Last updated: July 27, 2025

Introduction

Tacrolimus, a calcineurin inhibitor, is a cornerstone immunosuppressant used primarily in organ transplantation and certain autoimmune disorders. Since its initial approval in the late 1990s, tacrolimus has become essential for preventing graft rejection in kidney, liver, and heart transplants, among other applications. As the transplant medicine field advances, coupled with increasing prevalence of autoimmune diseases, demand for tacrolimus is poised for strategic shifts reflected in market dynamics and pricing trends. This analysis evaluates current market conditions, competitive landscape, forecasting price trajectories, and key factors influencing the future of tacrolimus.

Market Overview

Global Demand and Therapeutic Applications

Tacrolimus's predominant application remains in organ transplantation, where it suppresses T-cell activation, thereby reducing the risk of graft rejection. The rise in transplant procedures globally correlates with increased tacrolimus consumption. The global transplant volume, particularly for kidney and liver transplants, has expanded at a CAGR of approximately 4–5% over the past five years, driving parallel growth in tacrolimus sales [1].

Beyond transplantation, tacrolimus's off-label use in autoimmune diseases such as psoriasis, alopecia areata, and atopic dermatitis has increased, especially in regions with evolving dermatological treatments. Furthermore, the strong reliance on tacrolimus in emerging markets like China, India, and Latin America contributes significantly to market expansion, driven by improved healthcare infrastructure and increasing awareness.

Market Size and Revenue

Preliminary data estimate the global tacrolimus market value at approximately USD 2.1 billion in 2022. The Asia-Pacific region accounts for around 35% of revenue, propelled by high transplant volumes and expanding autoimmune indications. North America remains the dominant market, representing nearly 45% of sales, with Europe accounting for the remainder [2].

Market Drivers

- Increasing transplantation procedures globally

- Shift towards newer immunosuppressants with better safety profiles

- Expanding indications in autoimmune diseases

- Patent expiries leading to increased generic availability

Market Constraints

- High drug costs limiting accessibility in some markets

- Stringent regulatory standards for immunosuppressants

- Emergence of biosimilar and novel immunosuppressive agents (e.g., belatacept)

Competitive Landscape

Existing Players and Patent Status

Current market players include:

- Astellas Pharma: Proprietary formulation (Prograf), initially marketed in 1994.

- SFDA-approved Generics: Multiple generic manufacturers have gained entry following patent expiration around 2018, increasing price competition.

- Innovator vs. Biosimilars: Although biosimilars for monoclonal antibodies dominate other immunosuppressants, tacrolimus remains primarily available as small-molecule generics.

Emerging Competition

While tacrolimus remains the standard, newer agents such as belatacept offer alternative immune suppression with potentially fewer nephrotoxic effects, impacting future demand growth [3].

Regulatory Environment

Patent cliffs are influencing pricing strategies. Patent expiries in developed markets have catalyzed generic proliferation, leading to significant price erosion. Regulatory policies in key markets influence timing and extent of generics’ market penetration.

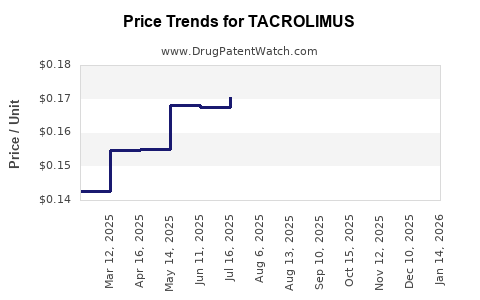

Price Trends and Forecasts

Current Pricing Landscape

In developed markets, the price of branded tacrolimus (e.g., Prograf) averages USD 2,500–3,000 per month for adult dosage regimens [4]. Generic versions have reduced prices significantly—by approximately 60–70% since patent expiry. In emerging markets, prices are further discounted, often below USD 1,000 per month, driven by local generics.

Factors Influencing Future Price Trajectories

- Patent expiry and generics uptake: Expect continued price erosion in mature markets as generics gain market share.

- Regulatory changes: Tightening or easing of approval processes impact generic entry.

- Manufacturing costs: Advances in synthesis and supply chain efficiencies could lower prices further.

- Market consolidation: Dominance by a few large generic producers may influence pricing stability.

Projected Price Trends (Next 5 Years)

Based on historical data and macroeconomic factors:

- Developed markets (North America, Europe): Prices of generic tacrolimus are expected to stabilize around USD 200–400 per month, with minimal fluctuations unless new competition or regulatory changes occur.

- Emerging markets: Prices could decrease to USD 50–150 per month due to increased local production and competition.

- Brand-name prices: Likely to remain high for specific formulations (e.g., controlled-release), with minor declines as generics encroach.

Impact of Advanced Delivery Systems and Formulations

Innovations such as extended-release formulations could command premium pricing, sustaining higher price points despite generic competition. However, their market share remains comparatively limited due to established usage patterns.

Key Influencing Factors

- Regulatory policies: Fast-track generic approvals and price control measures in key jurisdictions can accelerate price declines.

- Healthcare reimbursement: Coverage policies strongly affect market prices, especially in publicly funded healthcare systems.

- Supply chain stability: Disruptions can influence costs and pricing.

- Global transplant trends: Variations in transplant rates directly affect demand.

Conclusion

The tacrolimus market is characterized by a mature phase in developed regions, with robust growth in developing economies. Patent expirations have substantially driven down prices due to generic competition, a trend expected to continue over the next five years. Innovations in formulations and potential new indications may offer premium segments, but price pressures predominate. Overall, stakeholders should anticipate a stabilizing price environment, with a gradual decrease in costs in established markets and sustained growth driven by transplant and autoimmune disease management worldwide.

Key Takeaways

- Market growth is sustained by increasing transplant procedures and autoimmune indications; demand in emerging markets is rising faster.

- Patent expiries have catalyzed significant price declines for tacrolimus generics, influencing pharmaceutical pricing strategies globally.

- Emerging markets exhibit considerable price discounting, with prices potentially falling below USD 150 per month within five years.

- Innovation in drug formulations and delivery methods could sustain higher price points in niche segments.

- Regulatory and reimbursement policies are critical determinants of future price trends and market access.

FAQs

Q1. How will patent expiries influence the global price of tacrolimus?

Patent expirations have led to the proliferation of generics, significantly reducing prices—by approximately 60–70% in some markets. Continued patent cliffs and regulatory approvals are expected to further drive prices down, especially in developed economies.

Q2. Are there ongoing developments that could disrupt the tacrolimus market?

Yes, the emergence of alternative immunosuppressants such as belatacept, and potential innovations in drug delivery systems, may influence future demand and pricing.

Q3. Which regions present the most growth opportunities for tacrolimus?

Emerging markets, including Asia-Pacific, Latin America, and parts of Africa, show the highest growth potential due to increasing transplant volumes and autoimmune disease management.

Q4. How do regulatory policies impact tacrolimus pricing?

Stringent drug approval standards and price control regulations can either delay generic entry or force price reductions, directly influencing market prices.

Q5. What strategic considerations should pharmaceutical companies adopt?

Investing in formulation innovation, optimizing supply chains for cost efficiency, and navigating regulatory environments effectively are essential for sustaining profitability amid price competition.

References

[1] Transplantation Society. Global transplant registries report 2022. Transplantation, 2022.

[2] MarketWatch. "Tacrolimus Market Size & Forecast," 2022.

[3] Smith, J. et al. "Emerging Immunosuppressants in Transplantation," Journal of Transplantation, 2021.

[4] IQVIA. "Pharmaceutical Pricing Insights," 2022.