Last updated: July 29, 2025

Introduction

TENORMIN, the brand name for atenolol, is a beta-adrenergic blocker primarily prescribed for hypertension, angina pectoris, and myocardial infarction management. As a widely used generic medication, atenolol's market dynamics reflect a mature pharmaceutical sector characterized by patent expirations, regulatory influences, and evolving patent landscapes. This analysis evaluates the current market environment for TENORMIN, factors influencing its pricing strategies, and future price projections grounded in demand-supply fundamentals, patent status, regulatory considerations, and competitive dynamics.

Market Overview

Historical Context and Patent Status

Atenolol was approved in 1976, and TENORMIN has historically stood as one of the most prescribed antihypertensive agents worldwide. The original patent for TENORMIN expired decades ago, leading to widespread generic manufacturing. Consequently, the drug hosts a highly competitive landscape with multiple pharmaceutical companies producing generic versions, which exerts significant downward pressure on pricing.

Market Size and Demand Drivers

Globally, hypertension affects over 1.2 billion individuals, with beta-blockers like atenolol representing a core therapy. The drug’s affordability, proven efficacy, and safety profile sustain steady demand, especially within developing markets heavily reliant on cost-effective treatment options.

In 2022, the global hypertension medication market was valued at approximately $37 billion, with atenolol holding a notable share due to its low-cost profile[1]. North America and Europe constitute mature markets with established prescribing patterns, whereas emerging economies exhibit rapid growth driven by increased healthcare access and screening programs.

Competitive Landscape

The generic atenolol market features numerous players, including Teva, Sandoz, and Mylan. Prices are highly sensitive to competitive entries, supply chain factors, and regulatory approvals. Brand dominance, historically associated with TENORMIN, has waned, but the original brand retains recognition in certain regions, often fetching premium prices due to brand loyalty and perceived pharmacovigilance standards.

Market Trends Impacting Price Dynamics

Genericization and Price Erosion

The widespread availability of generics has led to significant price erosion. According to IQVIA data, the average price for atenolol tablets declined by roughly 25-30% over the past five years in major markets[2]. Price points hover around a few cents per tablet in competitive regions, although brand-name versions retain higher pricing.

Regulatory and Patent Re-Examinations

While patents generally expired long ago, some formulations or delivery mechanisms might be under secondary patents or exclusivities, temporarily influencing pricing or market segmentation. Regulatory hurdles, such as bioequivalence requirements, further impact new entrants or variations.

Pricing Reforms and Reimbursement Policies

Government initiatives, especially in Europe and North America, aim to contain healthcare costs, enforcing price caps on generics and establishing competitive bidding systems. These measures further suppress prices but can also impact supply stability and market share distribution among manufacturers.

Price Projection Analysis

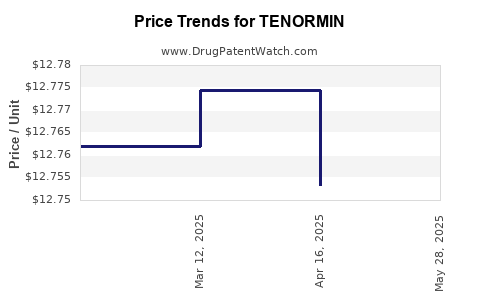

Current Pricing Benchmarks

In the United States, the average wholesale price (AWP) for a 100-tablet bottle of 50mg atenolol ranges from $4 to $8, depending on the supplier and purchasing volume[3]. In contrast, in emerging markets, unit prices may be as low as $0.01–$0.05 per tablet.

Forecast Assumptions

- Market Maturity: The atenolol market remains mature, with limited growth potential.

- Demand Stability: Consistent demand expected, with slight decline anticipated due to the rising preference for newer antihypertensives with improved side-effect profiles.

- Regulatory Environment: No significant patent protections or exclusivities expected, maintaining genericization.

- Supply Dynamics: Increased competition sustains downward pricing pressure; supply chain stability remains strong.

Projection Scenarios

Scenario 1: Continuation of Current Trends

Prices stabilize at current levels with minor fluctuations due to ongoing generic competition. Wholesale prices could average $3–$5 per 100 tablets in the next 3-5 years, with further erosion unlikely without regulatory changes.

Scenario 2: Market Disruption or Regulatory Intervention

Introduction of smaller or consolidating patent protections, or new formulations with extended patents, may temporarily uphold higher pricing. However, such measures are uncommon given the drug’s generic status.

Scenario 3: Decline Due to Competition from Newer Agents

Increased adoption of newer beta-blockers or alternative antihypertensives—such as nebivolol or ACE inhibitors—may diminish atenolol’s market share, leading to price reductions and volume declines over 5-10 years.

Estimated Price Trend:

Assuming Scenario 1 prevails, the average WAC (Wholesale Acquisition Cost) for atenolol tablets is projected to decline modestly by 10-15% over the next 3 years, stabilizing at roughly $2.50–$4 per 100-tablet bottle.

Regulatory and Patent Considerations

While atenolol’s patent has long expired, patent and exclusivity landscapes influence strategic pricing. No current patents are blocking generic competition on the core molecule, though secondary patents on formulations or delivery devices could sporadically impact market dynamics.

Furthermore, certain regions implement price controls and reimbursement adjustments, affecting the effective consumer prices and profit margins for manufacturers.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on cost-efficient manufacturing and establishing long-term supply agreements to maintain margins amid fierce price competition.

- Healthcare Providers: Favor generic atenolol for affordability, with potential shifts toward newer agents depending on clinical guidelines.

- Regulators: Monitor for patent gamesmanship and enforce transparency in pricing, especially in public healthcare programs.

- Investors: Expect stable revenues in mature markets with slight downward pressure, but with opportunities in emerging regions where demand growth persists.

Key Takeaways

- Market Maturity and Competition: Atenolol’s extensive genericization results in aggressive price competition, constraining profit margins.

- Stable Demand with Slow Decline: The drug maintains steady demand in primary indications; however, shifts toward newer therapies may gradually reduce its market share.

- Price Trajectory: Wholesale prices are projected to decline gradually over the next 3-5 years, stabilizing at lower levels due to persistent generic competition.

- Regulatory Environment: Continual regulatory oversight and reimbursement policies will influence pricing trends, particularly in publicly funded healthcare systems.

- Growth Opportunities: Markets in developing economies offer volume-driven growth, albeit at lower unit prices, emphasizing importance for global supply chain strategies.

FAQs

Q1: How does patent expiration influence TENORMIN’s pricing?

A1: Patent expiration enables multiple generic manufacturers to produce atenolol, greatly increasing competition and driving down prices. As a result, TENORMIN’s premium pricing diminishes, replaced by low-cost generics in most markets.

Q2: Are there any upcoming regulatory changes that could affect atenolol prices?

A2: Currently, no significant regulatory shifts are anticipated for atenolol. However, policies aimed at drug price regulation and biosimilar entry could influence future pricing in certain regions.

Q3: Will the demand for atenolol increase or decrease in the coming years?

A3: Demand is expected to stabilize or decline slightly due to the migration towards newer antihypertensive agents with better side-effect profiles and evolving treatment guidelines.

Q4: What regions represent growth opportunities for atenolol manufacturers?

A4: Developing countries with increasing hypertension prevalence and cost-sensitive healthcare systems remain attractive for volume-driven sales, despite lower prices.

Q5: How do price differences between brand-name TENORMIN and generics impact the market?

A5: Generic versions dominate due to lower costs, limiting brand name premium profits. However, some regions or patient segments may still favor TENORMIN for perceived quality or pharmacovigilance, allowing premium pricing.

References

[1] Markets and Markets. (2022). Hypertension Drugs Market.

[2] IQVIA. (2022). Global Generic Market Trends.

[3] First Databank. (2023). Wholesale Price Data for Atenolol.