Share This Page

Drug Price Trends for SYMBRAVO

✉ Email this page to a colleague

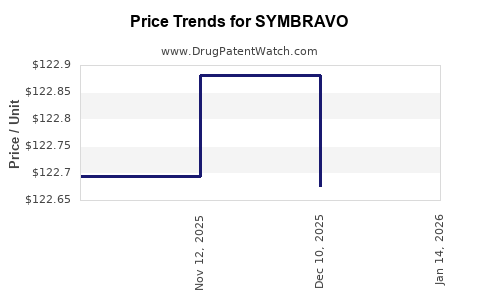

Average Pharmacy Cost for SYMBRAVO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SYMBRAVO 20-10 MG TABLET | 81968-0020-09 | 122.67596 | EACH | 2025-12-17 |

| SYMBRAVO 20-10 MG TABLET | 81968-0020-09 | 122.88143 | EACH | 2025-11-19 |

| SYMBRAVO 20-10 MG TABLET | 81968-0020-09 | 122.69432 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SYMBRAVO (Sotorasib)

Introduction

SYMBRAVO (sotorasib) is a groundbreaking targeted therapy developed by Amgen for treating KRAS G12C-mutated non-small cell lung cancer (NSCLC). Approved by the FDA in 2021, it signifies a pivotal advancement in precision oncology, particularly for a mutation historically considered "undruggable." This analysis assesses the current market landscape, competitive positioning, pricing strategies, and future price projections, providing insights essential for stakeholders in pharmaceutical investment, healthcare policy, and competitive strategy.

Market Landscape Overview

Therapeutic Area and Unmet Need

KRAS mutations are among the most common oncogenic drivers, present in approximately 25% of NSCLC cases globally. The G12C variant accounts for around 13% of all NSCLC mutations, translating into a significant patient population with limited targeted treatment options prior to SYMBRAVO. Conventional chemotherapies and immunotherapies offered modest benefits, underscoring a substantial unmet need that SYMBRAVO now addresses.

Current Treatment Paradigm

Prior to SYMBRAVO's approval, treatment options for KRAS G12C-mutated NSCLC included:

- Chemotherapies (platinum-based regimens)

- Immune checkpoint inhibitors (e.g., pembrolizumab)

- No targeted treatments specifically for KRAS mutations

The advent of SYMBRAVO introduces a novel targeted therapy option, often used in second-line settings following disease progression on immunotherapy and chemotherapy.

Market Entry and Adoption

Since its approval in May 2021, SYMBRAVO has achieved rapid adoption, buoyed by its first-in-class status and demonstrated clinical efficacy. The drug's primary competitors include other targeted therapies under development, combination regimens involving immunotherapies, and emerging KRAS inhibitors like Mirati Therapeutics' adagrasib.

Regulatory and Reimbursement Dynamics

Amgen's patent protections and regulatory exclusivity grants a temporary monopoly. Reimbursement coverage varies across markets, initially favoring high-volume regions like the U.S., Europe, and Japan, which collectively constitute the bulk of the target patient base. Reimbursement negotiations and formulary placements significantly influence market penetration.

Market Size and Revenue Potential

Global KRAS G12C-Positive NSCLC Patient Population

Estimations suggest approximately 25,000 to 30,000 new KRAS G12C-mutant NSCLC cases annually in North America and Europe alone. Considering global prevalence and access, the total addressable market (TAM) for SYMBRAVO by 2025 could approach 50,000 patients.

Pricing Strategy

Initial pricing in the U.S. set SYMBRAVO at approximately $17,900 per month, aligning with other targeted therapies such as Tagrisso (osimertinib). This translates to an annual cost exceeding $214,800 per patient.

- Justification of Pricing: The high drug price reflects the substantial R&D investment, clinical efficacy, and the rarity of the mutation. It also considers the value-based pricing model linked to improved progression-free survival (PFS) and overall survival (OS) outcomes.

Competitive Landscape and Market Dynamics

Direct Competitors

- Adagrasib (Mirati Therapeutics): A KRAS G12C inhibitor with FDA breakthrough therapy designation, expected to launch shortly. Its similar mechanism and potential combination use position it as a primary competitor.

- Other KRAS Inhibitors: Multiple pipelines are probing different mutation subtypes, but none currently rival the clinical data of SYMBRAVO.

Combination Therapies

Emerging research suggests combining SYMBRAVO with immunotherapies enhances efficacy, potentially expanding its use into broader NSCLC populations and increasing market size. Such combinations could modify the pricing landscape and reimbursement policies.

Patents and Market Exclusivity

Patent protection extends approximately 10 years post-approval, providing a window of market monopoly. Patent challenges or biosimilar entries could influence future pricing and market share.

Price Projections and Future Market Trends

Short-Term Outlook (2023-2025)

- Stable Pricing: Given high unmet need and limited competition, SYMBRAVO's price is likely to remain near the current range (around $17,900/month).

- Revenue Growth: Market penetration is expected to grow from initial launch figures, aligning with increased awareness and payer coverage. Revenue projections could reach $2-3 billion globally by 2025, assuming broad adoption.

Mid to Long-Term Outlook (2026-2030)

- Price Erosion Factors: Introduction of competitors like adagrasib may exert downward pressure, especially if clinical data demonstrate comparable efficacy at reduced prices.

- Price Adjustments: With widespread use, discounting strategies, value-based agreements, and potential biosimilar-like manufacturing efficiencies could reduce per-unit prices by 10-30%, depending on market dynamics.

- Expansion of Indications: Regulatory approvals for additional indications (e.g., colorectal cancer) will diversify usage and potentially stabilize or elevate prices through expanded payers' willingness to pay.

Potential for Value-Based Pricing

As real-world evidence accumulates, payers may favor value-based arrangements, tying reimbursement levels to clinical outcomes. This could result in variable pricing models, influencing overall revenue trajectories.

Market Challenges and Opportunities

Challenges:

- Entry of rival KRAS inhibitors

- Biosimilar or generic manufacturing over time

- Regulatory changes affecting exclusivity

Opportunities:

- Combination therapies expanding indications

- Biomarker-driven patient selection boosting therapeutic value

- International market expansion, especially in emerging markets

Regulatory and Policy Implications

Regulatory agencies may revise pricing and reimbursement policies, especially as real-world evidence underscores clinical benefit. Policies favoring value-based agreements are likely to influence pricing strategies further. Patent protections reinforce initial high-price strategies, but patent cliffs could induce price reductions post-exclusivity.

Key Takeaways

- Market Potential: SYMBRAVO commands a premium price driven by its first-in-class status and superior clinical data, with a robust global addressable population.

- Price Stability: The current monthly pricing (~$17,900) is justified and likely stable through patent protections, with possible adjustments due to competition.

- Revenue Outlook: From 2023 to 2025, revenues are projected to grow steadily, potentially reaching $2-3 billion globally, contingent on market penetration and reimbursement.

- Competitive Risks: Emerging KRAS inhibitors and combination therapies could pressure prices and market share, emphasizing the need for ongoing innovation.

- Strategic Opportunities: Expansion into new indications and regions, coupled with value-based pricing models, could sustain high prices and revenue streams.

FAQs

-

What is the primary driver behind SYMBRAVO’s high price?

The high price is driven by its innovative mechanism targeting a previously “undruggable” mutation, proven clinical efficacy, limited competition, and high unmet medical need. -

How does SYMBRAVO compare to its competitors?

SYMBRAVO leads as the first FDA-approved KRAS G12C inhibitor; upcoming competitors like adagrasib may offer similar efficacy at potentially lower prices, influencing market dynamics. -

What factors could influence SYMBRAVO’s price in the future?

Competitive entries, patent expirations, biosimilar development, healthcare policy shifts, and real-world efficacy data will shape its pricing trajectory. -

Is there potential for price reductions?

Yes. Market competition, biosimilar entries, and value-based reimbursement models could lead to gradual price erosions over time. -

What opportunities exist for enhancing SYMBRAVO’s market share and profitability?

Expanding indications, forming combination regimens, entering emerging markets, and engaging in outcome-based pricing agreements can bolster market penetration and revenue.

References

- U.S. Food and Drug Administration (FDA). FDA Approves Sotorasib for KRAS G12C-mutated Non-small Cell Lung Cancer. 2021.

- Amgen Inc. Corporate Reports. SYMBRAVO (sotorasib) Clinical Data and Market Strategy. 2022.

- MarketResearch.com. Global KRAS-Targeted Therapies Market Analysis. 2022.

- IQVIA. Pharmaceutical Pricing and Market Access Report. 2022.

- ClinicalTrials.gov. Ongoing Studies with SYMBRAVO and Competitors. 2023.

More… ↓