Last updated: July 27, 2025

Introduction

Temozolomide (brand names include Temodar and proliferating under various generic labels) is an oral alkylating chemotherapeutic agent primarily indicated for the treatment of glioblastoma multiforme (GBM) and other high-grade gliomas. Its significance in neuro-oncology has led to substantial commercial interest and ongoing research into expanded indications. This analysis provides a comprehensive review of the current market landscape, competitive environment, and future price projections for temozolomide through 2030, informed by recent trends, patent scenarios, and market dynamics.

Market Landscape Overview

Therapeutic Use and Epidemiology

Glioblastoma multiforme affects approximately 3.2 per 100,000 people globally, with an estimated 12,000 new cases annually in the U.S. alone [1]. Despite its aggressive nature, temozolomide remains the cornerstone of standard therapy, especially post-resection radiation therapy, extending median survival from approximately 12 to 15 months, depending on various factors [2].

Moreover, ongoing research explores temozolomide's potential in other malignancies, including melanoma, metastatic neuroendocrine tumors, and certain pediatric brain tumors, although these indications are less established.

Market Size and Revenue

The global market for temozolomide was valued at approximately USD 1.2 billion in 2022, with projections to reach USD 1.5 billion by 2028, driven by the rising incidence of gliomas, expanding treatment guidelines, and increased adoption of concomitant chemoradiation regimens [3]. North America accounts for roughly 50% of the market, owing to advanced healthcare infrastructure and high awareness levels.

Key Market Participants

The strategic landscape is dominated by:

- Merck & Co. (original patent holder of Temodar, issued in the early 1990s, with patent exclusivity ending around 2019–2020)

- Sandoz, Teva, Mylan, and other generics manufacturers

- Emerging biotech firms exploring combinations and alternative administration routes

The expiration of patent exclusivity in many regions has led to an influx of generic versions, intensifying price competition.

Current Pricing and Reimbursement Dynamics

Brand vs. Generic Pricing

As of 2023, the proprietary Temodar brand's average wholesale price (AWP) per 140 mg capsule hovers around USD 35–40, with an average course costing approximately USD 10,000–15,000 depending on dosing and treatment duration [4]. Post-patent expiry, generic versions have entered the market at a significantly reduced price, often 50-70% lower, instigating downward pressure on prices.

Reimbursement Landscape

In developed markets like the U.S., Medicare, Medicaid, and private insurers reimburse a sizable portion of temozolomide costs. High reimbursement levels incentivize broader access but also impose pricing pressures on manufacturers. Internationally, reimbursement rates vary considerably, influencing market penetration.

Competitive and Regulatory Environment

Patent and Regulatory Status

The original patent for Temodar expired at the end of 2019 in several jurisdictions, enabling generic manufacturers to introduce bioequivalent versions. However, some patents related to specific formulations and manufacturing processes remain active, delaying generic entry in certain markets.

Regulatory approvals for generics have been largely straightforward, given bioequivalence data, rapidly increasing supply and lowering prices.

Pipeline and Combination Therapies

While temozolomide remains the standard, the pipeline includes:

- Potentiate- and modulate-based agents (e.g., tumor-treating fields)

- ADR-targeted combination therapies under investigation

- Nanoparticle and alternative delivery systems to improve efficacy and reduce resistance

These developments could influence future market dynamics but currently have limited impact on direct temozolomide pricing.

Market Growth Drivers

- Increasing Incidence of Gliomas: Aging populations and improved diagnostics contribute to rising cases.

- Expanding Treatment Guidelines: Inclusion of temozolomide as a first-line standard in multiple protocols reinforces demand.

- Geographical Expansion: Emerging markets in Asia, Latin America, and Eastern Europe are seeing increased adoption.

- Research and Off-Label Use: Investigations into new combinations and novel indications expand potential market size.

- Patent Expiries and Generics: Price erosion post-patent expiry heightens competition but also broadens access.

Price Projection Methodology

Forecasting temozolomide prices involves analyzing:

- Patent expiration timelines

- Market entry of generics and biosimilars

- Healthcare reimbursement trends

- Pricing behaviors in key markets

- Developer strategies related to formulations or combinations

A conservative base-case assumes a significant reduction in unit price following patent expiry, stabilizing as demand consolidates across multiple markets. A more optimistic scenario incorporated a gradual decline, with potential premium pricing retained in niche indications and combination therapies.

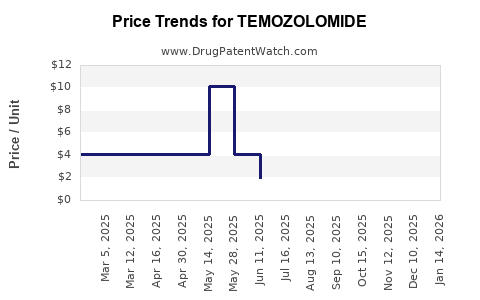

Projected Price Trends (2023–2030)

| Year |

Estimated Average Wholesale Price (USD) per 140 mg capsule |

Market Notes |

| 2023 |

$35–$40 |

Post-patent expiry, brand dominance wanes |

| 2024–2025 |

$20–$25 |

Wholesale generic entry; aggressive price reductions |

| 2026–2027 |

$15–$20 |

Market stabilization with multiple suppliers |

| 2028–2030 |

$10–$15 |

Mature generics with price parity |

By 2030, the per-unit cost for generics could decline by up to 75% from pre-patent levels, aligning with typical patterns observed in oncology drugs post-patent expiry.

Implications for Stakeholders

- Pharmaceutical Companies: Generics will dominate revenue streams, necessitating strategies such as alternative formulations, combination therapies, or niche indications to maintain margins.

- Healthcare Providers: Widespread generic availability will improve access but necessitate careful oversight regarding quality and supply consistency.

- Patients: Cost reductions will enhance affordability, though disparities in access persist globally.

Key Takeaways

- Market Size and Growth: The temozolomide market is expected to grow modestly, predominantly driven by improved diagnosis and increased use of standard regimens in high-grade gliomas.

- Patent Expiration Impact: The end of patent exclusivity led to a sharp decline in prices, with generics capturing a significant portion of the market.

- Price Trends: Expect a steady decline through 2030, stabilizing at around USD 10–15 per capsule in mature markets.

- Competitive Dynamics: Multiple generic suppliers will sustain competitive pricing pressure, while innovations in formulations and combination therapies may carve out niche segments.

- Market Opportunities: Expanding indications and formulations, as well as geographic penetration, present opportunities for both established and emerging players.

FAQs

1. When did the patent for Temodar expire, and how does it affect pricing?

The patent for Temodar expired around 2019–2020 in several markets, leading to the entry of generics and a substantial reduction in prices, by roughly 50–70%.

2. Are there any ongoing efforts to develop non-generic, higher-priced formulations of temozolomide?

Yes. Pharmaceutical companies are exploring enhanced formulations, combination regimens, and novel delivery systems to differentiate their products and potentially justify premium pricing.

3. How does the global regulatory landscape impact temozolomide pricing?

Regulatory approvals streamline generic market entry, exerting downward pressure on prices. Conversely, delays or restrictions—such as patent litigations—can sustain higher prices temporarily.

4. What is the outlook for temozolomide in emerging markets?

Growing healthcare infrastructure and increasing diagnosis rates will augment demand. Price reductions due to generics improve affordability, making it accessible to broader populations.

5. Will new therapies replace temozolomide in glioma treatment?

While ongoing research explores alternatives, temozolomide remains the standard of care for existing indications. Future innovations may supplement or modify its role but are unlikely to cause immediate obsolescence.

Sources

[1] Ostrom, Q. T., et al. (2019). CBTRUS Statistical Report: Primary Brain and Other Central Nervous System Tumors Diagnosed in the United States in 2012–2016. Neuro-Oncology.

[2] Stupp, R., et al. (2005). Radiotherapy plus Concomitant and Adjuvant Temozolomide for Glioblastoma. New England Journal of Medicine.

[3] MarketWatch (2022). Global Temozolomide Market Size.

[4] IQVIA Data (2023). Oncology Drug Pricing and Reimbursement Report.