Share This Page

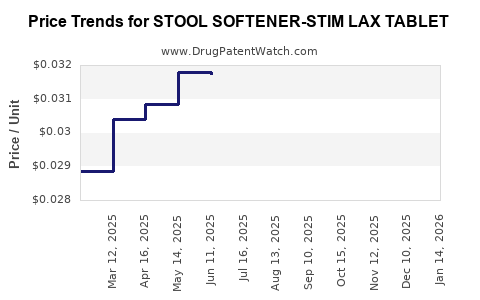

Drug Price Trends for STOOL SOFTENER-STIM LAX TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for STOOL SOFTENER-STIM LAX TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| STOOL SOFTENER-STIM LAX TABLET | 70000-0526-01 | 0.03270 | EACH | 2025-12-17 |

| STOOL SOFTENER-STIM LAX TABLET | 70000-0526-01 | 0.03270 | EACH | 2025-11-19 |

| STOOL SOFTENER-STIM LAX TABLET | 70000-0526-01 | 0.03217 | EACH | 2025-10-22 |

| STOOL SOFTENER-STIM LAX TABLET | 70000-0526-01 | 0.03099 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Stool Softener-Stim Lax Tablet

Introduction

The stool softener-stim lax tablet, a combination laxative used to relieve occasional constipation, is a segment within the broader gastrointestinal (GI) pharmaceutical market. This segment has experienced steady growth driven by aging populations, increasing awareness of digestive health, and the rising prevalence of chronic constipation related to lifestyle factors. This analysis examines current market dynamics, competitive landscape, regulatory considerations, and forecasts to inform stakeholders on potential growth opportunities and pricing strategies for stool softener-stim stim lax tablets.

Market Overview

Global Market Size and Growth Trends

The global laxatives market was valued at approximately USD 4.2 billion in 2022, with a compound annual growth rate (CAGR) estimated at 4.3% over the next five years [1]. Stool softeners and stimulant laxatives collectively represent a significant share owing to their widespread OTC availability and high demand among geriatric and adult populations.

Regionally, North America commands the largest market share, driven by high healthcare expenditure, aging demographics, and consumer preference for OTC digestive aids. The Asia-Pacific region is emerging rapidly due to urbanization, increased healthcare access, and a growing awareness of digestive health.

Key Market Drivers

- Demographic Shifts: The aging population (over 60 years) is more susceptible to constipation, propelling demand.

- Lifestyle Factors: Sedentary lifestyles, processed diets, and low fiber intake lead to increased constipation incidence.

- Regulatory Accessibility: OTC status for most stool softeners stimulates high consumer uptake.

- Healthcare Awareness: Growing awareness campaigns by health organizations emphasize digestive health importance.

Major Players and Competitive Landscape

Leading pharmaceutical companies include Johnson & Johnson (Dulcolax), Boehringer Ingelheim, and Major Pharmaceuticals. These firms focus on product innovation, marketing, and expanding OTC distribution channels.

Private-label brands also serve as competitive substitutes at lower price points, impacting pricing strategies for branded products.

Regulatory Environment

In most jurisdictions, stool softener-stim stim lax tablets are classified as OTC medications, with regulated safety and efficacy profiles. Regulatory bodies such as the FDA (USA) and EMA (Europe) have stringent guidelines concerning manufacturing standards, labeling, and health claims, influencing product development and pricing.

Market Segmentation

-

Product Type:

- Combination formulations (stool softener + stimulant laxative)

- Single-action products

-

Distribution Channel:

- OTC retail pharmacies

- Online pharmacies

- Hospitals and clinics (less common for OTC drugs)

-

Consumer Demographics:

- Elderly (>60 years)

- Adults with chronic constipation

- Pediatric use (certain formulations)

Price Dynamics

Current Price Range

The retail price of stool softener-stim stim lax tablets varies by region and brand. In North America and Europe, OTC packages typically range from USD 5 to USD 15 for a course of treatment (30-100 tablets), influenced by brand reputation, formulation complexity, and distribution channels. Generic brands tend to be priced 10-30% below branded counterparts, impacting overall market pricing strategies.

Price Factors Influencing Market

- Brand Positioning: Premium brands with extensive marketing command higher prices.

- Formulation Complexity: Combination products with added features (e.g., delayed release) may price above simpler formulations.

- Distribution Channel Margins: Online and direct-to-consumer models often reduce pricing compared to traditional brick-and-mortar stores.

- Regulatory and Manufacturing Costs: Stringent compliance increases production costs, affecting final prices.

Future Price Projections (2023-2028)

Based on current trends, expected market growth, and competitive dynamics, the following projections are outlined:

| Year | Average Price Range (USD) | Commentary |

|---|---|---|

| 2023 | $6 - $16 | Stabilization following recent price adjustments; increased competition in generic segments. |

| 2024 | $6 - $17 | Minor upward pressure due to inflation, regulatory compliance costs, and rising raw material prices. |

| 2025 | $7 - $18 | Market maturation encourages price differentiation; premium formulations may command higher markups. |

| 2026 | $7 - $19 | Increased adoption of online sales channels reduces some retail margins but maintains consumer prices. |

| 2027 | $8 - $20 | Emerging markets and demographic shifts create new demand, potentially elevating price ceilings. |

| 2028 | $8 - $21 | Longevity of OTC status and continued innovation sustain pricing power in premium segments. |

These projections assume stable regulatory environments and no significant market disruptions.

Key Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets with increasing healthcare infrastructure.

- Development of patient-friendly formulations, such as chewables or liquids, for pediatric or elderly populations.

- Digital marketing strategies and online sales channels to optimize margins and reach wider audiences.

- Strategic partnerships with healthcare providers for formulary inclusion.

Risks:

- Regulatory changes affecting OTC status could introduce prescription requirements, impacting sales volume and prices.

- Competition from alternative therapies, including probiotics and dietary supplements, may reduce demand.

- Price erosion driven by generic entrants and private-label brands.

- Raw material cost volatility affecting production pricing.

Concluding Remarks

The stool softener-stim stim lax tablet market is positioned for modest but steady growth driven by demographic changes and increasing digestive health awareness. Price stability is anticipated in the short-term with gradual upward trends owing to inflation and formulation enhancements. Companies should leverage innovation, strategic marketing, and expansion into underserved markets to capitalize on this evolving landscape.

Key Takeaways

- The global market for stool softener-stim stim lax tablets is expected to grow at a CAGR of around 4%, with pricing reflecting regional demand, brand positioning, and distribution channels.

- Average retail prices range from USD 6 to USD 16, with potential for incremental increases aligned with inflation and product sophistication.

- Emerging markets present significant growth opportunities, provided regulatory compliance is maintained.

- Competition from generics and private labels necessitates strategic pricing and product differentiation.

- Digital channels and patient-centric formulations are key avenues to expand market share and optimize profitability.

Frequently Asked Questions

Q1: What factors most influence the pricing of stool softener-stim lax tablets?

Pricing is primarily affected by brand reputation, formulation complexity, distribution channel margins, regulatory compliance costs, and regional market conditions.

Q2: Are there upcoming regulatory changes that could impact the market?

While current regulations support OTC status, any future changes curbing OTC sales or redefining approval standards could influence pricing and market accessibility.

Q3: How does generic competition impact pricing strategies?

Generics typically drive prices downward through increased competition, prompting brands to differentiate through formulations, packaging, and marketing to maintain margins.

Q4: What are the key growth markets for these medications?

North America and Europe are mature markets, but Asia-Pacific, Latin America, and the Middle East represent high-growth potential due to demographic shifts and healthcare expansion.

Q5: How can companies leverage digital platforms for this drug segment?

Online channels reduce distribution costs, enable direct engagement with consumers, and facilitate personalized marketing strategies, ultimately supporting competitive pricing and increased market penetration.

References

[1] MarketsandMarkets. "Laxatives Market by Product Type, Distribution Channel, and Region – Global Forecast to 2027." 2022.

More… ↓