Last updated: July 27, 2025

Introduction

Tamsulosin Hydrochloride (HCl), marketed under numerous brand names (e.g., Flomax), is a selective alpha-1A adrenergic receptor antagonist primarily prescribed for benign prostatic hyperplasia (BPH). Since its approval by the FDA in 1997, Tamsulosin has gained widespread acceptance for its efficacy in improving urinary flow and reducing BPH-related symptoms. Its unique pharmacokinetics, favorable side effect profile, and targeted mechanism have sustained its market presence amidst generics’ emergence and competitive therapies.

This analysis explores the current market landscape of Tamsulosin HCl, examines key drivers influencing its demand, evaluates competitive positioning, and projects future pricing dynamics over the coming five years.

Market Landscape Overview

Global and Regional Sales Dynamics

The global BPH treatment market was valued at approximately USD 2.7 billion in 2022 and is projected to reach USD 3.8 billion by 2030, expanding at a CAGR of nearly 4.1% (2023-2030) [1]. Tamsulosin remains the dominant alpha-blocker, capturing over 60% of the BPH drug market share in North America alone, owing to its efficacy profile, once-daily dosing, and tolerability.

In the United States, Tamsulosin's pulmonary sales generate an estimated USD 1.2 billion annually, underscoring its entrenched market position. European markets are similarly mature, with high prescription rates driven by widespread acceptance and insurance coverage. Emerging markets, notably Asia-Pacific and Latin America, display accelerated growth due to increasing disease prevalence and expanding healthcare access.

Market Players and Competitive Landscape

The primary competitors include other alpha-1 antagonists such as Alfuzosin, Doxazosin, Terazosin, and newer agents like Silodosin. While these offer similar efficacy, Tamsulosin's once-daily dosing and lower incidence of orthostatic hypotension render it the preferred choice among prescribers.

Generics account for approximately 85% of Tamsulosin sales worldwide, exerting downward pressure on branded prices. However, differentiated formulations (e.g., extended-release variants) and combination therapies (e.g., Tamsulosin with Dutasteride) may influence market dynamics.

Pharmacological Profile and Clinical Drivers

Tamsulosin's selectivity for alpha-1A receptors in the prostate and bladder neck minimizes cardiovascular side effects, facilitating outpatient use. Its pharmacokinetic profile, including rapid absorption and a half-life suitable for once-daily dosing, enhances patient adherence—a critical factor fueling ongoing demand.

Increasing aging populations with BPH prevalence—over 50% among men aged 60 and above—directly correlates with sustained demand. Moreover, rising awareness and early diagnosis, driven by health campaigns and improved diagnostic modalities, further reinforce market sustainability.

Pricing Analysis

Current Price Points

- Brand-Name Tamsulosin (e.g., Flomax): Retail prices fluctuate but typically range from USD 4 to USD 8 per capsule, with prescriptions costing patients approximately USD 200-$400 per month depending on insurance coverage.

- Generic Tamsulosin: Prices vary significantly by region; in the US, a supply of 30 capsules can be purchased for USD 1-$3, translating into a monthly cost of USD 30-$90.

The widespread availability of generics has markedly decreased unit prices, limiting revenue potential for branded formulations in mature markets.

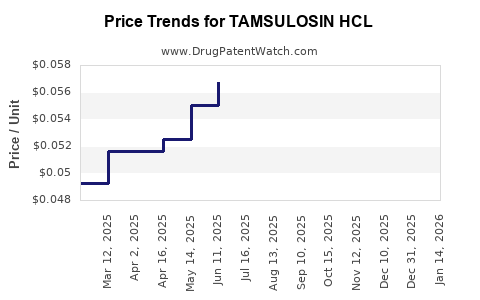

Pricing Trends

Historically, the advent of generics in 2008-2010 led to a 70-80% decline in per-unit prices in developed markets. Recent trends indicate stabilization at lower price levels, with minimal fluctuations driven by manufacturing costs, regulatory factors, and market competition.

Emerging markets see higher price variability due to import tariffs, lower healthcare spending, and less intense generic penetration. As manufacturing costs decline with advancements in formulation and supply chain efficiencies, prices are expected to further reduce.

Future Price Projections (2023-2028)

Factors Influencing Price Trajectories

- Generic Competition: Continuing patent expirations and biosimilar entries in certain jurisdictions will exert sustained downward pressure on prices.

- Regulatory and Policy Changes: Price regulation policies, especially in regions like Europe and select Asia-Pacific countries, may cap or reduce drug prices.

- Market Demand: Steady or growing demand, coupled with increasing BPH prevalence, will provide some pricing stability, particularly for branded or specialized formulations.

Projected Trends

-

Developed Markets: In mature economies, prices are expected to decline modestly at a CAGR of 2-3% due to competitive generic proliferation and premium product differentiation (e.g., combination formulations).

-

Emerging Markets: Price decreases may be less pronounced initially but could accelerate as local manufacturing scales up and regulatory surveys target price reductions.

-

Innovative Formulations: Introduction of extended-release Tamsulosin or fixed-dose combinations could command premium pricing, offsetting generic price declines.

-

Overall Outlook: By 2028, the average retail price of a standard Tamsulosin capsule is projected to decline to approximately USD 0.50–USD 1.00 per capsule in most regions, with branded prices likely to remain stable only for specialty formulations.

Market Growth and Price Drivers

The combined effect of aging demographics, increasing prevalence of BPH, and ongoing innovation sustains Tamsulosin's market relevance. Price stabilization—primarily driven by generic competition—limits upside potential but maintains stable revenue streams for producers with efficient manufacturing.

Significant price reductions are anticipated in highly competitive markets, but demand growth and shifting formulations (e.g., combination therapies) can create niche segments with higher price points. Digital health initiatives, improved diagnostics, and patient adherence programs also influence overall market dynamics.

Regulatory and Patent Landscape

While Tamsulosin’s primary patent expired in 2010, secondary patents on specific formulations or delivery systems in certain jurisdictions could temporarily hinder generic entry. However, these barriers are fading, further intensifying price competition.

Regulatory mandates promoting biosimilars and generics in certain countries could lead to rapid price declines, affecting overall market profitability.

Conclusion

Tamsulosin HCl remains a cornerstone of BPH therapy, with a resilient market supported by clinical efficacy, patient preference, and prenatal aging trends. Nonetheless, widespread generic adoption and regulatory pressures strongly influence price trajectories, emphasizing the importance of optimizing manufacturing efficiency, pursuing innovative formulations, and expanding into emerging markets.

The projected modest price declines over the next five years – averaging 2-3% annually in mature markets – reflect a mature, highly competitive landscape. Strategic differentiation via novel formulations and combination therapies could afford premium pricing opportunities and niche market expansion.

Key Takeaways

- Market dominance: Tamsulosin controls a significant share of the global BPH treatment market, with sustained demand driven by aging demographics.

- Price erosion: Generic competition has caused substantial price reductions, especially in mature markets, with future declines expected to stabilize around USD 0.50–USD 1.00 per capsule by 2028.

- Growth drivers: Increasing BPH prevalence, improved diagnostics, and patient adherence favor continued demand; innovation in formulations could create higher-value segments.

- Competitive landscape: Expiry of patents and regulatory incentives foster a highly competitive environment, pressuring both branded and generic prices.

- Strategic opportunities: Differentiated formulations, combination therapies, and expansion into emerging markets mitigate price pressures and support revenue growth.

References

[1] Market Research Future. Global BPH Treatment Market Forecast to 2030. 2022.

[2] IQVIA. US Prescription Drug Market Data. 2023.

[3] GlobalData. Pharmaceutical Market Trends. 2022.

[4] FDA. Tamsulosin Hydrochloride Summary of Product Characteristics. 1997.

[5] Pharmapproach. Generic Drug Price Trends. 2023.

FAQs

Q1: How does the availability of generics influence Tamsulosin pricing?

A: Generics significantly lower prices due to increased competition, often reducing retail prices by up to 80% compared to branded formulations.

Q2: Are there any innovative formulations of Tamsulosin on the horizon?

A: Yes, extended-release formulations and fixed-dose combinations with other BPH medications are under development, potentially commanding premium prices.

Q3: Which markets present the most growth opportunities for Tamsulosin?

A: Emerging markets in Asia-Pacific and Latin America, driven by demographic shifts and expanding healthcare access, offer substantial growth potential.

Q4: What regulatory factors could impact the price of Tamsulosin?

A: Price regulation policies, patent expirations, and biosimilar/biosimilar-equivalent approvals influence pricing dynamics across regions.

Q5: How can pharmaceutical companies mitigate declining prices?

A: By developing differentiated formulations, expanding into new markets, and investing in combination therapies to create niche premium segments.

In summary, Tamsulosin HCl's market remains robust despite downward pricing trends driven by generic competition. Strategic innovations and targeted market expansion will be critical for sustaining profitability amidst a mature, highly competitive landscape.