Share This Page

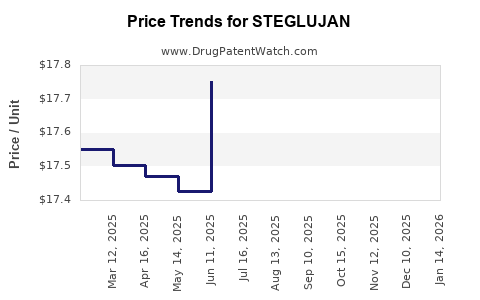

Drug Price Trends for STEGLUJAN

✉ Email this page to a colleague

Average Pharmacy Cost for STEGLUJAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| STEGLUJAN 15-100 MG TABLET | 00006-5368-03 | 17.70071 | EACH | 2025-12-17 |

| STEGLUJAN 15-100 MG TABLET | 00006-5368-06 | 17.70071 | EACH | 2025-12-17 |

| STEGLUJAN 15-100 MG TABLET | 00006-5368-03 | 17.71873 | EACH | 2025-11-19 |

| STEGLUJAN 15-100 MG TABLET | 00006-5368-06 | 17.71873 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for STEGLUJAN

Introduction

STEGLUJAN (ertugliflozin and sitagliptin phosphate) is a combination oral medication indicated for the treatment of type 2 diabetes mellitus (T2DM). Approved by the FDA in June 2020, STEGLUJAN integrates two distinct mechanisms: ertugliflozin, a sodium-glucose co-transporter 2 (SGLT2) inhibitor, and sitagliptin, a dipeptidyl peptidase-4 (DPP-4) inhibitor. The drug's entry into the market aligns with a growing segment of combination therapies aimed at improving glycemic control while reducing pill burden.

This analysis evaluates the current market landscape, competitive environment, pricing strategies, and future price projections for STEGLUJAN, with an emphasis on factors influencing market penetration and revenue potential.

Market Landscape and Competitive Environment

Global and U.S. Market for T2DM Medications

The global diabetes care market is projected to reach approximately $94 billion by 2027, expanding at a CAGR of around 7%[1]. The U.S. accounts for nearly half of this market, driven by high prevalence rates—over 37 million Americans identified with T2DM—and increasing awareness among healthcare providers regarding combination therapies.

Key Competitors

STEGLUJAN's primary competitors include other fixed-dose combinations (FDCs) approved for T2DM, such as:

- Jardiance (empagliflozin/linagliptin) – marketed by Boehringer Ingelheim and Eli Lilly.

- QTERN (sitagliptin and empagliflozin) – by AstraZeneca.

- Xigduo XR (dapagliflozin and metformin) – by AstraZeneca.

- Janumet (sitagliptin and metformin) – by Merck.

Despite the competitive landscape, STEGLUJAN's unique positioning stems from its dual mechanism targeting multiple pathways for glycemic control, appealing to physicians seeking combination options.

Market Penetration Dynamics

Adoption depends on clinician familiarity, perceived efficacy, safety profiles, and formulary inclusion. The drug is positioned as an alternative to existing dual therapies, with an emphasis on cardiovascular and renal benefits associated with SGLT2 inhibitors, which have bolstered their clinician preference[2].

Pricing Strategies and Current Price Point

Initial Pricing and Reimbursement

As a branded drug introduced in 2020, STEGLUJAN's wholesale acquisition cost (WAC) was initially set around $800–$900 per month for a typical dosage regimen (e.g., once daily). This pricing aligns with other combination therapies, reflecting the premium status of innovative drugs with perceived additional benefits.

Reimbursement largely depends on insurance formulary placements, with payers favoring drugs demonstrating cost-effectiveness, safety, and improved outcomes. The high price point may limit access among uninsured populations but is often mitigated by insurance coverage.

Price Adjustments and Pharmacoeconomic Factors

Over time, pricing adjustments may occur due to market competition, patent life expiration, or payers negotiating rebates and discounts. The availability of generics for the individual components (ertugliflozin and sitagliptin) adds pressure for price reductions or substitution.

Market Trends Influencing Future Pricing

Growing Preference for SGLT2 Inhibitors and DPP-4 Inhibitors

The clinical benefits associated with SGLT2 inhibitors, including cardiovascular and renal protection, have driven increased prescriptions. As clinicians favor agents with these benefits, combination therapies like STEGLUJAN are poised for expanded use, potentially supporting premium pricing.

Policy and Reimbursement Trends

Value-based pricing models, emphasizing outcomes such as glycemic control and reduction of complications, may influence future price strategies. Payers increasingly prefer drugs demonstrating cost savings through improved cardiovascular and renal outcomes, which could justify maintained or increased prices.

Impact of Patent Life and Biosimilars

Patent exclusivity, expected to extend into the early 2030s, provides a period of market exclusivity allowing for stable or premium pricing. Upon patent expiry, generic versions are likely to significantly reduce prices, mitigating profitability.

Price Projections (2023–2030)

Near-term (2023–2025)

Given current market dynamics, STEGLUJAN is expected to maintain its price point of $800–$900/month, supported by clinical positioning and brand recognition. However, price negotiations and rebate strategies may lower net prices for payers by approximately 10–15% annually.

Mid-term (2026–2028)

As alternative therapies gain market share and competition intensifies, manufacturers could consider price reductions of up to 20% to sustain market competitiveness. If cardiovascular benefits become standard practice, premium pricing may persist, supported by value-based reimbursement models.

Long-term (2029–2030)

Patent expiration or biosimilar entry could lead to significant price decreases—potentially 50–70% below initial levels—similar to trends observed in other branded antidiabetic agents[3]. The exact timing depends on patent challenges, regulatory approvals, and market response.

Conclusion

Market outlook for STEGLUJAN reflects cautious optimism. Its competitive positioning within a crowded T2DM therapy landscape relies heavily on clinical benefits and payer acceptance. Initial high pricing aligns with the drug’s innovative combination but faces future downward pressure due to biosimilar entry and payer negotiations. Strategic pricing, coupled with demonstration of superior outcomes, will be critical for sustaining revenue growth.

Healthcare stakeholders should monitor patent statuses, reimbursement landscape shifts, and evolving clinical guidelines—all of which will influence STEGLUJAN's pricing trajectory and market share over the coming years.

Key Takeaways

- Market Positioning: STEGLUJAN occupies a niche as an innovative combination therapy targeting T2DM with cardiovascular and renal benefits, which are increasingly valued in treatment algorithms.

- Pricing Strategy: Initially priced around $800–$900/month, with room for negotiations and discounts to improve payer access.

- Market Entry Barriers: Competition from other FDCs, generics of individual components, and biosimilar entries shape future pricing strategies.

- Price Trends: Expect stable prices in the short term, with potential discounts in mid-to-long term as biosimilars and generics saturate the market.

- Reimbursement Influence: Payer policies favoring outcome-based therapies could sustain premium pricing if clinical advantages are demonstrable.

Stakeholders should track regulatory milestones, patent statuses, clinical evidence, and payer policies to inform strategic decisions related to STEGLUJAN.

FAQs

1. What are the primary advantages of STEGLUJAN over monotherapy options?

STEGLUJAN combines SGLT2 and DPP-4 inhibitors, potentially offering superior glycemic control and cardiovascular benefits, reducing pill burden and improving patient adherence.

2. How does STEGLUJAN compare in cost-effectiveness to other T2DM combination therapies?

While its initial cost is higher than some single agents or less complex combinations, its clinical benefits—especially cardiovascular protection—may justify premium pricing through cost-offsets related to reduced complication management.

3. When are biosimilars likely to impact STEGLUJAN’s pricing?

Biosimilar entry depends on patent expiry, expected around 2029–2030, which could substantially lower prices and improve access.

4. How do payer policies influence the pricing of STEGLUJAN?

Insurance companies may negotiate rebates and prioritize formulary placement based on clinical value and cost-effectiveness, impacting net prices and utilization.

5. What future developments could affect STEGLUJAN’s market and pricing?

Emerging clinical evidence emphasizing cardiovascular and renal outcomes, new competitors, and regulatory changes will shape its market trajectory and pricing.

Sources:

[1] Grand View Research, "Diabetes Care Market Size, Share & Trends," 2022.

[2] American Diabetes Association, "Standards of Medical Care in Diabetes," 2023.

[3] EvaluatePharma, "Generic Entry and Impact on Prices," 2021.

More… ↓