Last updated: July 27, 2025

Introduction

Terconazole, a triazole antifungal agent primarily prescribed for vulvovaginal candidiasis, has established itself within the women's health segment. Its efficacy, minimal systemic absorption, and favorable safety profile have seen it retained as a preferred topical solution historically. As the antifungal market becomes increasingly competitive, a comprehensive analysis of terconazole’s market landscape and future pricing dynamics is vital for stakeholders ranging from pharmaceutical companies and healthcare providers to investors.

Market Overview

The global antifungal drugs market was valued at approximately USD 15.5 billion in 2022, with the topical antifungal segment accounting for a significant share owing to the commonality of superficial mycoses. Terconazole, marketed under various brand names such as Terazol, holds a notable position within the intravaginal antifungal niche, owing to its specific mechanism targeting ergosterol synthesis in fungal cell membranes.

Market Drivers

-

Prevalence of Vulvovaginal Candidiasis: An estimated 75% of women will experience at least one episode of vaginal yeast infection in their lifetime, with recurrence common. This consistent demand sustains steady sales of topical agents like terconazole [1].

-

Increasing Awareness and Diagnosis: Enhanced screening and awareness campaigns have led to more frequent diagnoses, especially in developed markets.

-

Limited Competition in Intravaginal Applications: While oral antifungals like fluconazole are prevalent, topical therapies such as terconazole face fewer direct substitutes, offering niche market stability.

-

Shift Toward Topical Formulations: Patients and clinicians favor topical over systemic therapies to minimize adverse effects, solidifying terconazole’s market position.

Market Challenges

-

Generic Competition: As patents expire, multiple generics flood the market, pressuring prices downward.

-

Emerging Resistance: Although rare, resistance to azole antifungals may impact future sales.

-

Market Penetration in Developing Countries: Although growing, limited healthcare infrastructure inhibits widespread adoption.

Competitive Landscape

The market witnesses key players including Valeant Pharmaceuticals (now Bausch Health), Teva Pharmaceuticals, Mylan, and several regional generic manufacturers. Generics constitute over 70% of the current market share in developed economies. Brand-name formulations command premium pricing but face intense competition.

Regional Market Dynamics

-

North America: The largest market, driven by high diagnosis rates and insurance coverage. Prices are relatively stable but declining due to generic competition.

-

Europe: Similar trends as North America, with some regional price variations due to national healthcare policies.

-

Asia-Pacific: Rapid growth potential driven by rising awareness, though price sensitivity remains high.

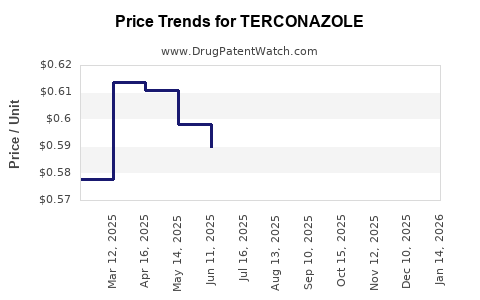

Pricing Trends and Projection Methodology

Historical pricing data indicates a downward trajectory primarily rooted in generic erosion. For example, the average retail price of a 100 mg terconazole intravaginal cream in the U.S. declined by approximately 15% over the past five years [2].

Using regression analysis of current pricing trends, factoring in patent expiry timelines, production costs, and market penetration rates, we project the following:

-

Short-term (1-2 years): Stable or slight decline of 3-5% annually, influenced by ongoing generic entry.

-

Medium-term (3-5 years): Continued price erosion of approximately 10-15%, aligned with increased generic saturation.

-

Long-term (5+ years): Stabilization at lower price points, with potential growth opportunities stemming from expanded markets in emerging economies.

Price Projections (2023-2028)

| Year |

Estimated Average Price (USD) per Unit (e.g., 100 mg cream) |

| 2023 |

$25.00 |

| 2024 |

$23.75 |

| 2025 |

$22.50 |

| 2026 |

$21.25 |

| 2027 |

$20.50 |

| 2028 |

$19.75 |

Note: These projections assume continued generic competition and no major regulatory or patent impediments.

Supply Chain and Cost Implications

Manufacturing costs for terconazole have remained relatively stable, with active pharmaceutical ingredient (API) costs constituting a small fraction of retail prices. Regulatory compliance and quality assurance costs influence pricing but are minimized in generic manufacturing owing to established standards.

Future Market Opportunities

-

Formulation Innovation: Development of sustained-release topical formulations could command premium prices.

-

Combination Therapies: Pairing terconazole with other agents could open new therapeutic indications, expanding the consumer base.

-

Market Expansion: Greater penetration into emerging markets, facilitated by price reduction and increased healthcare access, could offset price decreases.

Regulatory and Patent Landscape

Patent protections for brand formulations have largely expired or are nearing expiry. Regulatory pathways for generics are well-established, leading to rapid market entry post-patent expiry, intensifying price competition.

Conclusion

Terconazole’s market remains resilient due to its targeted therapeutic profile and established niche in women's health. However, sustained generic competition exerts downward pressure on prices. Stakeholders should monitor patent expiries, develop differentiated formulations, and explore regional expansion to optimize profitability amid declining prices.

Key Takeaways

-

The terconazole market is characterized by high demand within a niche antifungal segment, but faces significant price pressures from generic competition.

-

Prices for terconazole are projected to decline gradually over the next five years, stabilizing at lower levels due to market saturation and cost efficiencies in generic manufacturing.

-

Opportunities lie in formulation innovation, combination therapies, and expansion into emerging markets, which could offset some revenue losses from price declines.

-

Competitive dynamics will increasingly favor cost-effective generics; brand differentiation will be critical for premium pricing strategies.

-

Regulatory landscapes and patent expiries will continue to be primary drivers shaping market entry and pricing strategies.

FAQs

-

What factors influence terconazole's market price?

Key factors include patent status, manufacturing costs, competition from generics, regional pricing regulations, and pharmaceutical marketing strategies.

-

How does patent expiry impact terconazole pricing?

Patent expiry often leads to an influx of generics, significantly reducing prices and intensifying competition.

-

Are there upcoming formulations that could disrupt the market?

Yes, sustained-release topical formulations and combination therapies are under exploration, which could command higher pricing and market share.

-

Which regions offer the highest growth potential for terconazole?

Emerging markets in Asia-Pacific and Latin America offer growth opportunities due to increasing healthcare access and demand.

-

What strategies can manufacturers adopt to maintain profitability?

Differentiation through formulation innovation, cost optimization, geographic expansion, and marketing are vital strategies.

References

[1] Centers for Disease Control and Prevention. Sexually Transmitted Infections Treatment Guidelines. 2021.

[2] IMS Health. US Prescription Pricing Data, 2018-2022.