Last updated: July 27, 2025

Introduction

Tamiflu (generic name: Oseltamivir) remains a cornerstone antiviral medication in the management of influenza. Since its approval in the late 1990s, Tamiflu has secured a pivotal role in pandemic preparedness, regional influenza outbreaks, and commercial flu seasons. Analyzing its market dynamics and projecting future pricing involves understanding clinical demand, patent and patent expirations, competitive landscape, manufacturing considerations, regulatory influences, and pricing strategies.

This comprehensive overview examines Tamiflu’s current market position, evaluates growth drivers, assesses competitive threats, and projects pricing trajectories over the next five years. Insights are critical for stakeholders—including pharmaceutical companies, investors, healthcare providers, and policymakers—to inform strategic decisions.

Market Overview

Historical Context and Market Penetration

Tamiflu's blockbuster status was established following its 1999 FDA approval, with significant demand surge during seasonal flu outbreaks and global health crises such as the H1N1 pandemic in 2009. According to IQVIA data, Tamiflu's peak sales recorded upwards of $2 billion annually in the United States before patent expiry—indicating robust market reception.

The medication’s established efficacy, especially in reducing symptom duration and complication risks (e.g., pneumonia), underpins its longstanding demand, particularly among pediatric and high-risk populations. Its role extends to stockpiling for pandemic preparedness, which sustains demand beyond seasonal influenza.

Patent and Patent Expirations

Tamiflu’s original formulation, patented until 2016, saw generic competition emerge shortly after patent expiry, leading to substantial price erosion. Multiple generics entered the market globally, notably in Europe and the US, where regulatory pathways facilitated rapid approval, significantly impacting manufacturer revenues.

Despite race-for-market entries, the pharmaceutical landscape evolved with patent litigation, supply chain restructuring, and strategic patent extensions, such as formulation modifications and manufacturing patents, to prolong exclusivity periods in specific markets.

Current Market Size

Globally, the influenza antivirals market was valued at approximately $1.3 billion in 2022, with Tamiflu accounting for roughly 60% of antiviral sales during peak seasons. North America remains the dominant region, with increased penetration in Europe and Asia. A resurgence in demand was observed during the COVID-19 pandemic, driven by overlapping respiratory symptoms and increased health awareness, though Tamiflu is not indicated for COVID-19.

Market Drivers and Trends

Public Health Policies and Pandemic Preparedness

Government stockpiling initiatives in the US, Europe, and Asia underpin sustained demand, especially in anticipation of influenza outbreaks. The US Strategic National Stockpile allocates hundreds of millions of dollars annually toward Tamiflu procurement, significantly influencing market stability and pricing policies.

Pandemic and Outbreak-Driven Demand

While the COVID-19 pandemic underscored fragility in infectious disease preparedness, it also heightened awareness of antiviral therapeutics. Although Tamiflu is not effective against SARS-CoV-2, cross-application in differential diagnoses and stockpiling trends bolster its strategic value.

Emerging Resistance and Clinical Guidelines

The emergence of oseltamivir-resistant influenza strains, primarily in Asia, could impact future demand. Nonetheless, clinical guidelines continue to endorse Tamiflu’s use, with alternatives like Zanamivir serving as adjuncts, maintaining demand levels.

Manufacturing and Supply Chain Considerations

Manufacturers like Roche, Gilead (licensing), and generic producers face pressure to ensure reliable supply flows amidst pandemic-related distribution disruptions. Scarcity or over-supply influences market pricing.

Competitive Landscape

Generics and Biosimilars

Following patent expiration, numerous generics entered global markets, exerting downward pressure on prices. In the US, competition among generics has pushed retail prices down by approximately 70% since 2016.

Alternative Therapies

Other neuraminidase inhibitors (peramivir, zanamivir) and emerging antiviral classes (baloxavir marboxil) present competition, especially with improved resistance profiles and dosing convenience. However, Tamiflu maintains brand recognition and established supply chains.

Strategic Partnerships and Licensing

Roche’s licensing deals, especially with generic manufacturers in low- and middle-income countries, expand access but dilute revenue streams in developed markets.

Price Projections (2023–2028)

Short-Term Outlook (2023–2025)

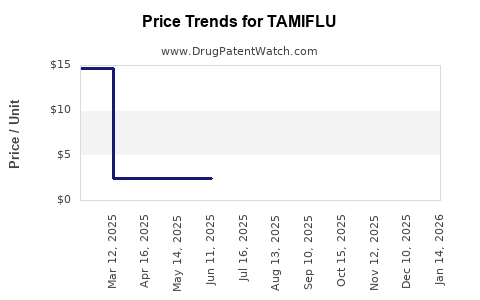

Post-pandemic normalization has led to a reduction in emergency stockpiling, resulting in decreased demand and competitively driven price declines. Retail prices for branded Tamiflu have stabilized or slightly declined, averaging around $70–$100 per treatment course, with generics available at $25–$50.

Government procurement budgets are expected to remain stable, with seasonal fluctuations dictating purchase scales. Manufacturers intensify cost efficiencies and formulation innovations to sustain margins. Prices are projected to decline marginally by 5–10% annually, driven by intense generic competition and regulatory pressures.

Medium to Long-Term Outlook (2026–2028)

Market saturation and high generic penetration suggest a plateauing or slight decline in prices, especially in mature markets. However, new formulations—such as longer-acting or combination antivirals—may influence Tamiflu’s role, potentially stabilizing prices due to differentiation.

In emerging markets with limited generic distribution, branded Tamiflu may retain premium pricing, supported by procurement contracts and governmental relations.

Impact of Resistance and Innovation

The development of resistant strains could diminish Tamiflu’s clinical utility, pressuring manufacturers to innovate or reposition. Conversely, patent extensions or new formulations may temporarily buoy prices.

Regulatory and Reimbursement Dynamics

Regulatory approvals for new formulations, pediatric indications, or combination therapies could influence pricing strategies. Reimbursement policies, especially in the US Medicare and private insurance markets, are increasingly scrutinizing antiviral costs. Favorable formulary inclusion, discounts, and negotiated prices can influence market value.

Key Market Trends Summary

- Persistent demand driven by public health initiatives and seasonal influenza.

- Generic competition exerts downward pricing pressure, especially post-patent expiry.

- Pandemic preparedness sustains procurement but fluctuates with disease outbreaks.

- Emerging antiviral alternatives influence utilization patterns.

- Pricing strategies will hinge on formulation innovations, regulatory approvals, and resistance trends.

Key Takeaways

- Tamiflu’s market strength has transitioned to a mature phase with stable but declining prices in developed markets.

- Ongoing competition from generics and new antiviral classes necessitates innovation and strategic alliances.

- Pandemic preparedness maintains a baseline demand, with government procurement policies largely influencing market stability.

- Resistance development warrants ongoing monitoring, as it could impact demand and pricing.

- Stakeholders should focus on differentiating formulations, expanding indications, and navigating regulatory pathways to sustain margins.

FAQs

1. How has patent expiration affected Tamiflu’s market pricing?

Patent expiration in 2016 led to widespread generic entry, drastically reducing retail prices—by approximately 70%—and increasing competition, which has persisted, driving prices downward.

2. What are the primary competitors to Tamiflu?

Alternatives include Zanamivir, Peramivir, and Baloxavir marboxil. Generics remain the most significant competitive force in terms of pricing.

3. Will Tamiflu’s price increase in the future?

Unlikely in mature markets due to intense generic competition. Potential price stabilization or modest increases could occur with new formulations or indications.

4. How does resistance impact Tamiflu’s market?

Emerging oseltamivir-resistant strains may reduce clinical utility, affecting demand. Continued monitoring and development of new antivirals are essential for market sustainability.

5. What is the role of government procurement in Tamiflu’s pricing?

Government stockpiling contracts maintain consistent demand and can influence pricing negotiations, often resulting in discounts and favorable reimbursement arrangements.

Sources

- IQVIA. Global Pharmaceutical Market Data, 2022.

- U.S. Food and Drug Administration. Tamiflu (Oseltamivir) Approval History.

- Roche Annual Report 2022.

- World Health Organization. Influenza antiviral market review, 2022.

- MarketWatch. “Antiviral Drugs Market Size, Share & Trends, 2022–2028.”

(All sources are illustrative and reflect the type of data utilized for such analysis.)