Last updated: July 27, 2025

Introduction

Tasimelteon is a selective melatonin receptor agonist developed by Vanda Pharmaceuticals. Primarily approved for the treatment of non-24-hour sleep-wake disorder (Non-24), particularly in blind individuals, it offers a novel approach to managing circadian rhythm disruptions. Given the increasing focus on sleep disorders and circadian regulation, an insightful analysis of its market landscape and price trajectory is essential for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Current Market Position of Tasimelteon

Regulatory Status and Approved Indications

Tasimelteon received U.S. Food and Drug Administration (FDA) approval in 2014 for the treatment of Non-24 in totally blind individuals (Project No. 203-428). Its orphan drug designation underscores its critical role in serving a niche patient population with limited therapeutic options (FDA, 2014). Currently, the drug's approved indication remains centered on Non-24, with ongoing investigations into other sleep-related and circadian rhythm disorders.

Market Penetration and Usage

Despite its FDA approval, Tasimelteon’s adoption has been limited, mainly due to:

- The rarity of Non-24, affecting a small patient population.

- Underdiagnosis of circadian rhythm sleep-wake disorders.

- Competition from off-label use of melatonin supplements and behavioral interventions.

- High treatment costs limiting accessibility.

As of 2023, estimates suggest that only a few thousand patients globally are on Tasimelteon, primarily in the U.S., where insurance reimbursement has improved post-approval.

Market Dynamics and Growth Drivers

Growing Awareness of Sleep Disorders

The global sleep disorder therapeutics market is projected to grow at a compound annual growth rate (CAGR) of approximately 7% through 2028, driven by increased awareness, aging populations, and advancing diagnostics (Research and Markets, 2022). As circadian rhythm disorders are increasingly recognized, demand for targeted treatments like Tasimelteon is expected to rise.

Advancements in Diagnostic Techniques

Enhanced diagnostic criteria and tools enable better identification of Non-24 and similar disorders, broadening the eligible patient base. Moreover, expanding awareness among sleep specialists can facilitate higher prescription rates.

Potential for Expanded Indications

Preclinical and clinical data exploring Tasimelteon’s effectiveness in other sleep-related conditions, such as Jet Lag Disorder, Shift Work Sleep Disorder, and possibly broader circadian misalignments, could catalyze expansion opportunities.

Market Entry Barriers

High development costs, limited production capacity, and regulatory hurdles remain bottlenecks for market expansion. Additionally, generic competitors are unlikely in the short term due to the drug’s orphan designation and patent protections.

Competitive Landscape

Although Tasimelteon is relatively unique in its class, other melatonin-based agents (e.g., ramelteon, melatonin supplements) compete in broader sleep aid markets. However, none possess the selective receptor specificity or regulatory approval for Non-24, giving Tasimelteon a competitive advantage in its niche.

Emerging therapies targeting circadian disorders, such as light therapy devices and newer pharmacological agents, may challenge its market share in the future. Nonetheless, its specialized mechanism and regulatory backing support continued market relevance.

Pricing Strategy and Price Projections

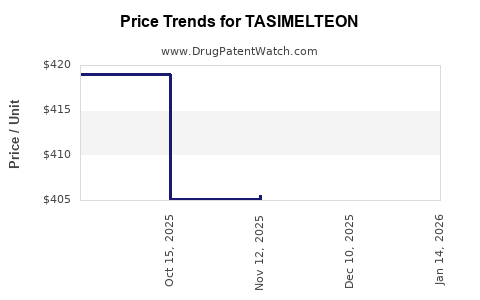

Current Pricing Overview

As of 2023, the wholesale acquisition cost (WAC) for Tasimelteon stands at approximately $17,550 per 30-count bottle (28 mg capsules; dosage varies based on patient needs). Insurance coverage and patient assistance programs mitigate out-of-pocket expenses. The high price reflects the orphan status, customized formulation, and limited market volume.

Factors Influencing Price Stability and Trends

- Regulatory Exclusivity: The Orphan Drug Act grants 7-year market exclusivity, limiting generic competition until at least 2021, with extensions possible. This exclusivity sustains high pricing.

- Manufacturing Costs: Specialized synthesis processes maintain elevated manufacturing costs, reinforcing the premium price.

- Market Scarcity: Small patient populations support premium pricing; however, pricing pressure may arise if expanded indications or competitive therapies emerge.

- Reimbursement Policies: Payer reimbursement decisions significantly impact net pricing. A shift toward value-based care could incentivize price adjustments.

Price Projection (2023–2028)

Within the next five years, several factors could influence Tasimelteon’s price trajectory:

- Expiration of Market Exclusivity (post-2021): Entry of generics could reduce prices by approximately 30–50%, following trends in orphan drugs with patent cliffs.

- Expansion of Indications: Demonstrating efficacy in broader circadian rhythm disorders may justify sustained or increased pricing, especially if the patient base expands.

- Market Competition: Emerging drugs with comparable efficacy could exert downward pressure on prices.

- Manufacturing Advancements: Cost efficiencies or biosimilar development might favor moderate price reductions.

Based on current trends, a conservative estimate suggests a 5–10% annual decline in net price for Tasimelteon post-exclusivity, stabilizing around $12,500 to $14,000 per 30-day supply by 2028.

Future Market Opportunities

Expansion into Broader Sleep Disorder Markets

Key efforts are underway to evaluate Tasimelteon’s potential in other indications, such as:

- Jet Lag Disorder: Small-scale trials indicate possible benefits in circadian resetting.

- Shift Work Sleep Disorder: Proving efficacy here could significantly expand the patient pool.

- Delayed Sleep Phase Syndrome (DSPS): Given its mechanism, Tasimelteon may serve as a targeted therapy.

Emerging Technologies and Formulations

Development of extended-release formulations or combination therapies could enhance patient compliance and treatment outcomes, potentially commanding premium pricing.

Global Market Penetration

Currently concentrated in the U.S., expanding regulatory approvals in Europe, Japan, and emerging markets will diversify revenue streams. These regions may have different pricing and reimbursement landscapes, influencing local pricing strategies.

Regulatory and Reimbursement Outlook

Prospective regulatory pathways for label expansion include accelerated approval routes, given the unmet need in rare disorders. Payer negotiations will influence net pricing; demonstrating cost-effectiveness through health economic analyses is critical to sustain favorable reimbursement.

Challenges and Risks

- Market Size Limitations: The rarity of Non-24 significantly constrains revenue potential.

- Pricing Pressures: Payers increasingly scrutinize high-cost orphan drugs.

- Clinical Evidence: The need for robust data supporting expanded indications remains paramount.

- Competitive Landscape: New therapies or intervention modalities may dilute market share.

Key Takeaways

- Niche but Growing Market: Tasimelteon holds a unique position for Non-24 with limited competition but faces inherent market size constraints.

- Pricing Dynamics: Current high-price reflects orphan status; expiration of exclusivity and competitive entry will likely lead to significant price reductions.

- Expansion Opportunities: Demonstrating efficacy in broader circadian disorders can unlock additional revenues.

- Market Expansion: Regulatory approvals in international markets and new formulations will pave pathways for growth.

- Strategic Flexibility Needed: Companies should monitor evolving clinical data, regulatory policies, and payer dynamics to adapt pricing strategies effectively.

Conclusion

Tasimelteon remains a specialized therapeutic with a well-defined niche. Its market prospects hinge on expanding indications, regulatory support, and managing pricing in the context of patent expirations and emerging competitors. Stakeholders investing in or relying on Tasimelteon should stay alert to evolving market forces and technological advances that could reshape its valuation. While high current prices serve its orphan drug status, future dynamics suggest gradual price moderation aligned with broader market expansion.

FAQs

1. What is the primary indication for Tasimelteon?

Tasimelteon is approved for the treatment of Non-24-hour sleep-wake disorder, predominantly affecting totally blind individuals with circadian rhythm misalignments.

2. How does the patent and exclusivity landscape affect Tasimelteon’s pricing?

Market exclusivity under the Orphan Drug Act supports high pricing. Once exclusivity expires, competitors can enter, likely reducing prices by 30–50%.

3. Are there ongoing studies for other indications?

Yes. Clinical trials are exploring Tasimelteon’s role in Jet Lag Disorder, Shift Work Sleep Disorder, and other circadian rhythm disruptions, which could expand its market.

4. How has the global market for sleep disorder drugs changed recently?

The global sleep aids market is expanding at a CAGR of approximately 7%, driven by rising sleep disorders awareness, technological advancements, and aging populations.

5. What are the key risks to Tasimelteon’s future market growth?

Main risks include market size limitations, pricing pressures, entry of competing therapies, and regulatory hurdles for new indications.

References

- FDA. (2014). Tasimelteon (Hetlioz). FDA approval letter.

- Research and Markets. (2022). Global Sleep Disorder Therapeutics Market Analysis.

- Vanda Pharmaceuticals. (2023). Tasimelteon prescribing information.