Last updated: July 27, 2025

Introduction

Stool softeners, primarily used to treat constipation and facilitate bowel movements, constitute a significant segment of the gastrointestinal (GI) pharmaceuticals market. As the global demand for supportive therapies for constipation rises, driven by demographic shifts, lifestyle factors, and increasing awareness, understanding the current market landscape and future pricing trends becomes essential for manufacturers, investors, and healthcare stakeholders. This report offers a comprehensive market analysis and detailed price projections for stool softeners, emphasizing key drivers, competitive dynamics, and forecasted pricing over the coming years.

Market Overview

Market Size and Growth Dynamics

The global stool softener market has experienced steady growth, with the increasing prevalence of chronic constipation globally. According to recent industry reports, the market was valued at approximately USD 1.8 billion in 2022, with an expected compound annual growth rate (CAGR) of about 4.5% from 2023 to 2030 ([1], MarketsandMarkets). The expansion is attributed to aging populations, rising incidence of GI disorders, and a growing preference for over-the-counter (OTC) bowel management solutions.

Key Market Drivers

- Aging Population: Elderly populations, notably in North America and Europe, exhibit higher constipation rates, boosting demand for stool softeners.

- Lifestyle Factors: Sedentary lifestyles, dietary fiber deficiency, and medication side effects contribute to increasing constipation cases.

- Healthcare Access and Self-medication: OTC availability in many regions fosters direct consumer access, supporting market growth.

- Chronic Disease Management: Conditions like diabetes, neuromuscular disorders, and post-surgical recovery elevate stool softener usage.

Regional Market Insights

- North America: Dominates the market, accounting for over 40% of global sales, driven by aging demographics and high healthcare spending.

- Europe: Holds a significant share with robust healthcare infrastructure and preventive treatment focus.

- Asia-Pacific: Represents the fastest growth segment (CAGR ~6%), fueled by rising urbanization, increasing awareness, and expanding OTC sales channels.

- Latin America and Middle East: Emerging markets with growing demand but limited market penetration.

Competitive Landscape

The market features prominent players, including Johnson & Johnson, Bayer AG, GlaxoSmithKline, and local OTC manufacturers. Generic formulations dominate due to their affordability, while branded products focus on innovation, formulation improvements, and patient convenience.

Product Landscape

Stool softeners predominantly contain active ingredients such as:

- Docusate sodium (most common OTC agent)

- Docusate calcium

- Glycerin suppositories (for rectal administration)

Market offerings also include combination products with other laxatives or fiber supplements.

Pricing Dynamics

Current Price Range

The average retail price of OTC stool softeners varies significantly by formulation, brand, and geographic region:

- Docusate sodium capsules/tablets: USD 4–8 per bottle (30–100 tablets)

- Glycerin suppositories: USD 2–5 each

- Combination products & branded formulations: USD 10–15 per package

In the United States, generic docusate drugs typically retail at USD 0.10–0.20 per tablet, whereas branded versions may be priced at USD 0.30–0.50 per tablet ([2]).

Cost Factors Influencing Pricing

- Manufacturing and formulation costs: Economies of scale and patent statuses influence prices.

- Brand positioning: Branded products command premium pricing.

- Regulatory environment: Stringent regulations may increase compliance costs, affecting retail prices.

- Distribution and supply chain efficiency: Well-established channels tend to lower end-user prices.

- Regional market dynamics: Price sensitivity, insurance coverage, and healthcare infrastructure impact retail pricing.

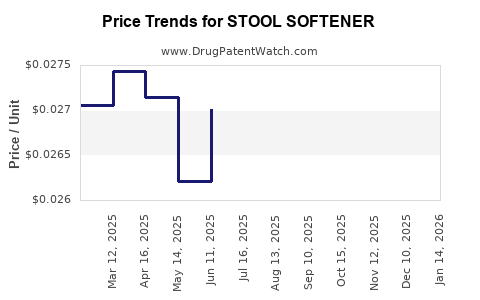

Price Projections (2023–2030)

Using current market trends, competitive forces, and external factors such as inflation and regulatory changes, we project the following pricing trends for stool softeners.

Short-term (2023–2025)

- Generic formulations: Prices are expected to remain stable or slightly decrease (−1% to −2% annually), driven by increased manufacturing efficiencies and generic market saturation.

- Branded formulations: May maintain or slightly increase (+0.5% annually) due to marketing and innovation efforts.

Mid-to-long-term (2026–2030)

- Generics: Prices could decline further by 2%–4% annually as new entrants expand production and price competition intensifies.

- Branded/Innovative products: Expect modest increases (0.5%–1%) in response to product advancement and consumer loyalty.

Influence of Regulatory and Market Factors

Potential regulatory modifications, such as stricter OTC guidelines or new approvals, could either stabilize prices during hurdles or prompt price reductions to remain competitive. Similarly, increased consumer price sensitivity in emerging markets may accelerate downward pricing pressures, especially for commoditized formulations.

Impact of Regional Variability

- High-income regions: Slight price increases are feasible due to consumer willingness to pay for branded and higher-quality formulations.

- Emerging markets: Prices are projected to decline or remain stable, emphasizing affordability and market penetration.

Key Market Trends and Future Outlook

Shift Toward Combination Therapy

Pharmaceutical companies increasingly develop combination products that incorporate stool softening with fiber supplementation or probiotics, aiming to differentiate offerings and justify premium pricing.

Digital and Telehealth Integration

Remote consultations and digital health platforms are facilitating greater OTC sales and consumer education, potentially influencing pricing strategies through enhanced marketing efficiencies and direct-to-consumer channels.

Innovation and Formulation Enhancements

Advancements such as sustained-release formulations, rapid-action suppositories, and natural ingredient-based products could command higher prices, especially in developed markets.

Conclusion

The stool softener market is positioned for steady growth driven by demographic shifts, lifestyle trends, and expanding OTC accessibility. While generic formulations will continue to dominate, innovation and regional differences will influence pricing dynamics. Forecasted slight declines in average prices, coupled with the increasing adoption of advanced formulations, present opportunities and challenges for stakeholders. Continuous monitoring of regulatory developments, consumer preferences, and competitive strategies will be essential for optimizing market positioning and pricing.

Key Takeaways

- The global stool softener market was valued at approximately USD 1.8 billion in 2022, with a projected CAGR of 4.5% through 2030.

- Price stability is anticipated in the short term, with marginal decreases in generic drug prices and modest increases in branded formulations over the longer term.

- Regional disparities influence pricing, with North America and Europe maintaining higher prices compared to emerging markets.

- Innovation, combination therapies, and digital health integration will shape future product offerings and pricing strategies.

- Manufacturers should consider regional consumer behavior, regulatory environment, and competitive pressures to optimize pricing and market share.

FAQs

1. What are the main active ingredients in stool softeners?

Docusate sodium is the most common active ingredient in OTC stool softeners, with alternatives including docusate calcium and glycerin-based suppositories.

2. How is the global demand for stool softeners expected to change?

Demand is projected to grow steadily, driven by aging populations, increased gastrointestinal health awareness, and OTC availability, with Asia-Pacific experiencing the fastest growth.

3. What factors influence stool softener pricing in different regions?

Pricing varies with regional economic development, regulatory environment, market competition, consumer purchasing power, and healthcare infrastructure.

4. Will innovative formulations significantly impact stool softener prices?

Yes, advanced formulations such as sustained-release products and combination therapies may command higher prices, especially in developed markets.

5. How might regulatory changes affect the stool softener market?

Stricter regulations can increase compliance costs, potentially leading to higher prices or reduced product availability; conversely, deregulation could lower prices and facilitate market expansion.

References

[1] MarketsandMarkets. "Constipation Therapeutics Market," 2022.

[2] Drug Price Guide, GoodRx, 2023.