Share This Page

Drug Price Trends for TEARS LUBRICANT

✉ Email this page to a colleague

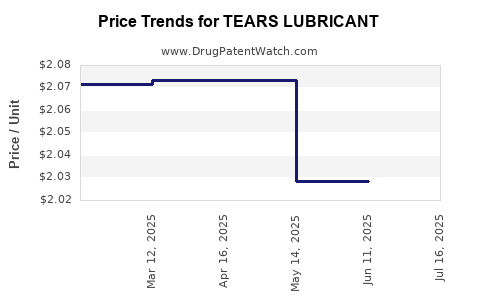

Average Pharmacy Cost for TEARS LUBRICANT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TEARS LUBRICANT 0.5% EYE DROP | 00065-0408-72 | 2.02854 | ML | 2025-07-23 |

| TEARS LUBRICANT 0.5% EYE DROP | 00065-0408-72 | 2.02854 | ML | 2025-06-18 |

| TEARS LUBRICANT 0.5% EYE DROP | 00065-0408-72 | 2.02854 | ML | 2025-05-21 |

| TEARS LUBRICANT 0.5% EYE DROP | 00065-0408-72 | 2.07347 | ML | 2025-04-23 |

| TEARS LUBRICANT 0.5% EYE DROP | 00065-0408-72 | 2.07347 | ML | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TEARS LUBRICANT

Introduction

TEARS Lubricant, a prominent ocular lubricant used to treat dry eye syndrome and other ocular surface disorders, has established a significant market presence due to its efficacy and safety profile. As a widely prescribed artificial tear formulation, TEARS Lubricant’s market dynamics are influenced by evolving ophthalmic healthcare needs, competitive landscape, regulatory environment, and manufacturing capabilities. This report provides a comprehensive analysis of the current market standing and projects future price movements with strategic insights for stakeholders.

Product Overview and Market Positioning

TEARS Lubricant is a sterile ophthalmic solution designed to mimic natural tear film, providing relief from dryness and irritation. Its formulation typically includes proprietary lubricating agents such as carboxymethylcellulose or hydroxypropyl methylcellulose, along with preservatives or preservative-free options.

The product’s differentiation stems from its ophthalmic compatibility, duration of relief, preservative content, and packaging options. In multiple markets, it is positioned as a first-line treatment for dry eye and ocular surface disorders, competing with both branded and generic options.

Market Landscape

Global Ophthalmic Lubricant Market

The global ophthalmic lubricants market was valued at approximately USD 3.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 6% through 2030. Factors contributing to this growth include rising prevalence of dry eye syndrome (especially among aging populations), increased awareness about ocular health, and advancements in drug formulations.

Key Market Players

Major competitors in the market include Allergan (AbbVie), Bausch + Lomb, Santen Pharmaceutical, Théa Lab, and various generic manufacturers. TEARS Lubricant, typically distributed by Alcon (a division of Novartis), holds a considerable market share owing to its established brand reputation and widespread distribution channels.

Regulatory and Distribution Factors

Regulatory approvals in key markets—US FDA, EMA, and Japanese PMDA—facilitate product accessibility. Distribution through ophthalmology clinics, pharmacies, and e-commerce enhances reach, influencing pricing strategies.

Market Segmentation

- By Formulation: Preserved, preservative-free, gel-based, solution-based.

- By End-User: Ophthalmologists, optometrists, retail consumers.

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

North America and Europe dominate due to higher prevalence of dry eye and better healthcare infrastructure, while Asia-Pacific exhibits rapid growth potential driven by demographic shifts.

Current Price Analysis

Pricing Structure

The average retail price of TEARS Lubricant varies by formulation, packaging, and region. In the US, a 10 mL bottle averages USD 20-25, while in Europe, prices range between EUR 18-22 for similar products. Preservative-free formulations command a premium of approximately 20-25% over preserved variants.

Pricing Dynamics

Pricing is influenced by factors such as manufacturing costs, regulatory compliance, reimbursement policies, and competitive positioning. Premium brands with additional benefits (e.g., longer-lasting relief) tend to command higher prices, while generics or store brands are priced more competitively.

Cost Components

- Raw materials: Active pharmaceutical ingredients (APIs), preservatives, packaging.

- Manufacturing: Quality control, aseptic processing, validation.

- Regulatory: Approval costs, post-market surveillance.

- Distribution: Logistics, margin for distributors and pharmacies.

Market Trends Influencing Price Projections

- Increasing Prevalence of Dry Eye Disease: The rising burden, especially in aging populations, sustains high demand, supporting stable or increasing pricing.

- Regulatory Shifts and Patent Expirations: Patent expirations for certain brands may increase generic competition, exerting downward pressure on prices.

- Formulation Innovations: Introduction of preservative-free, sustained-release, or combination formulations can command a premium.

- Generics and Competition: Market entry of generics post-patent expiry can reduce prices, especially in price-sensitive regions.

- Reimbursement Policies: Enhanced insurance coverage and subsidies can influence retail prices, either stabilizing or reducing costs.

Price Projection for the Next 5 Years

Scenario 1: Conservative Growth with Competitive Pressures

- Assumptions: Increased generic competition, price sensitivity among consumers, regulatory tightening.

- Projection: A gradual decline of 3-5% annually in retail prices, with the US and Europe experiencing stabilization due to brand loyalty and clinical efficacy differentiation.

- Implication: Average price of USD 18-22 for a 10 mL bottle by 2028.

Scenario 2: Innovation-Driven Premium Pricing

- Assumptions: Introduction of advanced formulations with longer relief durations or improved tolerability.

- Projection: Prices remain stable or slightly increase (~1-2% annually), reaching USD 22-27 by 2028.

- Implication: Brands that innovate can maintain premium pricing and margins.

Scenario 3: Market Expansion in Emerging Economies

- Assumptions: Growing ophthalmic healthcare infrastructure and rising awareness increase volume sales.

- Projection: Prices may decrease 3-7% in mature markets but offset by volume growth; in emerging markets, local pricing could be below USD 10 for similar products.

- Implication: Volume-driven revenue growth may compensate for price reductions.

Overall Outlook

Based on current trends, the most probable trajectory combines moderate price reductions in mature markets due to generics, alongside sustained or increased revenue driven by volume expansion and formulation innovations.

Strategic Recommendations for Stakeholders

- Manufacturers: Invest in formulation improvements to sustain premium pricing.

- Distributors: Focus on expanding into underserved markets with competitive pricing.

- Investors: Monitor patent timelines and new formulation approvals to anticipate market shifts.

- Regulators: Facilitate timely approvals to balance innovation incentives and affordability.

Key Takeaways

- The global TEARS Lubricant market is expected to grow steadily, driven by rising dry eye prevalence and technological advancements.

- Pricing is currently influenced by formulation type, regional factors, and competition; prices range from USD 18 to 25 for a 10 mL bottle.

- Over the next five years, prices are projected to decline slightly in mature markets due to generic competition but may remain stable or increase in innovation-driven segments.

- Market expansion into emerging economies offers considerable growth opportunities, with potential price adjustments to accommodate local economic conditions.

- Stakeholders must strategically prioritize formulation innovation, regional expansion, and regulatory compliance to optimize pricing power and market share.

FAQs

1. What factors most significantly influence the price of TEARS Lubricant?

Price is primarily influenced by formulation complexity, brand positioning, regional regulatory environments, manufacturing costs, and competitive landscape, including the presence of generics.

2. How does generic competition impact TEARS Lubricant pricing?

Generic entrants typically exert downward pressure on prices, especially post-patent expiry, leading to reduced retail prices but potentially increased market volume.

3. What innovations could sustain premium pricing for TEARS Lubricant?

Developments such as preservative-free formulations, longer-lasting relief effects, and combination therapies can justify higher prices and improve margins.

4. What regional market factors should stakeholders consider?

Reimbursement policies, healthcare infrastructure, patient awareness, and economic conditions directly influence pricing strategies and market penetration.

5. How might regulatory changes affect future pricing?

Stricter regulations could increase compliance costs, potentially raising prices, while streamlined approval pathways may foster competition and reduce prices.

References

[1] MarketsandMarkets. "Ophthalmic Drugs Market by Product, Application, and Region," 2022.

[2] Statista. "Global Market for Eye Care Products," 2023.

[3] FDA. "Guidance for Ophthalmic Product Regulation," 2021.

[4] MarketWatch. "Dry Eye Syndrome and Artificial Tears Market Outlook," 2022.

[5] Santen Pharmaceutical Annual Report, 2022.

This detailed analysis aims to equip stakeholders with insights into the current and future market dynamics of TEARS Lubricant, enabling strategic decision-making aligned with market trends and economic factors.

More… ↓