Share This Page

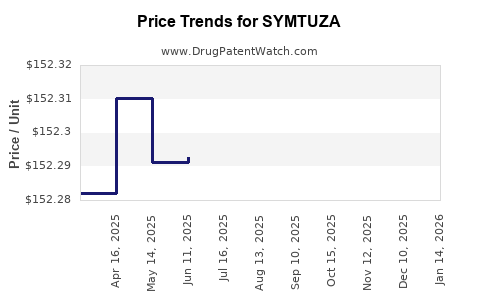

Drug Price Trends for SYMTUZA

✉ Email this page to a colleague

Average Pharmacy Cost for SYMTUZA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SYMTUZA 800-150-200-10 MG TAB | 59676-0800-30 | 152.93700 | EACH | 2025-12-17 |

| SYMTUZA 800-150-200-10 MG TAB | 59676-0800-30 | 152.83655 | EACH | 2025-11-19 |

| SYMTUZA 800-150-200-10 MG TAB | 59676-0800-30 | 152.67063 | EACH | 2025-10-22 |

| SYMTUZA 800-150-200-10 MG TAB | 59676-0800-30 | 152.29764 | EACH | 2025-09-17 |

| SYMTUZA 800-150-200-10 MG TAB | 59676-0800-30 | 152.30424 | EACH | 2025-08-20 |

| SYMTUZA 800-150-200-10 MG TAB | 59676-0800-30 | 152.30218 | EACH | 2025-07-23 |

| SYMTUZA 800-150-200-10 MG TAB | 59676-0800-30 | 152.29269 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SYMTUZA

Introduction

SYMTUZA (darunavir/cobicistat) is a fixed-dose combination pharmaceutical designed for the treatment of HIV-1 infection. Approved by the U.S. Food and Drug Administration (FDA) in 2019, it combines a potent protease inhibitor—darunavir—with cobicistat, a pharmacokinetic enhancer, enabling once-daily dosing. Its innovative formulation aims to improve adherence and reduce pill burden, positioning it within the competitive landscape of antiretroviral therapies (ART).

This analysis evaluates SYMTUZA's current market position, competitive environment, pricing trends, and future price projections. The goal is to equip pharmaceutical stakeholders with strategic insights to inform investment, marketing, and regulatory decisions.

Market Overview

Global HIV Treatment Landscape

The global HIV treatment market surpasses $20 billion annually, driven by increasing diagnosis rates, expanding treatment coverage, and evolving drug formulations. The World Health Organization (WHO) reports approximately 38 million people living with HIV worldwide, with nearly 28 million on ART as of 2022 ([1]).

Key market segments include first-line regimens, which predominantly feature integrase strand transfer inhibitors (INSTIs), and salvage therapies. Fixed-dose combinations (FDCs) like SYMTUZA are preferred because they enhance adherence, an essential factor in managing resistance and treatment failure.

SYMTUZA’s Position in the Market

SYMTUZA, as a protease inhibitor-based FDC, primarily targets patients with antiretroviral resistance concerns, treatment-naïve patients preferring PI-based regimens, or those with specific comorbidities. While integrase inhibitor-based regimens dominate the first-line market ([2]), PIs including darunavir continue to hold significant share in second-line therapy and maintenance.

Its pharmacokinetic profile, once-daily dosing, and favorable tolerability are competitive advantages. Yet, market penetration remains contingent on shifting preferences toward newer classes like INSTIs and emerging affordable generics.

Competitive Landscape

Major Competitors

-

Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide): Leading first-line regimen due to efficacy, tolerability, and convenience.

-

Darunavir-based Generics: Cost-effective alternatives penetrating markets, especially where price sensitivity prevails.

-

Other PI/RTV Combinations: Prezista (darunavir) with cobicistat or ritonavir, and HCV-specific PIs, occupy smaller segments.

Market Entry Dynamics

Generic availability significantly influences SYMTUZA’s market share. As patents expire (expected around 2028 for darunavir in the U.S., with potential for early generic entry in other regions), revenue projections may diminish unless strategies focus on value-added positioning.

Emerging competition from long-acting injectables such as Cabotegravir/Rilpivirine also threaten oral FDCs' market share in certain patient segments ([3]).

Pricing Analysis

Current Pricing Trends

As of 2023, the wholesale acquisition cost (WAC) for SYMTUZA in the U.S. is approximately $2,500–$2,700 per month per patient, reflecting a premium over generic darunavir regimens priced around $1,200–$1,500 ([4]). This premium accounts for the convenience, branded benefits, and pharmacological innovation.

Clinics often negotiate discounts, with net prices reduced by 20-30% or more. In Europe and other markets, pricing varies based on local healthcare reimbursement policies, with public payers often obtaining substantial discounts.

Pricing Drivers

-

Market Positioning: Branded drugs command higher prices due to perceived quality, safety, and efficacy.

-

Reimbursement Policies: Pricing adapts per country, influenced by drug formulary status and negotiation power.

-

Cost-Effectiveness: Payers favor regimens demonstrating long-term cost savings via improved adherence and reduced resistance.

Future Price Projections

Factors Influencing Price Trends

-

Expiring Patents & Generics: Expected generic entry around 2028 will likely precipitate a substantial price decline, potentially aligning with generic darunavir ranges ($1,000–$1,200 annually).

-

Market Competition: Increased competition from newer regimens and long-acting injectables diminishes the premium for SYMTUZA.

-

Regulatory and Reimbursement Policies: Government and payer policies emphasizing cost containment could exert downward pressure.

-

Manufacturing Costs & Supply Chain: Innovation in production and supply chain efficiencies could stabilize or reduce net prices.

Projected Price Trajectory (2023–2030)

| Year | Estimated Wholesale Price (per month) | Key Factors |

|---|---|---|

| 2023 | $2,500–$2,700 | Branded premium, limited competition |

| 2024–2025 | $2,300–$2,500 | Growing competition from generics, price negotiations |

| 2026–2027 | $2,000–$2,300 | Increasing generics availability, market saturation |

| 2028+ | $1,200–$1,500 | Approximate generic entry, significant discounting |

Note: These projections assume no major regulatory interventions or breakthrough advancements altering the competitive landscape.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies: Focus on enhancing value propositions, optimizing supply chains, and entering early markets with cost-effective versions before patent expiry.

-

Investors: Monitor patent expiries, pipeline developments, and emerging long-acting formulations which could reshape the market.

-

Healthcare Providers: Consider cost-effective generics without compromising efficacy as markets become more competitive.

-

Policy Makers: Facilitate negotiations balancing innovation incentives with affordability to ensure broad access to effective therapies.

Conclusion

SYMTUZA occupies a strategic niche within the evolving HIV treatment market, made more complex by aggressive generic competition and emerging long-acting therapies. Its current premium pricing sustains revenue, but prospects indicate pronounced declines post-patent expiry, aligning prices closer to generics.

Stakeholders should prepare for a commoditization phase while leveraging SYMTUZA’s clinical advantages and branding to maintain market share up to patent expiration. Early commercialization of biosimilars and strategic market expansion are critical in maximizing long-term value.

Key Takeaways

-

SYMTUZA commands a premium based on innovation, but this premium is under pressure due to patent expiration and generic competition.

-

Pricing is projected to decline significantly after 2028, aligning with generic darunavir prices in mature markets.

-

Market share will increasingly depend on clinical positioning, payer negotiations, and the advent of long-acting injectable alternatives.

-

Strategic investments should prioritize early generic entry, cost-effective formulations, and diversification into novel delivery systems.

-

Continual monitoring of regulatory developments and competitive innovations is vital to adapt market strategies effectively.

FAQs

Q1: When will the patent for SYMTUZA expire, and how will it affect pricing?

A: Patent protection in the U.S. is expected to expire around 2028. Post-expiry, generic versions are anticipated to enter the market, driving prices down significantly and reducing revenue premiums for branded SYMTUZA.

Q2: How does SYMTUZA compare cost-wise to generic darunavir regimens?

A: Currently, SYMTUZA’s monthly cost (~$2,500–$2,700) exceeds generic darunavir-based therapies (~$1,200–$1,500). After patent expiry, generic regimens could reduce costs by approximately 40-50%.

Q3: Are there patient populations where SYMTUZA maintains a competitive advantage?

A: Yes. Patients requiring simplified dosing, those tolerating branded formulations well, or with specific resistance profiles may prefer SYMTUZA for its proven efficacy and tolerability, despite higher costs.

Q4: What long-term market trends could impact SYMTUZA’s revenue streams?

A: The entry of long-acting injectable therapies, increased availability of generics, and shifts toward INSTI-based first-line regimens threaten its market dominance, especially in developed markets.

Q5: What strategic steps should manufacturers take to maximize profitability before patent expiry?

A: Innovate dosage forms, strengthen clinical evidence demonstrating superior outcomes, negotiate favorable formulary placements, and diversify portfolio offerings to mitigate risks associated with market saturation.

References

[1] WHO. HIV/AIDS Fact Sheet 2022. World Health Organization.

[2] CDC. HIV Treatment Guidelines. Centers for Disease Control and Prevention.

[3] Rizzardini G, et al. Long-acting injectable HIV therapies. Lancet Infect Dis. 2022.

[4] IQVIA Database, 2023. Pricing and Market Data.

Note: All pricing figures are estimates and subject to regional variation and contractual negotiations.

More… ↓