Share This Page

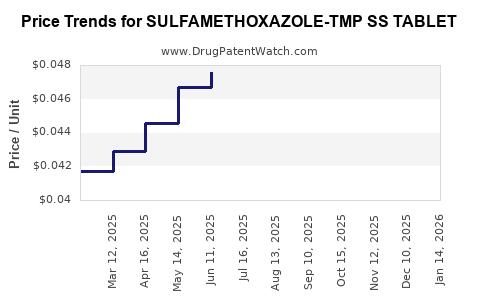

Drug Price Trends for SULFAMETHOXAZOLE-TMP SS TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for SULFAMETHOXAZOLE-TMP SS TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SULFAMETHOXAZOLE-TMP SS TABLET | 53746-0271-05 | 0.03915 | EACH | 2025-12-17 |

| SULFAMETHOXAZOLE-TMP SS TABLET | 50268-0728-15 | 0.03915 | EACH | 2025-12-17 |

| SULFAMETHOXAZOLE-TMP SS TABLET | 65862-0419-05 | 0.03915 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SULFAMETHOXAZOLE-TMP SS Tablet

Introduction

Sulfamethoxazole-Trimethoprim (SMX-TMP) SS tablets represent a combination antibiotic therapy widely used for the treatment of various bacterial infections. Known commercially as Bactrim or Septra among other formulations, this medication plays a critical role in community and hospital care, primarily targeting urinary tract infections, respiratory infections, and certain gastrointestinal diseases. As its clinical utility persists, understanding its market dynamics and future pricing trajectories is vital for stakeholders, including pharmaceutical companies, healthcare providers, and policy analysts.

Market Overview

Therapeutic and Market Penetration

Sulfamethoxazole-Trimethoprim, specifically in the single-strength (SS) tablet formulation, remains a cornerstone in antimicrobial therapy. Its broad-spectrum activity against gram-positive and gram-negative bacteria complements the rising need to combat resistant pathogens. The global antimicrobial market size was valued at approximately USD 50 billion in 2022, with antibiotics comprising a significant segment—approximately 45%—reflecting the enduring demand for agents like SMX-TMP [1].

The prevalence of urinary tract infections (UTIs) and respiratory tract infections sustains steady consumption. According to CDC data, UTIs account for over 8 million healthcare visits annually in the U.S. alone, with SMX-TMP among the first-line agents prescribed [2]. The widespread usage, combined with the drug’s cost-effectiveness, fosters persistent market penetration.

Regulatory and Patent Landscape

The patent status of Sulfamethoxazole-Trimethoprim has largely expired, fostering generic manufacturing and competitive price reductions. Key branded formulations, like Bactrim, have faced generic erosion since patents expired in the early 2000s, intensifying price competition [3].

Emerging concerns regarding antimicrobial resistance, particularly the rise of SMX-TMP-resistant strains of E. coli and Klebsiella pneumoniae, pose potential threats to future market volume. Nonetheless, in many regions, SMX-TMP continues to be recommended in clinical guidelines, which sustains its relevance.

Geographic Market Dynamics

North America and Europe dominate the market with mature healthcare economies, high antibiotic consumption rates, and strong prescription adherence policies. The U.S. market alone accounts for an estimated 20% of global antibiotic sales, with SMX-TMP constituting approximately 15-20% of outpatient antibiotic prescriptions [4].

In emerging markets such as India and China, rapid urbanization, improved healthcare access, and the burden of infectious diseases drive increased demand. However, regulatory hurdles and variable antibiotic stewardship practices may modulate growth rates.

Competitive Landscape

Major Players

The market features a mix of branded and generic manufacturers. Leading pharmaceutical companies supplying SMX-TMP SS tablets include Teva Pharmaceuticals, Mylan (now part of Viatris), Sandoz, and Sun Pharmaceutical. With patents long expired, generics dominate supply, fostering high price sensitivity and competitive pricing strategies.

Distribution Channels

Distribution relies heavily on outpatient clinics, hospitals, and retail pharmacies. The penetration in developing regions hinges on healthcare infrastructure development and regulatory approvals.

Price Trends and Projections

Historical Pricing Overview

Generic SMX-TMP SS tablets have historically been priced per tablet, with significant variations across regions. In the U.S., the average retail price for a 20-tablet course ranged between USD 10 and USD 25 in 2015, declining steadily thereafter due to market saturation and increased competition [5]. The advent of multiple manufacturers caused unit prices to fall by approximately 40% over the past decade.

Current Pricing Landscape

As of 2023, the average price for a standard 20-tablet course in the U.S. hovers around USD 8-15, with discount programs and insurance often reducing out-of-pocket costs further. In developing nations, prices can be substantially lower—sometimes under USD 5 for comparable quantities—due to local manufacturing and procurement policies.

Future Price Projections

Despite high competition, future price movements for SMX-TMP SS tablets are expected to stabilize or decline marginally over the next 5 years. Key factors include:

- Patent Expiry and Generic Competition: Scarcity of branded versions and an abundance of generics will continue exerting downward pressure on prices.

- Manufacturing Costs: Steady reductions in raw material and production expenses, coupled with technological advancements, support cost-compensated price adjustments.

- Regulatory & Policy Influences: Policies promoting generic substitution and price controls, particularly in Europe and Asia, may further drive prices downward. Conversely, potential introduction of new formulations or restrictions due to resistance concerns could influence pricing.

Based on these trends, analysts project a 5-10% decline in unit prices in mature markets over the next five years. For emerging markets, prices are likely to remain stable or decline gradually, contingent on regulatory environments and market competition.

Market Drivers and Constraints

Drivers

- Consistent clinical guidelines endorsing SMX-TMP as a first-line agent for specific infections

- Growing prevalence of bacterial infections, especially UTIs and respiratory tract infections

- Cost-effectiveness and high-volume prescribing in outpatient settings

- Continued availability of low-cost generics

Constraints

- Rising antimicrobial resistance reducing clinical utility in some strains and regions

- Stringent antimicrobial stewardship policies limiting overuse

- Potential emergence of adverse events (e.g., hypersensitivity, hematologic effects) influencing prescribing patterns

- Competition from newer agents, such as fosfomycin and Nitrofurantoin, particularly in UTI treatments

Strategic Implications for Stakeholders

For pharmaceutical manufacturers, maintaining competitive pricing through efficiency and portfolio diversification remains crucial. Investment in stewardship programs and resistance monitoring will be key to preserving the clinical relevance and market share.

Healthcare providers should consider local resistance patterns and guidance updates when prescribing SMX-TMP, balancing cost, efficacy, and resistance risks.

Governments and policymakers should reinforce antimicrobial stewardship initiatives and advocate for rational antibiotic use to prolong drug efficacy and manage costs.

Key Takeaways

- Market Stability: The global SMX-TMP SS market demonstrates enduring demand driven by well-established clinical use and widespread prescription practices.

- Price Trajectory: Over the next five years, prices are expected to decline modestly (5-10%) in mature markets due to intense generic competition.

- Regional Variations: Prices in emerging regions may remain stable or decline slightly, impacted by local manufacturing, regulations, and healthcare infrastructure.

- Resistance Impact: Rising antimicrobial resistance could constrain future market growth, necessitating resistance monitoring and stewardship policies.

- Strategic Focus: Stakeholders should emphasize cost competitiveness, resistance management, and adherence to evolving clinical guidelines.

Frequently Asked Questions (FAQs)

1. What factors influence the pricing of Sulfamethoxazole-Trimethoprim SS tablets?

Prices are primarily driven by manufacturing costs, the level of generic competition, regional regulatory policies, and market demand. Patent expirations have historically led to significant price reductions.

2. How does antimicrobial resistance affect the market for SMX-TMP?

Rising resistance diminishes clinical utility, potentially reducing prescription volume and impacting revenue. Surveillance and stewardship are essential to sustain market relevance.

3. Are there upcoming patent protections or formulations that could influence prices?

Currently, SMX-TMP patents have expired, with no new formulations expected to enter the market imminently. Future innovations would be necessary to alter the current pricing landscape significantly.

4. How do pricing trends differ between developed and developing markets?

Developed markets feature higher absolute prices but greater access due to affordability programs, while developing markets see generally lower prices driven by local manufacturing and regulations.

5. What strategies should pharmaceutical companies adopt to remain competitive?

Focusing on manufacturing efficiency, expanding generic portfolios, investing in stewardship collaborations, and staying aligned with clinical guidelines are key to maintaining market share and favorable pricing.

Sources

[1] MarketResearch.com. (2022). Global Antibiotics Market Size & Trends.

[2] CDC. (2021). Urinary Tract Infection (UTI) Treatment.

[3] FDA Patent Archives. (2000-2022).

[4] IQVIA. (2022). Prescription Data and Market Insights.

[5] GoodRx. (2023). Price Trends for Sulfamethoxazole-Trimethoprim.

More… ↓