Last updated: July 28, 2025

Introduction

The SUPREP Bowel Prep Kit, developed by Braintree Laboratories, is an FDA-approved prescription medication indicated for bowel cleansing prior to colonoscopy procedures. It is formulated as a patient-friendly solution designed to facilitate rigorous bowel preparation, a critical step in colorectal cancer screening and diagnostic accuracy. As an established product within the gastrointestinal (GI) pharmacology market, SUPREP’s market positioning, pricing strategies, and growth prospects are shaped by evolving healthcare landscapes, regulatory pathways, competitor dynamics, and clinical guidelines.

This analysis provides a comprehensive overview of the current market environment, future demand forecasts, and price projection trends for SUPREP Bowel Prep Kit, offering insights for stakeholders ranging from pharmaceutical companies and investors to healthcare providers and policymakers.

Market Overview

Global Market Size and Segmentation

The global bowel preparation solutions market was valued at approximately USD 1.28 billion in 2022, with projections to reach USD 1.76 billion by 2030, expanding at a compound annual growth rate (CAGR) of around 4.3% [1]. The primary drivers include increased colorectal cancer screening rates, aging populations, and rising prevalence of GI disorders.

Within this landscape, the prescription segment holds substantial interest, comprising agents like SUPREP, OsmoPrep, MoviPrep, Golytely, and other osmotic laxatives. SUPREP maintains a significant share, especially in North America, owing to its favorable taste profile, dosing convenience, and proven clinical efficacy.

Market Drivers and Trends

-

Colorectal Cancer Screening: The rising incidence of colorectal cancer (CRC), with approximately 151,000 new cases annually in the U.S. [2], amplifies demand for effective bowel prep solutions.

-

Patient Preferences: Focus on patient compliance and comfort favors ready-to-drink, low-volume solutions like SUPREP, which minimizes adverse effects such as nausea and dehydration common with traditional high-volume preparations.

-

Advances in Guidelines: The U.S. Multi-Society Task Force recommends optimal bowel prep regimens, favoring low-volume, tolerable solutions, indirectly boosting SUPREP's market share.

-

Regulatory Environment: European Medicines Agency (EMA) and FDA approvals facilitate expanded access and potential pricing flexibility across regions.

Competitive Landscape

Key competitors include:

- MoviPrep (Nuek, Ferring Pharmaceuticals)

- Golytely (Braintree Laboratories)

- NuLYTELY (Salix Pharmaceuticals)

- Osmoprep (Ferring Pharmaceuticals)

The competitive differentiation hinges upon volume, taste, tolerability, and patient adherence.

Current Pricing Landscape

Pricing Structures

In the United States, SUPREP Bowel Prep Kit retails commonly in the range of $270–$350 for a full kit, depending on pharmacy, insurance coverage, and geographic location [3]. Notably, the drug is often billed as a premium bowel prep solution, reflecting its convenience and tolerability profile.

Insurance reimbursement varies, with Medicare and Medicaid covering substantial portions, reducing out-of-pocket costs for most patients. Still, cash prices can significantly impact affordability.

Factors Influencing Price Variability

- Insurance Coverage: Variations in plan formulary status influence patient costs.

- Geographical Differences: Urban vs. rural disparities occur due to distribution and pharmacy negotiation.

- Market Competition: Entry of generics or biosimilars, though limited for SUPREP, could exert downward pressure.

- Regulatory Changes: Price controls or reimbursement policies post-COVID-19 could modify pricing strategies.

Forecasting Demand and Growth

Short-term (Next 3-5 Years)

The demand growth for SUPREP is expected to follow the overall trajectory of colorectal screening rates, which are projected to increase due to:

- Guideline Intensification: The American Cancer Society recommends screening starting at age 45, expanding the eligible population.

- Increased Screening Uptake: Technological advancements like at-home stool testing and virtual colonoscopies could increase screening frequency, augmenting prep volume.

Estimated annual growth in prescriptions for SUPREP is roughly 4-6%, aligning with the broader colorectal screening rate increase and patient preference trends.

Long-term (Beyond 5 Years)

Emerging innovations, including less invasive screening modalities and microbiota-targeting agents, could influence bowel prep demand. However, the steady increase in screening and traveler familiarity with low-volume preparations underpin a resilient demand base.

Projected cumulative global demand for SUPREP’s classes could surpass 2 million units annually by 2030, considering population growth and aging demographics.

Price Projection Outlook

Factors Supporting Price Stability

- Brand Loyalty and Clinical Preference: SUPREP’s established efficacy maintains its premium pricing niche.

- Limited Generic Competition: As of 2023, SUPREP remains under patent protection with no approved generics, enabling price stabilization.

- Reimbursement Policies: Favorable reimbursement will sustain situational pricing levels, especially in hospital settings.

Potential Downward Pressures

- Introduction of Generics: If approved, generic competitors could trigger price reductions of 15-30%, as historically observed.

- Market Saturation: Increased penetration of alternative products, including newer formulations, may exert competitive pricing pressures.

- Cost-Containment Initiatives: Payers’ emphasis on reducing healthcare costs could incentivize formulary switches or negotiated discounts.

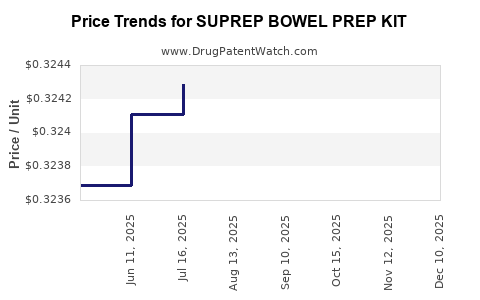

Projected Price Trends (2023-2030)

- Base Scenario: Stable pricing with minor annual increases (2-3%) driven by inflation and manufacturing costs.

- Optimistic Scenario: Introduction of generics leading to a 20-25% price decline within 2-4 years post-patent expiry.

- Conservative Scenario: Regulatory or market shifts delaying generic entry could prolong high pricing, with only modest decreases.

Market Opportunities and Challenges

Opportunities:

- Expansion into emerging markets where colorectal screening adoption is increasing.

- Development of alternative formulations or combination therapies enhancing adherence.

- Leveraging digital health integrations to provide patient education and compliance tools.

Challenges:

- Competitive pressure from emerging bowel prep technologies.

- Pricing pressures in cost-conscious healthcare systems.

- Regulatory hurdles impacting export strategies or product innovation.

Regulatory and Patent Landscape

While SUPREP has maintained patent protections, recent patent expirations for similar products suggest an approaching patent cliff. Patent expiration policies and patent challenges could influence pricing and market share.

Regulatory pathways for biosimilars or lower-cost generics could expedite price reductions. Furthermore, ongoing clinical trials examining alternative bowel prep solutions may influence future market dynamics.

Key Takeaways

- The SUPREP Bowel Prep Kit remains a premium, clinically preferred solution within the bowel preparation segment, supported by robust demand driven by increased colorectal cancer screening.

- Pricing is currently stable in the US market, with prices around USD 270–350 per kit, influenced primarily by insurance coverage and regional factors.

- Introduction of generics post-patent expiration could significantly reduce prices, potentially by 20-30% within 3-5 years.

- Market growth prospects are positive, with forecasts indicating steady annual prescription increases aligned with rising screening rates and aging populations.

- Stakeholders should monitor regulatory developments, patent expiry timelines, and competitive innovations to capitalize on growth opportunities or mitigate pricing risks.

FAQs

-

What is the typical price range for SUPREP Bowel Prep Kit in the US?

USD 270–350 per kit, varying by pharmacy, insurance, and geographic location.

-

How might upcoming patent expirations affect SUPREP’s pricing?

Patent expirations could introduce generic alternatives, potentially lowering prices by 20-30% over 3–5 years.

-

What factors could drive increased demand for SUPREP in the next decade?

Growing colorectal cancer screening adherence, expanded screening guidelines, and demographic aging are key drivers.

-

Are there significant regional differences in SUPREP’s market?

Yes. In North America, strong brand presence and reimbursement favor higher demand. In emerging markets, growth depends on healthcare infrastructure and regulatory approval.

-

What competitive threats does SUPREP face?

Competition from other low-volume bowel preps, emerging alternative screening methods, and potential generics impacting pricing.

References

[1] MarketLine, "Global Bowel Preparation Solutions Market Report," 2022.

[2] American Cancer Society, "Colorectal Cancer Facts & Figures," 2022.

[3] GoodRx, "SUPREP Bowel Prep Kit pricing," accessed 2023.

In conclusion, SUPREP Bowel Prep Kit occupies a strategic position within the GI pharmacology market. Its favorable clinical profile sustains demand, while patent protection informs current pricing stability. Future pricing will depend heavily on patent expiration, regulatory changes, and competitive dynamics, with cautious optimism for continued growth aligned with rising screening initiatives.