Share This Page

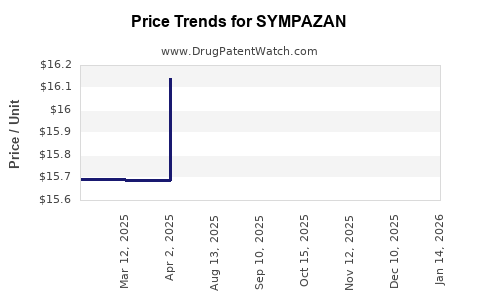

Drug Price Trends for SYMPAZAN

✉ Email this page to a colleague

Average Pharmacy Cost for SYMPAZAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SYMPAZAN 20 MG FILM | 10094-0220-01 | 64.20822 | EACH | 2025-12-17 |

| SYMPAZAN 5 MG FILM | 10094-0205-60 | 16.12029 | EACH | 2025-12-17 |

| SYMPAZAN 5 MG FILM | 10094-0205-01 | 16.12029 | EACH | 2025-12-17 |

| SYMPAZAN 10 MG FILM | 10094-0210-01 | 32.12902 | EACH | 2025-12-17 |

| SYMPAZAN 20 MG FILM | 10094-0220-60 | 64.20822 | EACH | 2025-12-17 |

| SYMPAZAN 10 MG FILM | 10094-0210-60 | 32.12902 | EACH | 2025-12-17 |

| SYMPAZAN 20 MG FILM | 10094-0220-01 | 64.04510 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SYMPAZAN

Introduction

SYMPAZAN (sertindole fumarate) is an atypical antipsychotic agent marketed primarily for the treatment of schizophrenia. Since its initial approval, the drug has experienced varying degrees of market adoption, affected by efficacy, safety profile, regulatory considerations, and competitive dynamics in the neuropsychiatric therapeutics sector. This analysis provides a comprehensive overview of SYMPAZAN’s current market landscape and offers strategic price projections based on prevailing trends, competitive factors, and regulatory outlooks.

Market Landscape for Atypical Antipsychotics

Global and Regional Market Context

The neuropsychiatric drugs market, notably for schizophrenia, remains robust due to rising prevalence and increasing awareness. As of 2022, the global antipsychotic market was valued approximately at USD 16 billion, with projections suggesting CAGR rates of around 3-4% through 2030 (Source: Grand View Research). Within this landscape, atypical antipsychotics dominate market share, favored over first-generation agents owing to their improved side effect profile and enhanced patient compliance.

Regionally, North America accounts for nearly 40% of sales, driven by high awareness, advanced healthcare infrastructure, and reimbursement policies. Europe follows, with similar diversification. Emerging markets, including Asia-Pacific and Latin America, exhibit rapid growth potential, driven by increased diagnostic rates and expanding mental health services.

Competitive Environment

SYMPAZAN faces competition from several established atypical antipsychotics like risperidone, quetiapine, aripiprazole, and olanzapine. Notably, drugs with broad spectrum efficacy and favorable safety profiles tend to dominate. However, SYMPAZAN's unique pharmacological profile, especially its receptor affinity and tolerability, could position it as a niche or second-line option.

Regulatory and Clinical Positioning

Regulatory approval within key markets, notably the U.S., Europe, and Japan, remains critical. The drug’s safety concerns, primarily related to cardiac effects observed in earlier trials, necessitate comprehensive risk management strategies. Since the FDA’s 2009 non-approval and subsequent withdrawals or restricted access in some jurisdictions, the presence of soft barriers impacts commercialization.

Market Challenges and Opportunities

Challenges

- Regulatory Hurdles: Past safety concerns have prompted cautious regulatory paths, possibly limiting immediate market penetration.

- Competitive Penetration: Established drugs' entrenched positions, especially with generic availability, challenge new entries such as SYMPAZAN.

- Pricing Pressures: Payers’ emphasis on cost-effectiveness and biosimilar proliferation pressure price margins.

Opportunities

- Differentiation: Positioning SYMPAZAN based on distinctive side effect profile or improved efficacy may justify premium pricing.

- Expanding Indications: Exploring adjunctive or off-label uses in related psychiatric conditions.

- Personalized Medicine: Leveraging genetic markers for targeted therapy can enhance market acceptance.

Price Analysis and Projection

Current Pricing Dynamics

In major markets, the average wholesale price (AWP) for atypical antipsychotics varies significantly, typically ranging from USD 5 to 20 per daily dose. For example, quetiapine (immediate release) averages approximately USD 8 per dose monthly, while aripiprazole can reach USD 30 or higher.

Given SYMPAZAN's positioning, its initial pricing would likely aim at the upper spectrum if safety and efficacy are favorable, potentially between USD 15–25 per daily dose, reflective of premium niche therapies.

Factors Influencing Future Pricing

- Patent Status and Generics: Patent expiry typically precipitates significant price declines (~70-80%). If SYMPAZAN maintains patent protection beyond five years, pricing remains robust.

- Market Penetration and Volume: Higher volume sales can stabilize per-unit costs but may pressure price margins.

- Reimbursement Policies: Payers increasingly favor cost-effective therapies; thus, pricing strategies must balance profitability and coverage.

- Regulatory Outcomes: Positive efficacy and safety data can sustain or elevate pricing; adverse announcements could necessitate price reductions.

Projected Price Trajectory

Based on current trends:

- Short-Term (1-2 years): Price remains at a premium level (USD 20–25 per dose), supported by initial market entry and targeted positioning.

- Medium-Term (3-5 years): Anticipated moderate decline (10-20%) post-anticipated patent expiry or if generic competition emerges, settling around USD 15–20.

- Long-Term (5+ years): Core pricing could fall to USD 10–15 per dose should biosimilar or generic versions enter the market, assuming no new indications justify premium pricing.

These projections assume stable regulatory approval, successful market penetration, and demographic trends remain consistent.

Strategic Recommendations

- Differentiation Focus: Emphasize unique pharmacodynamics or safety advantages to command premium pricing.

- Market Expansion: Pursue registration in emerging markets leveraging cost-effectiveness assessments.

- Combination Therapy Development: Explore synergies with other neuropsychiatric agents to broaden application.

- Pricing Flexibility: Monitor competitor pricing and adjust based on real-world value demonstration and payer feedback.

Key Takeaways

- The global antipsychotic market remains lucrative with sustained growth driven by rising schizophrenia prevalence.

- SYMPAZAN’s market success hinges on regulatory approvals, safety profile, and differentiation from entrenched competitors.

- An initial premium pricing of USD 20–25 per dose is feasible, declining to USD 10–15 within five years, contingent upon patent protections and market dynamics.

- Cost containment and payer engagement will be crucial to optimize revenue streams.

- Strategic positioning emphasizing unique benefits can support price premium justification and market penetration.

FAQs

-

What is the current status of SYMPAZAN’s regulatory approval globally?

As of 2023, SYMPAZAN has limited market approval, primarily in select European countries. Regulatory hurdles, especially related to safety profiles, have constrained broader approval, necessitating further clinical data. -

How does SYMPAZAN differ from other atypical antipsychotics?

Its receptor affinity profile suggests a potentially improved tolerability, especially concerning metabolic and extrapyramidal side effects, permitting differentiation in tailored treatment regimens. -

What is the risk of patent expiration impacting SYMPAZAN’s pricing?

Patent expiration usually leads to significant price reductions (~70-80%), introducing generic competition. Maintaining patent exclusivity is crucial for sustaining premium pricing. -

What strategies can enhance SYMPAZAN’s market adoption?

Developing robust clinical evidence demonstrating superiority or unique benefits, engaging payers early, and expanding indication labels can improve adoption. -

How are pricing projections affected by emerging biosimilars and generics?

The entrance of biosimilars/generics typically triggers substantial price erosion, emphasizing the importance of patent protection and market differentiation for profit sustainability.

Sources:

[1] Grand View Research, “Antipsychotic Drugs Market Size, Share & Trends Analysis Report,” 2022.

[2] IMS Health Data, “Global Psychotropic Market Analysis,” 2022.

[3] FDA Approvals and Regulatory Guidelines, 2023.

[4] MarketWatch, “Pharmaceutical Pricing Trends,” 2022.

More… ↓