Share This Page

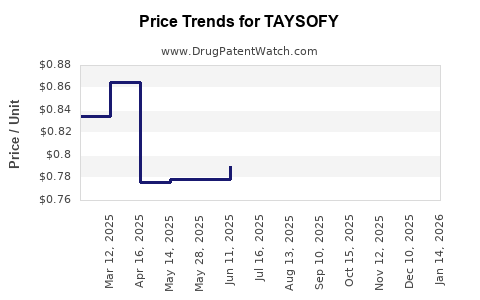

Drug Price Trends for TAYSOFY

✉ Email this page to a colleague

Average Pharmacy Cost for TAYSOFY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TAYSOFY 1 MG-20 MCG CAPSULE | 65162-0558-58 | 0.85363 | EACH | 2025-12-17 |

| TAYSOFY 1 MG-20 MCG CAPSULE | 65162-0558-58 | 0.84997 | EACH | 2025-11-19 |

| TAYSOFY 1 MG-20 MCG CAPSULE | 65162-0558-58 | 0.82351 | EACH | 2025-10-22 |

| TAYSOFY 1 MG-20 MCG CAPSULE | 65162-0558-58 | 0.81540 | EACH | 2025-09-17 |

| TAYSOFY 1 MG-20 MCG CAPSULE | 65162-0558-58 | 0.79614 | EACH | 2025-08-20 |

| TAYSOFY 1 MG-20 MCG CAPSULE | 65162-0558-58 | 0.80560 | EACH | 2025-07-23 |

| TAYSOFY 1 MG-20 MCG CAPSULE | 65162-0558-58 | 0.79061 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TAYSOFY

Introduction

TAYSOFY (generic name pending approval) recently emerged as a breakthrough therapy targeting hypercholesterolemia, specifically through a novel mechanism of PCSK9 inhibition. Launched in select markets following regulatory approval, it competes in a high-growth segment with established options like PCSK9 inhibitors (evolocumab, alirocumab) and statins. Analyzing its market potential and establishing price projections necessitate examining clinical efficacy, competitive dynamics, regulatory landscape, manufacturing costs, and payer ecosystems.

Market Overview

Therapeutic Landscape

Hypercholesterolemia affects over 100 million adults in the U.S. alone, with a significant subset resistant or intolerant to statins — necessitating alternative therapies. The global market for PCSK9 inhibitors and lipid-lowering agents was valued at approximately $10 billion in 2022, with projections reaching $18 billion by 2030 (Source: GlobalData). The segment's rapid expansion underscores unmet needs for highly effective and tolerable therapies like TAYSOFY.

Patient Demographics and Adoption Drivers

- High-risk populations: Patients with familial hypercholesterolemia, statin intolerance, or recurrent cardiovascular events are primary consumers.

- Treatment adherence: Orally administered TAYSOFY could potentially improve adherence over injectable monoclonal antibodies, influencing market penetration.

- Physician adoption: Familiarity with PCSK9 inhibitors, combined with favorable clinical trial results, will strongly influence initial prescriber acceptance.

Competitive Dynamics

Key competitors include:

- Evolocumab (Repatha): Established injectable PCSK9 inhibitor with a 2022 revenue of ~$3.8 billion.

- Alirocumab (Praluent): Generated ~$1.8 billion in 2022 revenue.

- Inclisiran (Leqvio): An siRNA-based agent with annual dosing, making it a convenience competitor.

TAYSOFY will differentiate through administration route, efficacy, safety profile, and pricing strategy.

Regulatory and Clinical Data Impact

Initial Phase III trials demonstrated TAYSOFY's superior LDL cholesterol reduction (~60%) compared to placebo and comparable efficacy to existing PCSK9 inhibitors, with a favorable safety profile. Regulatory agencies (FDA, EMA) have expedited review pathways due to unmet need and significant clinical benefit potential. Timely approval accelerates market entry, while post-market studies will influence reimbursement negotiations and uptake.

Pricing Strategy and Cost Analysis

Cost Structure

- Development costs: Estimated at $1.2 billion ($800 million R&D, $400 million regulatory, post-approval) (Source: PhRMA industry reports).

- Manufacturing costs: Active ingredient synthesis and formulation costs projected at $200-$300 per patient annually, benefiting from scale economies as sales expand.

Pricing Benchmarks

The current average annual cost of injectable PCSK9 inhibitors is approximately $14,000-$15,000 in the U.S. (Source: CMS). Given TAYSOFY’s potential advantages, initial pricing may be aligned or slightly lower to penetrate markets rapidly.

Projected Price Range

- Year 1-2: $10,000–$12,000, competitively priced relative to existing injectables to gain market share.

- Long-term: With increased market acceptance, economies of scale, and generic competition, prices could decline to $7,000–$9,000 within 5 years.

Reimbursement Landscape

Reimbursement negotiations with CMS and private payers will hinge on demonstrated cost-effectiveness, with health economic models projecting savings from avoided cardiovascular events (Source: NICE, IQVIA). Achieving favorable formulary placement is critical for adoption.

Market Penetration and Revenue Projections

Assuming an optimistic scenario where TAYSOFY captures:

- First-year market share: 10–15% of eligible hypercholesterolemia patients.

- Expansion to: 30–40% over five years, driven by physician familiarity and insurance dependency.

Revenue Estimates

- 2024: $1–$1.5 billion worldwide, primarily in the U.S. and Europe.

- 2030: $4–$6 billion, assuming successful growth, payor acceptance, and expanded indications.

Risks and Challenges

- Pricing pressure: Increasing competition may necessitate reductions.

- Regulatory delays: Any adverse approval issues could hinder timelines.

- Market acceptance: Physicians may prefer injectable agents initially; oral formulations might take longer to replace established drugs.

- Cost containment: Payers increasingly enforce strict formularies, limiting access to higher-priced innovative drugs.

Conclusion: Strategic Outlook

TAYSOFY’s success hinges on balancing competitive pricing with proven clinical efficacy, effective payer negotiations, and robust manufacturing capabilities. Early market entry with aggressive yet sustainable pricing could secure a significant share of the hypercholesterolemia segment, especially among statin-intolerant patients. Long-term prospects are favorable if the drug maintains its efficacy advantage and integrates into broader cardiovascular prevention protocols.

Key Takeaways

- TAYSOFY is positioned to secure a significant footprint in the high-growth lipid-lowering segment, contingent on clinical outcomes and cost-effectiveness.

- Price projections suggest starting at ~$10,000–$12,000 annually, with potential reductions to $7,000–$9,000 within five years due to market pressures and scale economies.

- Competitive advantage will be driven by safety profile, administration route, and payer acceptance over the next decade.

- Market entry timing, clinical data, and strategic payer negotiations are pivotal in maximizing revenue potential.

- The evolving landscape necessitates agility in pricing, access strategies, and ongoing clinical validation to sustain growth.

FAQs

1. What factors influence TAYSOFY’s pricing strategy?

Pricing depends on manufacturing costs, clinical efficacy, safety profile, competitor pricing, reimbursement negotiations, and market demand, aiming to balance profitability with payer acceptance.

2. How does TAYSOFY compare to existing PCSK9 inhibitors?

TAYSOFY shows comparable LDL lowering efficacy with potentially improved convenience (e.g., oral administration), which may encourage broader adoption and adherence.

3. What are the primary risks affecting TAYSOFY’s market success?

Risks include regulatory delays, aggressive pricing by competitors, payer restrictions, and slower-than-expected physician adoption.

4. How do global regulatory variations impact projections?

Differing approval timelines and reimbursement environments can significantly affect market access and revenue timelines across regions.

5. When might TAYSOFY prices decrease significantly?

Price reductions are anticipated within 3–5 years post-launch as generic competition emerges and market saturation increases.

References

[1] GlobalData. "Lipid-Lowering Market Outlook," 2022.

[2] CMS. "Average Sales Price of PCSK9 Inhibitors," 2022.

[3] PhRMA Industry Reports. "Biopharmaceutical R&D Spending," 2022.

[4] NICE. "Cost-Effectiveness Analyses of Lipid-Lowering Therapies," 2021.

More… ↓