could open avenues for increased premiums. Strategic engagement with emerging markets, formulation improvements, and regulatory navigation are critical for stakeholders seeking growth or margin enhancement.

Key Takeaways

- The global tetracaine market is valued at USD 120-150 million, with a CAGR of 4-5%, driven by ophthalmic procedures and surface anesthesia needs.

- Prices are declining modestly, with an average of USD 10–15 per 5 mL unit expected in the coming years.

- Patent expirations and formulation innovations will influence pricing strategies, potentially allowing for premium offerings.

- Emerging markets present significant growth opportunities, supported by increased healthcare infrastructure and procedural volumes.

- Competition from alternative anesthetics necessitates differentiation via formulation advancements, targeted marketing, or regional localization.

FAQs

1. How does tetracaine compare to other local anesthetics in terms of market share?

Tetracaine holds a specific niche primarily in ophthalmic and specialized surface anesthesia, but it faces stiff competition from lidocaine and benzocaine, which enjoy broader usage and higher market share in certain regions.

2. What factors could lead to an increase in tetracaine prices?

Innovative formulations offering longer duration or reduced side effects, regional regulatory approvals, and limited competition in niche applications can elevate prices.

3. Are there any recent regulatory developments influencing tetracaine's market?

Yes, regulatory approvals in emerging markets and ongoing clinical evaluations for new indications can expand use cases and influence pricing and market access strategies.

4. What is the outlook for tetracaine's application in cosmetic dermatology?

While currently limited, expanding approval for dermal procedures and innovative delivery systems could create new revenue streams and affect overall market growth.

5. How might patent expirations impact the tetracaine market?

Expirations may lead to increased generic manufacturing, exerting downward pressure on prices but simultaneously encouraging market penetration and volume sales.

Sources

[1] Pharmacology texts on local anesthetics.

[2] MarketsandMarkets, “Global Local Anesthetics Market,” 2022.

[3] American Ophthalmological Society, procedural statistics.

[4] Regulatory Agency reports (e.g., FDA, EMA).

[5] IQVIA wholesaler pricing data, 2022.