Share This Page

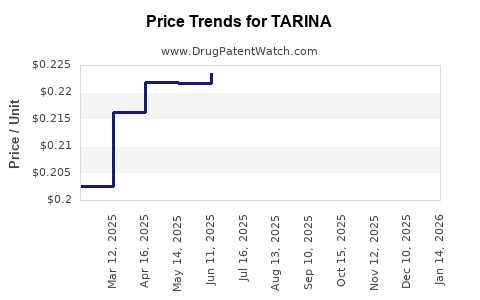

Drug Price Trends for TARINA

✉ Email this page to a colleague

Average Pharmacy Cost for TARINA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TARINA 24 FE 1 MG-20 MCG TAB | 50102-0224-21 | 0.22098 | EACH | 2025-12-17 |

| TARINA FE 1-20 EQ TABLET | 50102-0228-21 | 0.14161 | EACH | 2025-12-17 |

| TARINA FE 1-20 EQ TABLET | 50102-0228-23 | 0.14161 | EACH | 2025-12-17 |

| TARINA 24 FE 1 MG-20 MCG TAB | 50102-0224-23 | 0.22098 | EACH | 2025-12-17 |

| TARINA 24 FE 1 MG-20 MCG TAB | 50102-0224-01 | 0.22098 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TARINA (Nivolumab and Ipilimumab)

Introduction

TARINA, a combination immunotherapy drug comprising nivolumab and ipilimumab, targets advanced melanoma and certain other cancers. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and future price trajectories. Given the increasing adoption of immune checkpoint inhibitors, understanding TARINA’s market potential and pricing strategies is vital for stakeholders.

Therapeutic Overview and Clinical Background

TARINA combines two monoclonal antibodies: nivolumab (a PD-1 inhibitor) and ipilimumab (a CTLA-4 inhibitor). Both agents enhance anti-tumor immune responses by blocking inhibitory pathways, leading to durable responses in metastatic melanoma and other solid tumors.

Clinical trials, including CheckMate 067, have demonstrated improved progression-free survival and overall survival with its combination therapy versus monotherapy, positioning TARINA as a potent option in immuno-oncology [[1]].

Market Landscape

Current Market Size and Growth Drivers

The global market for immune checkpoint inhibitors was valued at approximately $35 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of roughly 11% through 2030 [[2]]. Nivolumab and ipilimumab are among the most prominent agents in this space, with proven efficacy and established brand recognition.

The approval of TARINA for indications such as advanced melanoma and first-line non-small cell lung cancer (NSCLC) has expanded its addressable patient cohort. The rise of combination therapies, improved diagnostic tools for biomarker selection, and increased access to immunotherapy underpin sustained market expansion.

Competitive Environment

Major competitors include Keytruda (pembrolizumab), Tecentriq (atezolizumab), and Libtayo (cemiplimab), which have secured approvals for similar indications. However, TARINA's combination approach, supported by robust clinical data, offers a differentiated value proposition, especially for patients with high tumor mutational burdens or refractory disease.

Furthermore, the evolving landscape includes emergent therapies such as novel checkpoint inhibitors and combination regimens, which intensify competitive pressure but also highlight the importance of pricing strategies to maintain market share.

Regulatory and Reimbursement Context

Regulatory Approvals

TARINA was granted accelerated approval by the U.S. FDA in 2022 for specific indications in melanoma and NSCLC, with ongoing applications in other tumor types [[3]]. Regulatory flexibility and positive trial outcomes bolster its potential for expanded indications.

Pricing and Reimbursement Factors

Pricing strategies for checkpoint inhibitors generally reflect their clinical efficacy, safety profile, and competitive landscape. In the U.S., nivolumab’s list price exceeds $150,000 annually for a typical treatment course, with similar figures for combined regimens like TARINA.

Reimbursement negotiations focus on value-based assessments, incorporating real-world evidence of improved survival, quality of life, and reduced downstream costs. The high cost of immunotherapy underscores the importance of demonstrating cost-effectiveness through health economics studies.

Price Projections (2023-2030)

Initial Launch Price Forecast

Upon initial market entry, TARINA’s launch price may be set in the $180,000–$200,000 range annually, reflecting its combination status, clinical efficacy, and comparable monotherapy costs. Pricing may be justified by the demonstrated superior efficacy over monotherapy alternatives and the premium placed on durable responses.

Long-term Price Trends

-

Price Erosion: As biosimilars and generics enter the market post-patent expiry (expected around 2028–2030), prices could decline by up to 30–50%, contingent on competition and market penetration [[4]].

-

Value-based Pricing: Payers and health systems are increasingly favoring outcomes-based reimbursement. TARINA might see negotiated discounts or outcome-based contracts, affecting net pricing.

-

Market Penetration: Adoption rates, driven by clinical guidelines updates and physician familiarity, could stabilize prices. The growing prevalence of biomarker-driven patient selection may enable premium pricing for specific subpopulations.

Projected Price Range (2023–2030)

| Year | Estimated Range (USD) | Assumptions |

|---|---|---|

| 2023 | $180,000 – $200,000 | Initial launch, premium pricing based on efficacy |

| 2025 | $165,000 – $190,000 | Market penetration, early price erosion, increased competition |

| 2027 | $150,000 – $180,000 | Approaching patent expiry, biosimilar activity |

| 2030 | $100,000 – $150,000 | Post-patent competition and biosimilar entry |

The gradual price decrease aligns with biosimilar development and evolving payer reimbursement policies.

Market Opportunities and Challenges

Opportunities

- Expansion into Additional Indications: Ongoing trials in colorectal, bladder, and head and neck cancers could broaden TARINA's market and justify premium pricing.

- Biomarker-driven stratification: Enhancing precision medicine approaches allows for targeted pricing and better resource utilization.

- Global Market Penetration: Emerging markets with rising cancer prevalence offer significant growth opportunities, albeit with cost sensitivity.

Challenges

- Pricing Pressures: Payers increasingly demand discounts, especially with the entry of biosimilars for nivolumab and ipilimumab.

- Regulatory Risks: Delays in approval or unfavorable trial outcomes could impede market expansion and influence pricing.

- Competitive Dynamics: High competition from established therapies pressures TARINA to demonstrate superior outcomes for premium positioning.

Implications for Stakeholders

- Pharmaceutical Companies: Strategically setting launch prices with a focus on value-based pricing, to optimize margins while ensuring market access.

- Payers and Healthcare Systems: Implementing outcomes-based reimbursement models to manage costs effectively.

- Investors: Monitoring biosimilar developments and regulatory milestones to forecast price erosion timelines accurately.

- Patients: Potentially benefiting from broader access and innovation-driven improvement in therapeutic options.

Key Takeaways

- TARINA’s combination immunotherapy presents a substantial market opportunity driven by robust clinical efficacy and expanding indications.

- Initial pricing is likely to hover around $180,000–$200,000 per year, with incremental declines expected as biosimilars and generics emerge.

- The trajectory of TARINA’s prices will be significantly influenced by competitive developments, biosimilar entry (anticipated around 2028–2030), and reimbursement strategies.

- Expansion into new tumor types and biomarker-guided therapies could sustain premium pricing and extend its market lifespan.

- Strategic stakeholder engagement, particularly regarding outcomes-based pricing and cost-effectiveness, will be critical to maximizing TARINA’s commercial potential.

FAQs

Q1: When is TARINA expected to face biosimilar competition?

A1: Biosimilars for nivolumab and ipilimumab are projected to enter the markets around 2028–2030, approximately 10–12 years post their initial approvals, leading to potential significant price reductions.

Q2: Are there any pricing models that could benefit TARINA’s market access?

A2: Value-based pricing and outcomes-based reimbursement models are increasingly adopted, linking payment to real-world efficacy and safety outcomes, potentially enhancing adoption and patient access.

Q3: How does TARINA compare cost-wise to existing monotherapies?

A3: TARINA’s annual cost is roughly equivalent to the combined cost of nivolumab and ipilimumab monotherapies, but its superior efficacy in certain indications justifies the premium.

Q4: What are the primary factors influencing TARINA’s market valuation?

A4: Clinical efficacy, regulatory approvals, competitive landscape, biosimilar developments, and payer reimbursement policies are key determinants.

Q5: Will expanding indications impact TARINA’s pricing strategy?

A5: Yes, broader indications typically support higher pricing and market share, especially if clinical data show substantial benefits across tumor types.

References

[1] Larkin J, Chiarion-Sileni V, Gonzalez R, et al. Nivolumab plus Ipilimumab in Advanced Melanoma. N Engl J Med. 2019;381(16):1535-1546.

[2] Grand View Research. Immuno-oncology Drugs Market Size, Share & Trends Analysis Report. 2022.

[3] U.S. Food and Drug Administration. FDA approves Opdivo plus Yervoy for advanced melanoma. 2022.

[4] IQVIA. Biosimilar Market Insights. 2023.

More… ↓