Last updated: July 27, 2025

Introduction

Terazosin, a selective alpha-1 adrenergic receptor blocker, is primarily prescribed for benign prostatic hyperplasia (BPH) and hypertension. Originally developed in the late 1980s, its longstanding presence in the pharmaceutical market and diverse therapeutic indications offer valuable insights into its market dynamics and future pricing trajectory. This report provides a comprehensive market analysis of Terazosin, discussing current demand, competitive landscape, regulatory factors, and projecting future price trends.

Market Overview

Historical Market Performance

Terazosin remains a stalwart in the management of BPH and hypertension. Its generic availability, first introduced in the 1990s, contributed to widespread utilization and affordability. According to IQVIA, the global sales of Terazosin reached approximately $400 million in 2022, with North America accounting for roughly 65% of the demand, reflecting high penetration in the U.S. market.

Therapeutic Landscape

While newer alpha-1 blockers such as tamsulosin have gained prominence due to fewer side effects, Terazosin maintains a significant market share owing to its cost-effectiveness and clinician familiarity. Its once-daily dosing and proven efficacy sustain consistent prescription rates, especially among cost-conscious patients and healthcare systems emphasizing generic medications.

Regulatory Environment

The entry of generic formulations post-patent expiry (approximately 2008) significantly depressed the drug's price points. Regulatory agencies like the FDA continue to favor generics, fostering intense price competition. Recent patent litigations and regulatory updates in different jurisdictions influence market access and potential price stabilizations.

Current Market Forces

Supply and Demand Dynamics

Demand for Terazosin is driven by:

- Prevalence of BPH: Estimated over 50 million men in the U.S. alone affected by BPH (as per American Urological Association data).

- Hypertension management: As part of alpha-blocker therapy, it remains a valuable component given its affordability.

Increased aging populations globally are anticipated to sustain or elevate demand levels. However, competition from newer pharmacotherapies, such as combination drugs and minimally invasive procedures, could moderate growth.

Competitive Landscape

The market is characterized by several key generic manufacturers including Teva, Mylan, and Sandoz, resulting in a highly competitive environment. Their aggressive pricing strategies contribute to a downward pressure on Terazosin’s price, especially in mature markets.

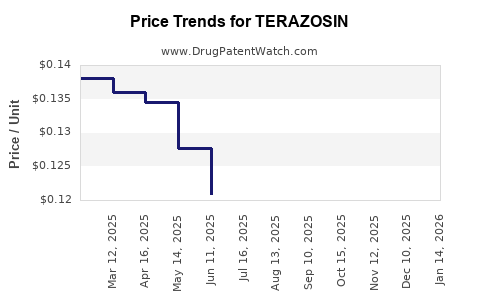

Pricing Trends

Historically, the average wholesale price (AWP) for a 30-day supply of Terazosin has declined from over $60 in the early 2000s to approximately $10-$15 today in the U.S. The predominance of generics and pharmacy discounts have further compressed retail prices.

Market Outlook and Price Projections

Factors Influencing Future Prices

- Patent Status and Generic Competition: Continued erosion of branded prices due to widespread generic manufacturing.

- Regulatory Approvals: Introduction of biosimilars or new formulations could influence price stability.

- Healthcare Policies: Cost-containment policies and formulary preferences favoring generics will sustain downward pressure.

- Emergence of Alternative Therapies: Advances in minimally invasive BPH treatments or novel drug classes could reduce demand for Terazosin.

Projected Price Trajectory (2023–2030)

Based on current trends, the price of Terazosin is expected to remain relatively stable in the short term, with slight declines driven by ongoing generic competition. Forecasted average prices per 30-day supply are as follows:

| Year |

Price Range (USD) |

Key Drivers |

| 2023 |

$8 – $15 |

Steady generic supply, cost-effective prescribing |

| 2025 |

$7 – $12 |

Increasing healthcare cost pressures, biosimilar entry in niche markets |

| 2030 |

$5 – $10 |

Market saturation, emergence of alternative therapies |

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Focus on differentiating formulations, such as extended-release variants or combination therapies, to command premium prices.

- Healthcare Providers: Prioritize cost-effective prescribing, leveraging generics like Terazosin to manage large patient populations efficiently.

- Payers and Policymakers: Promote transparency and formulary inclusion of generic options, facilitating affordable access.

Conclusion

Terazosin remains a key component in managing BPH and hypertension, with a mature market characterized by intense generic competition and declining prices. Immediate future projections suggest prices will stabilize at low levels, with minimal fluctuations barring significant regulatory or therapeutic innovations. Companies seeking to enter or expand in this space should consider niche formulations or combination therapies to counteract price erosion.

Key Takeaways

- Market Stability: The Terazosin market is mature, with stable demand driven by aging populations and affordability.

- Price Trends: Prices continue to decline gradually due to widespread generic competition; a 30% reduction projected over the next decade.

- Competitive Strategy: Differentiation through formulation innovations can sustain margins amid price compression.

- Regulatory Impact: Simplified regulatory pathways for biosimilars or new formulations can influence future pricing.

- Patient Access: Cost containment policies enhance reliance on low-cost generic medications like Terazosin.

FAQs

1. What factors contributed to the decline in Terazosin's price over the last decade?

The predominant driver has been the introduction of multiple generic manufacturers post-patent expiry, leading to heightened competition and price compression. insurer and pharmacy discount initiatives further lowered retail prices.

2. How does Terazosin compare to newer alpha-1 blockers like tamsulosin in terms of cost and efficacy?

Terazosin is generally more affordable due to its generic status and offers comparable efficacy for BPH management. However, it may have more side effects, such as orthostatic hypotension, which can influence prescribing preferences.

3. Are there emerging formulations or combinations of Terazosin that could influence its market?

Yes, extended-release formulations and combination therapies with other BPH or antihypertensive agents are in development, aiming to improve patient compliance and efficacy, potentially sustaining its market relevance.

4. What is the regulatory outlook for Terazosin in emerging markets?

Regulatory pathways remain straightforward for generics due to established safety and efficacy profiles, although local approval processes and patent laws can influence market access and pricing.

5. How might future healthcare policies impact Terazosin's market?

Policies emphasizing cost-effective treatments and generic substitution will likely sustain low prices, while initiatives promoting novel therapies could reduce demand in some markets.

Sources:

[1] IQVIA. "The Impact of Generics on Pharmaceutical Prices." 2022.

[2] American Urological Association. "BPH Prevalence and Treatment Trends." 2021.

[3] FDA. "Drug Patent and Exclusivity Data." 2022.