Share This Page

Drug Price Trends for STOMACH RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for STOMACH RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| STOMACH RELIEF 525 MG/15 ML | 00536-1287-36 | 0.01012 | ML | 2025-12-17 |

| STOMACH RELIEF 525 MG/15 ML | 70000-0045-01 | 0.00949 | ML | 2025-12-17 |

| STOMACH RELIEF 262 MG CHEW TAB | 70000-0591-02 | 0.08393 | EACH | 2025-12-17 |

| STOMACH RELIEF 525 MG/30 ML | 70000-0698-01 | 0.01250 | ML | 2025-12-17 |

| STOMACH RELIEF 262 MG CAPLET | 70000-0594-01 | 0.09240 | EACH | 2025-12-17 |

| STOMACH RELIEF 262 MG CHEW TAB | 70000-0591-01 | 0.08393 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Stomach Relief

Introduction

The global market for digestive health medications, particularly over-the-counter (OTC) products marketed as “Stomach Relief,” has experienced consistent growth driven by increasing consumer awareness of gastrointestinal ailments, rising prevalence of digestive disorders, and a shift toward self-medication. This report provides a comprehensive market analysis, including current demand, competitive landscape, regulatory environment, and future price projections for Stomach Relief products.

Market Overview

Market Size and Growth Dynamics

The global digestive health market was valued at approximately USD 18 billion in 2022, with OTC antacids and gastrointestinal treatments accounting for a significant share[1]. The Stomach Relief segment, encompassing antacids, proton pump inhibitors (PPIs), probiotics, and herbal formulations, constitutes roughly 30-40% of this market.

Predominant growth drivers include:

- Rising incidence of gastrointestinal diseases such as acid reflux, gastritis, and irritable bowel syndrome (IBS).

- Increasing consumer preference for OTC solutions over prescription drugs.

- Growing awareness of digestive health through digital media and wellness trends.

- Expansion into emerging markets with improving healthcare infrastructure and rising disposable incomes.

Consumer Demographics

The primary consumers of Stomach Relief products are adults aged 25-55, particularly urban dwellers with busy lifestyles prone to dietary indiscretion. The elderly population also represents a significant segment due to the increased prevalence of acid-related disorders.

Distribution Channels

- Retail pharmacies and drugstores dominate sales channels, accounting for approximately 70% of OTC Stomach Relief sales.

- Supermarkets and hypermarkets contribute around 20%.

- Online pharmacies and e-commerce platforms are rapidly expanding, especially in North America and Europe, driven by convenience and digital health trends.

Competitive Landscape

Major players include multinational corporations such as Johnson & Johnson (e.g., TUMS, Pepcid), GlaxoSmithKline (e.g., Zantac – phased out due to regulatory issues), and Bayer, alongside numerous regional brands. Innovation focuses on:

- Formulation enhancements (e.g., longer-lasting effects, reduced side effects).

- New delivery forms such as chewables, liquids, and gummies.

- Incorporation of natural or herbal ingredients to cater to the organic product segment.

The market's fragmentation results in moderate pricing pressure, yet strong brand recognition allows leading brands to command premium prices.

Regulatory Environment

Regulatory agencies such as the FDA (U.S.) and EMA (Europe) govern OTC drug approvals. Recent regulatory shifts emphasize safety, efficacy, and claims substantiation, impacting product formulations and labeling. Patent protections typically last 10–15 years, incentivizing innovation but also compressing patent-protected margins as generics enter the market.

Market Trends

- Natural and Herbal Products: Consumers’ inclination toward herbal and organic ingredients has led to a surge in natural Stomach Relief offerings.

- Personalized Medicine: Advances in microbiome research are paving the way for personalized probiotics.

- Digital Health Integration: Apps and telemedicine services increasingly recommend OTC solutions, influencing consumer behavior.

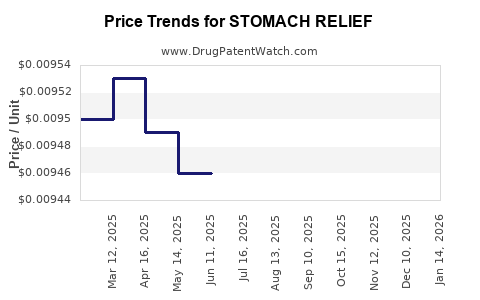

Price Dynamics and Historical Trends

Historically, Stomach Relief products have ranged in retail prices from USD 0.10 to USD 0.50 per tablet or dose, depending on formulation complexity, brand positioning, and regional factors. Premium natural or herbal products can command higher prices.

Pricing is affected by:

- Raw material costs, especially for herbal extracts or specialty ingredients.

- Packaging complexity.

- Regulatory compliance costs.

- Competitive positioning and consumer willingness to pay.

Price Projections (2023–2030)

Assuming minimal disruptive innovations but steady regulatory and market expansion, the following projections are outlined:

Short-Term (2023–2025)

- Price Stability with Slight Increases: Average retail prices are expected to rise modestly (2–4% annually) due to inflation and ingredient cost inflation.

- Premium Segment Growth: Natural and herbal Stomach Relief products are anticipated to see higher price increments (~5% p.a.) as consumer demand grows.

Mid to Long-Term (2026–2030)

- Price Growth Rate: Predicted to average 4–6% annually, driven by:

- Introduction of innovative delivery systems.

- Regulatory tightening enforcing higher quality standards.

- Expansion into less penetrated emerging markets with higher willingness to pay.

- Natural & Organic Products: Likely to retain premium pricing margins, further widening consumer price differentiation.

Regional Variations

- North America: Maintains higher average prices driven by brand dominance and consumer willingness to pay for organic and natural formulations.

- Europe: Slightly lower prices due to strict regulation and competitive generic markets.

- Emerging Markets: Lower prices (<USD 0.20 per dose) but with high volume sales potential.

Implications for Market Participants

- Manufacturers should innovate in delivery formats and ingredient sourcing to command premium pricing.

- Distributors must optimize supply chains to maintain margin margins amid inflationary pressures.

- Retailers need to balance pricing strategies with consumer demand for value and quality.

Risks and Opportunities

Risks

- Regulatory bans or restrictions on certain ingredients may limit formulation options.

- Market saturation in mature regions could lead to price wars.

- Supply chain disruptions could escalate input costs.

Opportunities

- Growing consumer interest in personalized and microbiome-targeted treatments.

- Expansion into emerging markets where urbanization and income growth fuel demand.

- Digital marketing and e-commerce growth augur well for brand differentiation.

Key Takeaways

- The Stomach Relief market is poised for steady growth, driven by rising GI disorder prevalence and shifting consumer preferences.

- Prices are expected to increase modestly in the short term, with natural and herbal segments commanding premium margins.

- Innovation in delivery and personalized health products will be critical to sustaining price premiums.

- Regional divergence influences pricing strategies, with North America leading in premium product prices.

- Strategic focus should be placed on R&D, regulatory compliance, and digital channels to capture evolving market opportunities.

FAQs

1. What factors influence the pricing of Stomach Relief products?

Pricing is influenced by formulation complexity, ingredient costs (especially herbal or proprietary compounds), packaging, regulatory compliance, brand positioning, and regional market dynamics.

2. How will consumer trends affect Stomach Relief prices?

Growing demand for natural, herbal, and personalized gastrointestinal treatments drives premium pricing. Conversely, market saturation and increased competition can exert downward price pressure.

3. Are there significant regional differences in Stomach Relief pricing?

Yes. North America and Europe tend to have higher prices due to consumer willingness to pay and regulatory standards. Emerging markets generally offer lower price points, though margins can be higher due to volume.

4. What innovations can impact future Stomach Relief prices?

Innovations include advanced delivery formats, microbiome-based personalized therapies, natural ingredient formulations, and digital health integrations, all of which can support higher price points.

5. What are the main risks to price stability in this market?

Regulatory restrictions, patent expirations, disruptive generics, supply chain disruptions, and aggressive price competition pose risks to stable pricing trajectories.

Sources

[1] MarketResearch.com, "Digestive Health Market Size & Trends," 2022.

More… ↓