Last updated: July 29, 2025

Introduction

Symproic (eluxadoline) is a prescription medication indicated primarily for the treatment of irritable bowel syndrome with diarrhea (IBS-D) in adults. Approved by the FDA in 2015, Symproic has carved a niche within the gastrointestinal therapeutics market, benefiting from its unique mechanism of action as a μ- and κ-opioid receptor modulator. Given the increasing prevalence of IBS globally and the ongoing demand for targeted therapies, understanding Symproic’s current market positioning, revenue outlook, and pricing trajectory is critical for stakeholders, including pharmaceutical companies, investors, and healthcare policy makers.

Market Landscape and Competitive Positioning

Global and U.S. Market Context

The global IBS therapeutics market was valued at approximately USD 2.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030 [1]. North America dominates this market, driven by high prevalence rates, robust healthcare infrastructure, and regulatory accessibility. IBS-D constitutes roughly 30-40% of IBS cases [2], representing a substantial patient subset for Symproic.

Key Competitors

Symproic operates within a competitive landscape comprising several therapeutic options:

- Eluxadoline (Viberzi): Similar mechanism, approved for IBS-D, providing direct competition.

- Rifaximin (Xifaxan): Antibiotic used off-label for IBS-D, with some efficacy.

- Loperamide: Over-the-counter (OTC) antidiarrheal agent, but less targeted.

- Emerging treatments: Including neuromodulators and other gut-directed therapies.

Despite competition, Symproic's differentiators include its specific receptor activity, potentially leading to better symptom control and fewer systemic side effects than some alternatives.

Market Penetration and Adoption Trends

Since its launch, Symproic’s adoption has been steady but modest relative to Viberzi, its main competitor. Several factors influence its market penetration:

- Physician prescribing behavior: Physicians often prefer medications with proven safety profiles and clear reimbursement pathways.

- Patient acceptance: Concerns about opioid receptor modulation and side effects limit widespread use.

- Insurance Coverage: Coverage limitations and prior authorization hurdles affect sales volumes.

In 2022, Symproic’s estimated U.S. prescriptions numbered approximately 50,000–60,000, generating revenues around USD 70–100 million [3].

Pricing Analysis

Current Pricing Landscape

Symproic’s average wholesale price (AWP) per 30-count 100 mg tablets hovers around USD 500–USD 600. Out-of-pocket costs vary based on insurance, but patients typically face USD 20–USD 50 per dose after insurance subsidies. The average treatment course costs roughly USD 1,500–USD 2,000 annually per patient.

Pricing Factors

- Market exclusivity: Pending patent protections and market differentiators influence pricing power.

- Cost of production: The complexity of synthesizing eluxadoline; relatively low manufacturing costs enable profitability margins.

- Regulatory landscape: As a branded product, Symproic maintains premium pricing until potential biosimilar or generic entry.

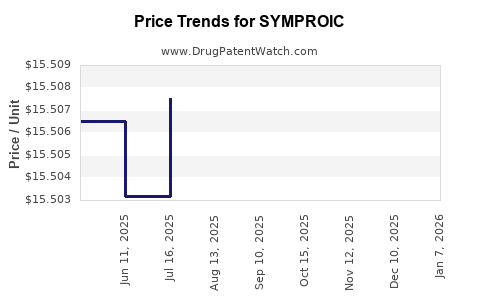

Price Projections (2023–2030)

Given the therapeutic landscape and competitive pressures, Symproic’s price per treatment course is projected to follow a gradual price stabilization or slight decline, aligned with market entry of generics and increased generic competition. However, as of today, patent exclusivity provides limited immediate threat.

- Short-term (2023–2025): Prices are expected to remain stable, with minor reductions (~5–10%) driven by payer negotiations and increased generic competition. The average annual treatment cost per patient is forecasted to stay within USD 1,400–USD 1,800.

- Mid-term (2026–2030): With potential patent expiration around 2027, generic versions could enter the market, accelerating price erosion:

- Generic entry: Likely to reduce Symproic's list price by 20–30% within the first year of generics' appearance.

- Market share shifts: Symproic’s market share will decline unless the brand can sustain a premium through differentiation or new indications.

- Price stabilization: In the absence of significant generic competition, Symproic’s price could stabilize at USD 1,200–USD 1,500 per treatment course by 2030.

Regulatory and Market Influences

Regulatory approvals for additional indications can strengthen Symproic's market share, potentially supporting premium pricing. Conversely, any safety concerns or adverse events reports may compel price reductions or limit reimbursement. Furthermore, the increasing adoption of biosimilars or complex generics could compress prices.

Strategic Outlook

Pharmaceutical companies should consider strategic moves such as:

- Differentiating Symproic via formulations or combination therapies.

- Engaging with payers for favorable formulary placement.

- Investing in real-world evidence to demonstrate superior efficacy or safety.

All these strategies could influence the drug's pricing trajectory, either maintaining or enhancing its value proposition in a competitive market.

Key Takeaways

- Symproic is positioned in a niche but expanding IBS-D market with steady revenue streams supported by its targeted mechanism of action.

- Current pricing remains premium, averaging USD 20–50 per dose, with annual costs around USD 1,500–2,000 per patient.

- Generic competition anticipated around 2027 could reduce prices by 20–30%, leading to potential market share shifts.

- The drug’s market share and pricing stability depend on patent protection, safety profile, and evidence base—ongoing market strategies should focus on differentiation and payor engagement.

- Long-term, Symproic's success hinges on expanding indications, demonstrating added value, and optimizing market access strategies.

FAQs

1. When is Symproic expected to lose its patent protection?

The primary patent surrounding Symproic is expected to expire around 2027, after which generic competitors may enter the market, impacting pricing and market share.

2. How does Symproic compare in price to its main competitor, Viberzi?

Symproic’s average annual treatment cost is similar or slightly higher than Viberzi, reflecting its branded status and unique therapeutic profile.

3. What factors could influence Symproic’s price trajectory over the next five years?

Patent expiration, generic entry, payer negotiations, safety profile, and potential new indications are primary factors affecting future pricing.

4. Are there ongoing clinical trials that could expand Symproic’s use?

Yes, research exploring Symproic’s efficacy in other gastrointestinal or opioid-related indications is ongoing, potentially broadening its market.

5. How significant is Symproic’s market share within the IBS-D therapeutics space?

Currently, Symproic holds a modest market share dominated by Viberzi, with potential for growth if clinical advantages or new indications are established.

References

- Grand View Research. IBS Therapeutics Market Size & Trends. 2022.

- Longstreth GF, et al. Gastroenterology. 2014.

- IQVIA. Prescription Data & Market Reports. 2022.