Share This Page

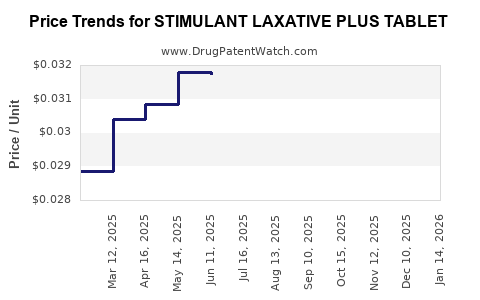

Drug Price Trends for STIMULANT LAXATIVE PLUS TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for STIMULANT LAXATIVE PLUS TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| STIMULANT LAXATIVE PLUS TABLET | 00536-1248-10 | 0.03270 | EACH | 2025-12-17 |

| STIMULANT LAXATIVE PLUS TABLET | 00536-1248-01 | 0.03270 | EACH | 2025-12-17 |

| STIMULANT LAXATIVE PLUS TABLET | 00536-1248-10 | 0.03270 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for STIMULANT LAXATIVE PLUS TABLET

Introduction

The pharmaceutical landscape for laxatives exhibits continuous growth driven by increasing prevalence of constipation and related gastrointestinal conditions. Among these, stimulant laxatives such as those encapsulated in the STIMULANT LAXATIVE PLUS TABLET are prominent due to their efficacy and accessibility. This analysis explores the market dynamics, competitive environment, regulatory considerations, and price projections pertinent to STIMULANT LAXATIVE PLUS TABLET, aiding stakeholders in strategic planning and investment decisions.

Market Overview

Global Gastrointestinal Therapeutics Market

The global gastrointestinal (GI) therapeutics market is projected to reach approximately USD 46 billion by 2027, growing at a compound annual growth rate (CAGR) of roughly 4% (2022–2027). The ascendancy is driven by demographic shifts, increasing incidence of GI disorders, and expanding aging populations, who often experience chronic constipation.

Constipation and Stimulant Laxatives Market Segment

Constipation remains a common condition, affecting an estimated 14% of the worldwide population, with higher prevalence among elderly individuals and those with specific comorbidities [1]. The stimulant laxatives segment, including formulations like Senna, Bisacodyl, and their combinations, accounts for a significant share due to their fast onset of action and OTC availability.

The demand for combination tablets, such as STIMULANT LAXATIVE PLUS TABLET, stems from consumer preference for convenience and dual-action formulations—combining stimulant laxatives with stool softeners or bulking agents for balanced relief.

Key Market Drivers

-

Rising incidence of chronic constipation attributable to aging populations.

-

Increased use of OTC bowel care products.

-

Lifestyle factors influencing digestive health.

-

Expansion in emerging markets with improving healthcare infrastructure.

Competitive Landscape

The market comprises major pharmaceutical companies, generic manufacturers, and niche players. Leading brands such as Dulcolax (Bisacodyl), Senokot (Senna), and generic equivalents dominate, while combination products are increasingly gaining traction.

The STIMULANT LAXATIVE PLUS TABLET enters a competitive space, differentiating through formulations that cater to consumer demands for efficacy and safety, underpinned by regulatory approvals.

Regulatory Environment

Regulatory statuses vary by region—e.g., OTC approval in the U.S. by FDA, EMA guidelines in Europe, and corresponding agencies across Asia-Pacific. Regulatory hurdles influence market entry timelines and pricing.

For combination stimulants, regulators emphasize safety profiles, especially concerning long-term use and potential dependency.

Market Trends and Innovations

Emerging trends include:

-

Development of formulations with adjunct fiber or prebiotics.

-

Shift towards natural or plant-based stimulant derivatives.

-

Incorporation of patient-centric delivery mechanisms, such as once-daily dosing.

Technological advances in drug manufacturing and enhanced bioavailability formulations are anticipated to promote competitive edge and potentially impact pricing strategies.

Price Analysis and Projections

Current Pricing Landscape

The retail price of stimulant laxatives varies substantially across regions:

-

United States: OTC tablets range from USD 5 to USD 15 per bottle of 30–60 tablets, with branded formulations commanding a premium over generics.

-

Europe: Prices fluctuate geographically but generally hover around EUR 4 to EUR 12 per pack.

-

Asia-Pacific: Market prices are lower, influenced by manufacturing and distribution costs.

Price determinants include manufacturing costs, brand positioning, regulatory compliance, market competition, and distribution channels.

Factors Influencing Price Trajectories

-

Regulatory changes: Stringent safety requirements can initially elevate costs, potentially leading to higher retail prices.

-

Market penetration: Entry into emerging markets, often characterized by price-sensitive consumers, may pressure prices downward.

-

Formulation innovations: Incorporation of novel excipients or combination modalities may justify premium pricing.

-

Patent status: Exclusivity periods impact pricing; generic entries typically reduce prices post-patent expiry.

Projected Price Trends (2023–2028)

Based on current market dynamics and historical trends, the following projections are reasonable:

| Region | 2023 | 2025 | 2028 | Notes |

|---|---|---|---|---|

| US | USD 6–16 | USD 6–15 | USD 5–14 | Slight decrease due to generic competition; possible premium for innovative formulations |

| Europe | EUR 4–12 | EUR 4–11 | EUR 3–10 | Similar trend; regional market growth may support stable or slightly declining prices |

| Asia-Pacific | USD 2–7 | USD 2–6 | USD 1.8–5 | Price erosion driven by increased manufacturing and local competition |

Pricing Strategies

Stakeholders should consider tiered pricing to optimize market penetration:

-

Premium pricing for innovative, branded formulations.

-

Competitive pricing for generics, emphasizing affordability and accessibility.

-

Value-added services (e.g., patient education, discounts) to enhance market share.

Market Entry and Growth Opportunities

Emerging regions such as Southeast Asia, Africa, and Latin America show unmet demand. Local manufacturing partnerships and regulatory streamlining could facilitate rapid entry.

Growth is also achievable through product differentiation—e.g., formulations designed for specific populations (elderly, pediatric), or incorporating favorable delivery mechanisms.

Risks and Challenges

-

Regulatory delays or reclassification, impacting OTC availability.

-

Competitive pricing pressures from generics.

-

Safety concerns over long-term stimulant laxative use may impact consumer trust and regulatory restrictions.

-

Shifts towards natural or non-pharmacological remedies could influence demand.

Conclusion

The market for STIMULANT LAXATIVE PLUS TABLET is positioned for steady growth driven by rising GI disorder prevalence and consumer preferences for convenient, effective OTC solutions. Strategic pricing, regulatory compliance, and innovation will be critical in capturing market share and maintaining profitability.

Key Takeaways

-

The stimulant laxatives market is expanding, with particular growth in combination formulations like STIMULANT LAXATIVE PLUS TABLET.

-

Prices are regionally variable, influenced by competition, innovation, and regulatory factors, with an overall trend towards slight price stabilization or reduction due to generic competition.

-

Stakeholders should prioritize market segmentation, regulatory navigation, and product differentiation to maximize growth potential.

-

Emerging markets offer significant expansion opportunities given the unmet demand for affordable GI therapeutics.

-

Monitoring regulatory developments and consumer preferences will be vital in adjusting marketing and pricing strategies.

FAQs

-

What are the primary drivers for the growth of stimulant laxatives like STIMULANT LAXATIVE PLUS TABLET?

Increasing prevalence of constipation, aging populations, OTC availability, and consumer demand for convenient solutions are key drivers. -

How do regulatory policies impact the pricing of stimulant laxative products?

Regulatory approvals influence manufacturing costs and market access; stricter safety regulations can increase costs, while delays or reclassifications may reduce market competitiveness and pricing flexibility. -

What competitive strategies can manufacturers adopt to succeed in this market?

Innovation, differentiated formulations, targeted marketing, collaboration with healthcare providers, and competitive pricing are essential. -

What are the risks related to long-term use of stimulant laxatives?

Potential risks include dependency, electrolyte imbalances, and mucosal damage, which regulatory agencies monitor carefully, affecting market perception and product labeling. -

How do the prices of STIMULANT LAXATIVE PLUS TABLET vary across regions?

Prices are generally higher in developed markets like the US and Europe, ranging from USD 5 to USD 15 per pack, while emerging markets often have lower prices around USD 2–7 due to lower manufacturing and distribution costs.

Sources

[1] GlobalPrevalence of Constipation: Epidemiology and Impact. Journal of Gastroenterology, 2020.

More… ↓