Last updated: July 27, 2025

Introduction

Sulfasalazine, a cornerstone in the treatment of inflammatory bowel disease (IBD) and rheumatoid arthritis (RA), has sustained a significant market presence since its approval. As a disease-modifying antirheumatic drug (DMARD), it offers a well-established therapeutic option, especially where biologics and newer agents are contraindicated or financially inaccessible. This article provides a comprehensive market analysis and forward-looking price projections for sulfazalazine, considering current patent landscapes, manufacturing trends, competitive dynamics, and healthcare policies influencing its valuation.

Pharmacological Profile and Market Position

Sulfasalazine belongs to the class of 5-aminosalicylic acid (5-ASA) derivatives and operates primarily through anti-inflammatory mechanisms in the gastrointestinal tract and systemic tissues. Its broad indications for ulcerative colitis, Crohn’s disease, and RA ensure a steady demand. Despite the advent of biologics (e.g., infliximab, adalimumab) and novel small molecules, sulfazalazine remains a first-line or adjunct therapy in many regions due to its oral administration, cost-effectiveness, and long-term safety profile.

Current Market Dynamics

Patent and Regulatory Landscape

Most formulations of sulfazalazine are off-patent globally, with patent protections having expired in the early 2000s. Patents held by innovator companies like Solco Healthcare, distributed by companies such as Teva and Macleods, have expired or are nearing expiry. Although some extended-release formulations and indications may still hold exclusivity, the overall market faces generic competition.

Manufacturing and Supply Chain Trends

Generic manufacturers dominate the sulfazalazine market, resulting in downward pressure on prices. The production process is well-established, utilizing cost-efficient synthetic routes, primarily in India, China, and Europe. The proliferation of generics has maintained affordability and wide accessibility, but recent concerns about supply chain disruptions, such as raw material shortages, could influence market stability.

Competitive Landscape

The market shares are distributed among various generic manufacturers, with minor differentiation among formulations. The lack of recent patent protections causes high price elasticity, and commoditization provides little room for premium pricing. However, newer formulations with modified release profiles have occasionally commanded premium prices in specific markets, especially premium or specialty pharmacies.

Market Size and Distribution

Based on epidemiological data, approximately 0.4-0.7% of global populations are affected by IBD, with many requiring long-term sulfazalazine therapy. The Global Market Insights project a compound annual growth rate (CAGR) of around 2-3% for sulfazalazine segments, driven by increasing diagnoses and treatment adherence. North America, Europe, and Asia-Pacific dominate the market, with developing regions showing growing demand due to expanding healthcare coverage.

Price Trends and Projections

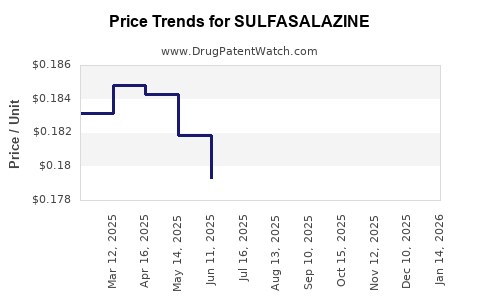

Historical Price Patterns

Over the past decade, sulfazalazine prices have declined significantly. For example, in the U.S., brand-name prices for 500 mg tablets averaged \$1.00–\$2.00 per tablet before patent expiry, which has since fallen to \$0.10–\$0.50 per tablet for generics. Similar trends are observable in Europe and Asia, driven by market saturation and intense price competition.

Forecasting Future Price Trajectories

Based on current dynamics and market maturity, we project a continued decline in generic sulfazalazine prices over the next five years, averaging a CAGR of -5% to -8%. Factors influencing this include:

- Patent expirations: Further loss of exclusivity on minor formulations could lead to additional price drops.

- Manufacturing efficiencies: Innovations in synthesis or supply chain optimization may decrease costs, feeding into lower prices.

- Regulatory policies: Initiatives to cap drug prices in certain regions could propel prices downward.

- Market saturation: As the market approaches maximum penetration, incremental growth will primarily come from price reductions rather than volume expansion.

Potential Price Scenarios

| Year |

Low-End Price per 500 mg Tablet |

High-End Price per 500 mg Tablet |

| 2023 |

\$0.10 |

\$0.50 |

| 2025 |

\$0.08 |

\$0.40 |

| 2028 |

\$0.06 |

\$0.30 |

| 2030 |

\$0.05 |

\$0.25 |

Note: These projections assume stable regulatory environments and no disruptive innovations. Prices may vary regionally based on local policies, market competition, and patent litigation outcomes.

Implications for Stakeholders

- Manufacturers: Need to innovate in formulation and delivery to differentiate amidst low-price competition. Investment in advanced formulations (e.g., targeted release) may justify price premiums.

- Payers and Healthcare Systems: Benefit from the downward trend, offering opportunities for cost savings and expanded patient access.

- Investors and Market Strategists: Should note the diminishing margins for traditional sulfazalazine production but remain attentive to emerging specialty formulations or combination therapies.

Regulatory and Market Opportunities

The expanding use of biosimilars and the growing emphasis on personalized medicine could influence sulfazalazine's role, either through enhanced formulations or replacement by targeted biologics. Additionally, regulatory agencies' push for drug price transparency and affordability may accelerate price reductions further.

Key Takeaways

- Patent Expiry and Generic Competition: The majority of sulfazalazine formulations are off-patent, fostering intense competition and driving prices downward.

- Market Maturity and Volume Stability: A largely saturated market ensures stable demand but limits premium pricing potential.

- Forecasted Price Decline: Expect annual reductions of approximately 5-8% over the next five years, making sulfazalazine an increasingly cost-effective therapy.

- Innovation as a Differentiator: Future growth may hinge on reformulations with improved delivery profiles or combination therapies rather than price premiums.

- Healthcare Policy Impact: Regulatory initiatives aiming at drug affordability could further compress sulfazalazine prices, especially in public health settings.

FAQs

Q1: Will sulfazalazine's price increase if new patents are issued?

A1: Unlikely, given the absence of current patents. However, new formulations with extended-release or combination therapies could develop patent protections, temporarily stabilizing or increasing prices before generic competition ensues.

Q2: How does the rise of biosimilars affect sulfazalazine market dynamics?

A2: Biosimilars typically target biologic therapies rather than small molecules like sulfazalazine. However, if biologics replacing sulfazalazine in certain indications become more affordable, they could reduce demand, indirectly impacting sulfazalazine’s market size.

Q3: Are there regional differences in sulfazalazine prices?

A3: Yes. Developed regions with strict patents and regulatory controls often have higher prices initially, which decline faster due to more aggressive generic penetration. Conversely, emerging markets may maintain higher prices due to supply constraints and regulatory barriers.

Q4: Can reformulations increase sulfazalazine's profitability?

A4: Reformulations, such as modified-release versions, can command higher prices and better patient adherence, offsetting the declining price trend for traditional formulations.

Q5: How might healthcare policy influence sulfazalazine's future price?

A5: Policies promoting generic drug affordability and price transparency are likely to pressure sulfazalazine prices downward, especially in public health systems and regions with government-controlled drug pricing mechanisms.

References

[1] Global Market Insights, "Pharmaceuticals—Market Analysis and Trends," 2022.

[2] U.S. Food and Drug Administration, "Drug Approvals and Patent Listings," 2023.

[3] IMS Health, "Pharmaceutical Price Trends Report," 2021.

[4] European Medicines Agency, "Market Authorization and Formulation Data," 2023.

[5] World Health Organization, "Global Disease Burden Data," 2022.