Share This Page

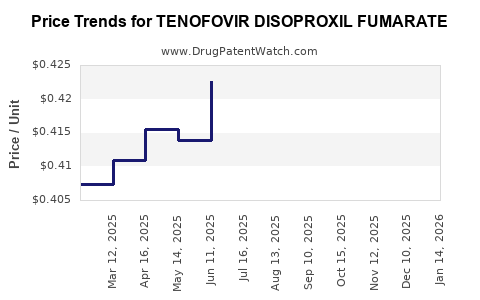

Drug Price Trends for TENOFOVIR DISOPROXIL FUMARATE

✉ Email this page to a colleague

Average Pharmacy Cost for TENOFOVIR DISOPROXIL FUMARATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TENOFOVIR DISOPROXIL FUMARATE 300 MG TABLET | 16714-0820-01 | 0.34668 | EACH | 2025-12-17 |

| TENOFOVIR DISOPROXIL FUMARATE 300 MG TABLET | 33342-0096-07 | 0.34668 | EACH | 2025-12-17 |

| TENOFOVIR DISOPROXIL FUMARATE 300 MG TABLET | 50268-0758-11 | 0.34668 | EACH | 2025-12-17 |

| TENOFOVIR DISOPROXIL FUMARATE 300 MG TABLET | 31722-0535-30 | 0.34668 | EACH | 2025-12-17 |

| TENOFOVIR DISOPROXIL FUMARATE 300 MG TABLET | 69097-0533-02 | 0.34668 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Tenofovir Disoproxil Fumarate

Introduction

Tenofovir disoproxil fumarate (TDF) is a nucleotide reverse transcriptase inhibitor (NRTI) widely used in the treatment of HIV/AIDS and chronic hepatitis B. Approved by the FDA in 2001, TDF remains a critical component in antiretroviral therapy (ART) regimens due to its efficacy, once-daily dosing, and generally favorable safety profile. As the landscape of HIV management shifts towards newer formulations and combination therapies, the market dynamics surrounding TDF are evolving, influencing pricing strategies and future projections.

Current Market Landscape

Global Market Overview

The global antiviral drugs market, notably for HIV treatments, was valued at approximately USD 17 billion in 2022, with TDF-based formulations accounting for a significant share. The prevalence of HIV/AIDS — estimated at 38 million globally — sustains high demand, particularly in low- and middle-income countries (LMICs) where affordability and access are critical factors. The World Health Organization (WHO) recommends TDF as a first-line component in ART, ensuring steady demand.

Key Manufacturers and Market Share

Major pharmaceutical companies producing TDF include Gilead Sciences (brand: Viread), Teva, Mylan (now part of Viatris), and Cipla. Gilead commands the dominant market share due to its early market entry and extensive patent portfolio. However, patent expirations and the rise of generic manufacturers have increased competition, especially in LMICs, leading to significant price reductions.

Patent Expiry and Generic Competition

Gilead’s patents for TDF expired in numerous jurisdictions between 2017 and 2020, prompting a proliferation of generic equivalents. Notably, India, a hub for pharmaceutical manufacturing, began producing affordable generics, significantly impacting global pricing. The entry of these generics has driven costs down, making TDF-based regimens more accessible.

Regional Market Dynamics

- High-Income Countries (HICs): Tend to maintain higher prices due to brand loyalty, patent protections, and advanced healthcare infrastructure. Gilead retains significant pricing power here with brand formulations.

- LMICs: Rely heavily on generics, benefitting from lower costs due to local manufacturing and international aid programs. Organizations like WHO and PEPFAR heavily subsidize TDF procurement.

- Emerging Markets: Experience both brand influence and increasing generic adoption, with price points steadily declining.

Market Drivers and Challenges

- Drivers: Growing global HIV prevalence, WHO guidelines endorsing TDF as first-line therapy, and increasing access programs.

- Challenges: Emergence of tenofovir alafenamide (TAF), a newer formulation with better safety and efficacy profiles, progressively replacing TDF in certain markets. This substitutive trend impacts TDF demand and prices.

Price Trends and Projections

Historical Pricing Trajectory

- Brand Pricing (Gilead Viread): Initially, Viread was priced around USD 1,600 per month in HICs (circa 2001), with prices decreasing over time due to generics and market competition.

- Generic Pricing: Post-patent expiry, generic TDF prices have plummeted. For example, in India, monthly prices as low as USD 3–5 are common for quality-assured generics [1].

Factors Influencing Price Fluctuations

- Regulatory Approvals: Speedy approvals of generics accelerate price declines.

- Supply Chain Dynamics: Increased manufacturing capacity and competitive bidding lower costs.

- Political and Economic Factors: Currency fluctuations, trade policies, and tariffs impact pricing in different regions.

- Pricing Agreements: International aid groups and governments often negotiate substantial discounts.

Future Price Projections

-

Short to Medium Term (Next 3–5 Years):

- In LMICs: Expect continued price stability or slight reductions, maintaining sub-USD 5 per month for quality generics. Increased biosimilar competition may further lower prices.

- In HICs: Prices are likely to stabilize or slightly decrease, influenced by patent protections and formulary negotiations. Gilead may sustain premium pricing for brand formulations in specialty segments.

-

Long Term (5+ Years):

- Shift to TAF and Combination Therapies: As TAF replaces TDF in many regimens, demand for TDF may plateau or decline. This could lead to prices adjusting downward, especially if significant generic manufacturing capacity persists.

- Potential Price Stabilization: If TDF remains in use for specific niches or in emerging markets, prices may stabilize at ultra-low levels (USD 1–3/month), aligned with generic production costs.

Impact of Emerging Technologies and Policies

Innovations like long-acting injectable formulations could alter oral TDF's significance. Additionally, international health policies aiming to eradicate HIV/AIDS may influence procurement budgets, affecting supply chain dynamics.

Market Opportunities and Risks

Opportunities

- Expansion in underdeveloped regions with high HIV prevalence.

- Use of simplified, fixed-dose combination (FDC) therapies incorporating TDF.

- Potential for lifecycle extension via new delivery formats or formulations.

Risks

- Competition from newer agents like TAF and alternative regimens.

- Patent litigations or regulatory delays affecting generic availability.

- Market saturation in regions transitioning to newer therapies.

Conclusion and Strategic Outlook

The TDF market remains resilient, primarily driven by global HIV treatment needs and ongoing generic proliferation. Short-term price declines are predictable, especially in LMICs, with prices stabilizing around USD 1–5 per month. The introduction and adoption of alternative agents, notably TAF, pose long-term challenges, potentially diminishing TDF's market share and influencing pricing. Stakeholders should monitor regulatory developments, regional market shifts, and technological advancements to optimize procurement and investment strategies.

Key Takeaways

- Pricing dynamics are heavily influenced by patent status, regional demand, and generic competition, with substantial reductions in LMICs.

- Future prices for TDF are expected to stabilize at ultra-low levels (USD 1–5/month), barring major shifts in treatment guidelines.

- Emerging therapies like TAF are gradually replacing TDF, shaping market demand and pricing trends.

- Global health initiatives sustain TDF demand in underserved markets, preserving its strategic importance.

- Investors and healthcare providers should consider the evolving therapeutic landscape and regional market conditions for informed decision-making.

FAQs

1. Will TDF prices continue to decline in the coming years?

Yes. The expiration of patents and increased generic manufacturing, especially in India and China, are likely to keep TDF prices low, particularly in LMICs. However, in HICs, prices may stabilize due to brand loyalty and procurement agreements.

2. How does the rise of tenofovir alafenamide (TAF) affect TDF market projections?

TAF offers improved safety profiles and is increasingly incorporated into newer ART regimens. Its adoption may reduce demand for TDF over time, potentially leading to a gradual decline in TDF purchase volumes and price stabilization.

3. Are there any regulatory barriers to generic TDF in different markets?

Regulatory considerations vary by country. While generic approvals have facilitated price declines in many regions, some jurisdictions maintain stringent regulatory hurdles, which can delay generic entry and influence local pricing.

4. What is the impact of international aid programs on TDF pricing?

Aid programs like PEPFAR and the Global Fund negotiate bulk purchases and discounts, ensuring affordable TDF access in low-income settings. These initiatives significantly influence the global demand and price landscape.

5. What are the key factors to watch for future TDF market shifts?

Regulatory developments, patent expirations, the pace of TAF adoption, advancements in drug delivery technologies, and global health policies are critical factors shaping the TDF market trajectory.

References

[1] World Health Organization. (2022). HIV and AIDS estimates, 2022.

[2] Gilead Sciences. (2023). Viread product information.

[3] IMS Health data reports. (2022). Global generic drug pricing trends.

[4] WHO Prequalification of Medicines Programme. (2022). Guidance on generic antiviral medicines.

More… ↓