Last updated: July 27, 2025

Introduction

Tazarotene, a topical retinoid primarily prescribed for the treatment of acne vulgaris and psoriasis vulgaris, commands a specialized segment within dermatological therapeutics. As of 2023, its market dynamics are influenced by factors such as patent status, regulatory landscape, clinical efficacy, competition, and emerging alternatives. This analysis dissects current market conditions, forecasts future pricing trends, and identifies growth opportunities and challenges.

Market Overview

Product Profile and Indications

Tazarotene (sold under brands like Tazorac and Avage) functions by modulating keratinocyte proliferation and differentiation via retinoic acid receptor pathways. Its indications extend from acne and psoriasis to off-label uses such as photoaging. The global dermatology market, valued at approximately USD 15 billion in 2022, includes retinoid products as a significant segment, with tazarotene constituting a niche within topical retinoids.

Market Drivers

- Increasing prescription for psoriasis and acne: Rising incidence rates of acne (especially among adolescents and young adults) and psoriasis bolster demand.

- Product efficacy and safety profile: Tazarotene's prolonged clinical use and approval for long-term therapy sustain its preference over some competitors.

- Growing dermatology awareness: Increased access to dermatological care in emerging markets expands potential user base.

- Pipeline developments: Formulation improvements (e.g., foam, gel formulations) enhance patient adherence.

Market Challenges

- Patent expiration: Patent cliffs have led to generic entry, intensifying price competition.

- Side effect profile: Skin irritation and teratogenic risks demand caution, slightly limiting broader usage.

- Reimbursement constraints: Insurance coverage varies, affecting prescribing patterns.

- Emerging competitors: Other topical retinoids like tretinoin, adapalene, and novel therapies (biologics for psoriasis) pose substitution threats.

Current Market Landscape

Leading Pharmaceutical Players

- Mitsubishi Tanabe Pharma: Original patent holder for Tazorac in the US.

- Other generics manufacturers: A surge in generic tazarotene formulations post-patent expiry has significantly lowered retail prices.

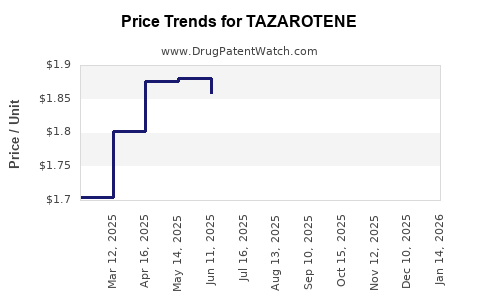

Pricing Trends (Pre- and Post-Patent Expiry)

- Brand-name tazarotene (Tazorac): In 2022, average retail prices ranged from USD 300–400 per 30-gram tube, with significant variations based on pharmacy and insurance coverage.

- Generics: Post-patent expiry (approx. 2019–2020), average prices decreased by approximately 50–60%, with some brands available for under USD 150 per 30-gram tube.

Price Projections

Factors Influencing Future Pricing

- Patent Status: As patents continue to expire, prices are expected to remain under downward pressure owing to increased generic competition.

- Regulatory landscape: New formulations or indications could temporarily impact pricing, but generic penetration will likely dominate.

- Market penetration: As generics gain acceptance, especially in emerging markets, price points will decline further.

- Supply chain efficiencies: Cost reductions due to manufacturing improvements can translate into lower consumer prices.

Projected Price Trajectory (2023–2028)

| Year |

Brand-name Price (USD) |

Generic Price (USD) |

Expected Trend |

| 2023 |

300–400 |

120–200 |

Stabilization with persistent competition |

| 2024 |

290–390 |

110–190 |

Slight decrease as generics expand |

| 2025 |

280–380 |

100–180 |

Continued downward trend |

| 2026 |

270–370 |

90–170 |

Market saturation of generics |

| 2027 |

260–360 |

80–160 |

Marginal price decrease, market maturation |

| 2028 |

250–350 |

70–150 |

Price stabilization at lower levels |

Key Drivers for Price Decline

- Increasing saturation of generics.

- Entry of biosimilars (if applicable) in broader dermatological treatments.

- Cost-efficient manufacturing and distribution.

Market Opportunities and Strategic Considerations

- Emerging Markets: Large populations with rising skin disorders present growth opportunities; prices may be further reduced to improve access.

- Combination Therapies: Formulations combining tazarotene with other agents could command premium pricing.

- Innovative Delivery Systems: Nanoformulations or patch systems might justify higher prices but depend on regulatory approval and clinical efficacy.

- Off-label Expansion: Use in additional dermatological indications could boost demand, influencing pricing dynamics.

Challenges and Risks

- Pricing Pressure: Ongoing competition and regulatory policies favoring generic proliferation will maintain downward pressure.

- Regulatory constraints: Stringent safety warnings, especially concerning teratogenicity, may limit broader use.

- Market saturation: Slower growth potential in mature markets.

Key Takeaways

- Patent expirations have shifted tazarotene's market from branded to predominantly generic, exerting downward price pressures.

- Pricing stability in recent years is expected to persist into the next five years, with gradual declines aligning with market saturation.

- Emerging markets offer growth opportunities but necessitate affordability strategies due to price sensitivity.

- Innovation and formulations may serve as differentiation points, potentially supporting higher price points.

- Regulatory and safety concerns remain pivotal in shaping market access and pricing strategies.

FAQs

1. How will patent expirations affect tazarotene prices?

Patent expirations have led to increased generic competition, causing significant reductions in retail prices—potentially lowering costs by over 50%. The continuation of price declines depends on market entry strategies and regulatory factors.

2. Are there upcoming formulations that could impact the market price of tazarotene?

Yes, novel delivery systems (such as foam, patches, or nanoemulsions) could command premium prices if proven more effective or user-friendly, provided they gain regulatory approval and market acceptance.

3. How do pricing trends vary globally?

In developed markets like the US and Europe, prices remain relatively stable due to insurance coverage and brand loyalty, but generic prices are declining. In developing countries, prices are generally lower but vary based on local regulations and purchasing power.

4. What is the projected growth outlook for tazarotene?

Market growth will be moderate, driven by expanding dermatology treatment needs and formulation innovations, but constrained by competition from other retinoids and generic pricing pressure.

5. Could biosimilars or biologics impact tazarotene's market?

While biosimilars mainly pertain to biologic drugs, their presence in psoriasis and other skin conditions could influence the overall market. Tazarotene’s topical nature limits direct competition from biologics, but alternative therapies might impact its prescription rate.

Sources:

[1] MarketResearch.com, “Global Dermatology Drugs Market,” 2022.

[2] IQVIA, “Topical Retinoids Market Analysis,” 2022.

[3] Company filings and patent databases, 2022–2023.

[4] FDA drug approvals and patent data, 2020–2022.