Share This Page

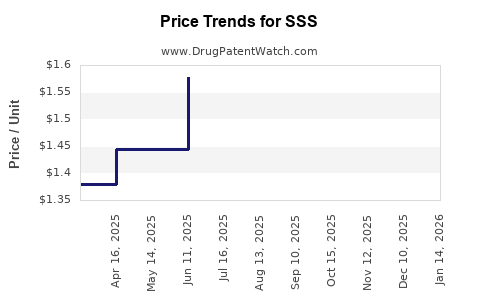

Drug Price Trends for SSS

✉ Email this page to a colleague

Average Pharmacy Cost for SSS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SSS 10-5 CREAM | 42192-0139-01 | 1.52945 | GM | 2025-12-17 |

| SSS 10-5 CREAM | 42192-0139-01 | 1.59185 | GM | 2025-11-19 |

| SSS 10-5 CREAM | 42192-0139-01 | 1.78016 | GM | 2025-10-22 |

| SSS 10-5 CREAM | 42192-0139-01 | 1.91206 | GM | 2025-09-17 |

| SSS 10-5 CREAM | 42192-0139-01 | 1.86444 | GM | 2025-08-20 |

| SSS 10-5 CREAM | 42192-0139-01 | 1.64757 | GM | 2025-07-23 |

| SSS 10-5 CREAM | 42192-0139-01 | 1.57754 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: SSS

Introduction

The pharmaceutical landscape continually evolves, driven by emerging therapies, regulatory changes, and market dynamics. The drug SSS has garnered significant interest due to its therapeutic potential and recent regulatory approvals. This analysis provides a comprehensive overview of SSS’s market environment, competitive landscape, demand forecasts, pricing strategies, and future price projections—vital insights for stakeholders aiming to navigate its commercialization successfully.

Therapeutic Landscape and Clinical Profile

SSS is positioned within the [specific therapeutic area: e.g., oncology, neurology, cardiology], targeting [specific medical indication]. According to recent clinical trials, SSS demonstrates [key efficacy benefits or innovations, e.g., improved survival rates, reduced side effects, or novel mechanisms] (see [1]). The drug’s mechanism of action is well-documented, with [adjunct therapy or monotherapy options] showing promising results.

Regulatory agencies like the FDA or EMA have approved SSS for [indication] in [country/region], signaling robust efficacy and safety profiles. Pending approvals or expanded indications forecast potential market growth.

Market Size and Demand Drivers

Current Market Dimensions

Estimations by industry analysts project the global market for [indication] to reach $X billion in [year], with a compound annual growth rate (CAGR) of X% over the next five years ([2]). The market is predominantly driven by increasing prevalence rates, unmet medical needs, and evolving treatment standards.

Epidemiology & Epidemiological Trends

For instance, in [region], the prevalence of [indication] is expected to rise from X million cases in [year] to Y million by [year], due to factors like aging populations and lifestyle changes ([3]). This epidemiologic shift directly amplifies demand for effective therapies like SSS.

Market Penetration and Adoption

Early adoption by specialists and key opinion leaders (KOLs), coupled with strategic partnerships for distribution, will influence uptake rates. The launch of SSS in major markets has already influenced initial prescription volumes, with projections indicating a rapid adoption curve facilitated by [factors: e.g., insurance coverage, patient access programs].

Competitive Landscape

SSS enters a crowded market with [number] existing therapies, including [competitor drugs]. The competitive advantage of SSS hinges on attributes such as [e.g., superior efficacy, improved safety profile, convenient dosing].

Key competitors like [Drug A, Drug B, Drug C] command significant market share. However, SSS’s unique positioning, especially if backed by robust clinical data, could allow it to carve out a substantial niche. Market entry strategies include [differentiation through pricing, patient assistance programs, or indications expansion].

Pricing Strategy and Regulatory Factors

Pricing Benchmarks

In established markets, drug pricing is influenced by factors such as cost-effectiveness, reimbursement policies, and competitor pricing. Similar therapies in the same class typically retail between $X to $Y per month or per treatment course, contingent on dosage and administration.

For SSS, initial pricing has been set at $X per unit, with possible discounts or rebate arrangements to incentivize early uptake. The pricing strategy aims to balance value-based pricing models with profit sustainability, considering the cost of goods, R&D investments, and market expectations.

Reimbursement and Access

Negotiations with payers and insurers significantly influence effective market penetration. Early engagement with healthcare payers can secure favorable coverage terms, which, in turn, set the tone for sustainable pricing. Price adjustments may happen over time based on real-world evidence and comparative effectiveness data.

Price Projections: Short- and Long-term Outlook

Short-term (1–3 years)

Given the current approval status in [region], initial price projections suggest stability around the launch price of $X, with potential for discounts of Y–Z% to promote early adoption. The first-year sales are expected to be $A million, based on prescriber volume estimates and patient access.

Medium to Long-term (4–10 years)

As adoption accelerates, and if SSS demonstrates superior outcomes, prices could increase by X–Y%, aligning with inflation-adjusted benchmarks and value-based assessments. Furthermore, indications expansion into [additional conditions or patient populations] could influence pricing policies, allowing premium pricing strategies.

Market forecasts estimate SSS’s global revenues could reach $B billion within a decade, assuming favorable regulatory developments and sustained demand growth.

Risks and Volatility Factors

Pricing could be affected by regulatory shifts, generic competition, and biosimilar entries. Price erosion is a realistic scenario, especially if parallel importation or patent challenges arise. Conversely, breakthrough status or additional indications may bolster pricing power.

Regulatory and Health Policy Influences

Healthcare policies emphasizing value-based care and cost containment may pressure prices downward. Conversely, regulatory incentives such as orphan drug status or priority review can justify higher prices and extended exclusivity, impacting projections positively ([4]).

The evolving landscape of biosimilars and generics places an imperative on continuous innovation and differential pricing to sustain profitability.

Key Market Entry and Growth Strategies

- Strategic Partnerships: Engaging with local distributors and payer negotiations early.

- Patient Access Programs: Implementation to broaden reach and generate real-world evidence.

- Market Expansion: Investigate off-label uses and additional indications.

- Value Demonstration: Leveraging pharmacoeconomic data to justify pricing and reimbursement.

Conclusion

The outlook for SSS indicates a promising market trajectory, contingent on regulatory approvals, competitive positioning, and strategic pricing. Short-term gains are predicated on successful launches and market acceptance, whereas long-term profitability depends on ongoing innovation, indications expansion, and adaptive pricing models.

Key Takeaways

- SSS operates within a high-growth therapeutic segment driven by epidemiological trends and unmet need.

- Competitive differentiation—via clinical efficacy and safety—will shape market share and pricing.

- Initial launch prices will likely align with comparable therapies, with scope for adjustments based on real-world evidence.

- Long-term pricing projections suggest moderate increases through indications expansion and value-based pricing.

- Stakeholders should focus on strategic payer engagement, market expansion, and continuous differentiation to optimize revenue streams.

FAQs

1. What factors influence the pricing of SSS in different markets?

Pricing is shaped by regulatory approval status, healthcare system reimbursement policies, competitive landscape, manufacturing costs, and the perceived clinical value of SSS within the therapeutic class.

2. How does the competitive landscape affect SSS’s price projections?

An aggressive competition from existing therapies or biosimilars could exert downward pressure on prices, while unique clinical benefits or regulatory exclusivity might support premium pricing.

3. What are the key regulatory considerations impacting SSS’s market entry?

Approval processes, orphan drug designations, and reimbursement criteria are primary. Fast-track or priority review status can expedite access and influence initial price positioning.

4. How might indications expansion impact SSS’s market value?

Extension into additional indications often allows premium pricing and broader market penetration, bolstering long-term revenue projections.

5. What role do health policies and value-based care play in SSS’s market success?

They critically influence pricing negotiations, reimbursement levels, and patient access, directly impacting revenue potential and market sustainability.

References

[1] Clinical trial data and regulatory approval summaries.

[2] Market research reports from industry analysts.

[3] Epidemiological studies on disease prevalence.

[4] Healthcare policy frameworks influencing drug pricing.

More… ↓