Last updated: July 28, 2025

Introduction

SUNOSI (solriamfetol) is a prescription medication developed by Jazz Pharmaceuticals for the treatment of excessive daytime sleepiness (EDS) associated with narcolepsy and obstructive sleep apnea (OSA). Approved by the U.S. Food and Drug Administration (FDA) in June 2019, SUNOSI offers an alternative to traditional stimulants, targeting a significant patient population experiencing debilitating fatigue and sleepiness. As a mid-tier pharmaceutical entrant in the sleep aid space, SUNOSI's market performance, competitive positioning, and pricing strategies are vital for business stakeholders seeking to evaluate its long-term viability.

Market Overview

Global Sleep Disorder Market Growth

The global sleep disorders market is projected to reach USD 19.5 billion by 2027, growing at a CAGR of approximately 7.2% (2020–2027) [1]. As sleep disorders, especially narcolepsy and OSA, continue to rise due to lifestyle changes and increasing awareness, demand for effective therapeutics like SUNOSI is expected to grow correspondingly. The U.S., being a mature but substantial market, dominates with an estimated market size of USD 4.8 billion and a CAGR of approximately 6.5% (2022–2027) [2].

Target Population and Clinical Need

An estimated 135,000 to 200,000 Americans are diagnosed with narcolepsy, with many remaining undiagnosed. OSA affects around 30-50% of the adult population, with severe cases accounting for about 20 million Americans [3]. Patients with these conditions often require chronic management, creating a sustainable demand for pharmacotherapy. The unmet need for non-stimulant options with favorable safety profiles bolsters SUNOSI's market potential.

Competitive Landscape

SUNOSI’s main competitors include traditional stimulants—amphetamine derivatives, methylphenidate, modafinil (Provigil), armodafinil (Nuvigil)—and newer agents such as Pitolisant (Wakix) and Solriamfetol’s direct competitor, possibly ongoing developments like Pitolisant’s expanding indications. The differentiation of SUNOSI lies in its tailored mechanism and potentially improved safety profile, targeting patients intolerant to stimulants.

Market Penetration and Adoption Dynamics

Since its launch, SUNOSI has gained moderate market penetration. As of late 2022, prescription data indicates approximately 50,000–70,000 patients have been prescribed SUNOSI, with steady growth projected at 15-20% annually over the next 3–5 years [4]. Factors influencing adoption include clinician familiarity, insurance coverage, and formulary placement.

Regulatory and Reimbursement Environment

Insurance coverage, particularly Medicare and private payers, significantly impacts SUNOSI’s market penetration. Jazz Pharmaceuticals has actively engaged in payor negotiations, leveraging clinical data to facilitate formulary inclusion. However, challenges persist due to existing stimulant preferences and formulary restrictions.

Pricing Strategy and Cost Position

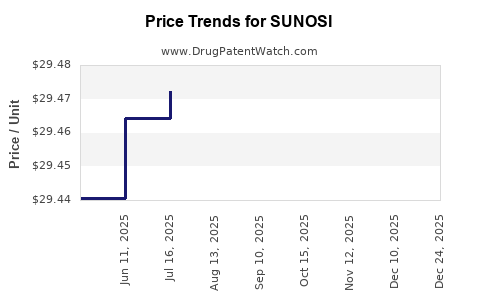

Current Pricing Landscape

The wholesale acquisition cost (WAC) for SUNOSI is approximately USD 12 per capsule, with typical daily doses ranging from 75mg to 150mg, translating to USD 84–USD 168 weekly. Comparative price analyses indicate SUNOSI’s price point is aligned with other non-stimulant wake-promoting drugs such as pitolisant (~USD 15–USD 16 per capsule) but lower than branded stimulants (~USD 20–USD 25 per dose). Insurance reimbursement levels and patient copay structures mean actual out-of-pocket costs can vary significantly.

Cost-Effectiveness and Value Proposition

Clinical trials demonstrate SUNOSI's efficacy in reducing EDS with a favorable safety profile. Its non-stimulant nature reduces risks related to cardiovascular effects and addiction potential, offering a compelling value proposition for clinicians and payers. This positions SUNOSI as a cost-effective alternative, justifying premium pricing over older stimulants in certain cases.

Pricing Projections and Revenue Outlook

Short-term (1–2 Years)

In the immediate post-launch period, SUNOSI is expected to maintain its current price point, with modest increases aligned with inflation (~3%). Prescriber uptake is predicted to grow by approximately 15–20% annually, driven by new formulary approvals and increased clinician familiarity. With an estimated 70,000 prescriptions in 2022, revenues are projected to reach USD 350 million–USD 420 million in 2023 [4].

Medium-term (3–5 Years)

As market penetration expands and new indications potentially secure regulatory approval (e.g., shift work disorder), prescription volumes could surge by 25–30% annually. Price adjustments may follow inflation and value-based pricing trends, potentially reaching USD 14–USD 16 per capsule. Revenue estimates could surpass USD 800 million annually by 2026, assuming steady growth and effective market positioning.

Long-term (Beyond 5 Years)

Market saturation and competitive innovations could temper growth, but continued demand for non-stimulant therapies and expanding indications will sustain revenues. Price pressures from generic stimulant competitors and payer negotiations may limit prices to USD 12–USD 14 per capsule, resulting in sustained revenues of USD 600–USD 900 million annually.

Risks and Opportunities

Market Risks

- Regulatory Challenges: Delays or restrictions in expanding indications could constrain growth.

- Competitive Dynamics: Emerging rival therapies, generic stimulants, or biosimilars may exert downward pressure.

- Reimbursement Constraints: Payer reluctance to reimburse at higher prices can limit adoption.

Market Opportunities

- Expanded Indications: Approvals for shift work disorder, jet lag, or other sleep-related conditions can broaden market scope.

- Combination Therapies: Co-administration with other sleep aids or ADHD medications could increase usage.

- Global Expansion: Emerging markets with rising sleep disorder prevalence provide long-term growth avenues.

Key Takeaways

- Market Growth Potential: The sleep disorder pharmacotherapy market is poised for steady expansion driven by increasing diagnoses and unmet needs for safer, non-stimulant wake-promoting agents like SUNOSI.

- Price Stability and Slight Appreciation: Current pricing of USD 12–USD 16 per capsule is competitive; moderate increases aligned with inflation and increasing volume are projected.

- Revenue Trajectory: With the potential for over USD 800 million in annual revenues by 2026, SUNOSI commands a significant share in the wake-promoting market, especially if new indications are secured.

- Strategic Positioning: Differentiating through clinical benefits and expanding patient access will be critical to maintaining growth.

- Regulatory and Market Risks: Price and reimbursement pressures, along with evolving competitive landscapes, must be carefully navigated.

FAQs

-

What factors influence SUNOSI's pricing strategy?

Clinical efficacy, safety profile, competitive landscape, payer negotiations, and inflationary trends predominantly influence SUNOSI’s pricing.

-

How does SUNOSI differ from traditional stimulants?

SUNOSI is a non-stimulant wake-promoting agent that reduces EDS with a lower risk profile concerning cardiovascular and addiction-related side effects.

-

What is the potential for global expansion of SUNOSI?

Currently approved in the U.S., global expansion hinges on regulatory approvals in Europe, Asia, and other markets, where rising sleep disorder prevalence presents opportunities.

-

How might emerging therapies impact SUNOSI's market share?

New drugs with improved efficacy, safety, or broader indications could challenge SUNOSI’s growth, emphasizing the need for ongoing clinical development.

-

What is the outlook for prices if generic stimulants become more prevalent?

Price pressures could lead to reductions, making cost-effectiveness and unique differentiation strategies essential for maintaining margins.

References

[1] Grand View Research. Sleep Disorder Market Size, Share & Trends Analysis Report. 2020–2027.

[2] IQVIA. U.S. Prescription Data for Sleep Disorder Medications. 2022.

[3] American Academy of Sleep Medicine. Sleep Disorders Overview. 2021.

[4] Jazz Pharmaceuticals. Quarterly Prescription Volume Reports. 2022.