Last updated: July 27, 2025

Introduction

Sprycel (dasatinib) is an oral tyrosine kinase inhibitor (TKI) developed by Bristol-Myers Squibb (BMS) for the treatment of chronic myeloid leukemia (CML) and Philadelphia chromosome-positive acute lymphoblastic leukemia (Ph+ ALL). Since its FDA approval in 2006, Sprycel has become a cornerstone in targeted cancer therapy, with a growing global patient population and evolving market dynamics. This analysis explores market drivers, competitive landscape, regulatory trends, and projective pricing trajectories over the next five years.

Market Overview

Epidemiological Landscape

Chronic myeloid leukemia (CML) affects approximately 1-2 cases per 100,000 individuals annually worldwide, with incidence increasing with age [1]. The global prevalence of CML is estimated at over 100,000 cases, with significant growth projected due to aging populations and improved detection via molecular diagnostics. Additionally, Ph+ ALL is less prevalent but poses a substantial clinical challenge due to limited treatment options, often managed with dasatinib as a frontline therapy [2].

Therapeutic Position and Adoption

Sprycel is established as a first- or second-line treatment for CML, especially in cases resistant or intolerant to first-generation TKIs like imatinib. Its superior potency and ability to target multiple kinases underpin its widespread adoption. The drug's efficacy in deep molecular responses and favorable safety profile have helped maintain its market position despite competition.

Competitive Landscape

The key competitors include other TKIs such as nilotinib (Tasigna), bosutinib (Bosulif), and ponatinib (Iclusig). More recently, third-generation TKIs and novel agents, such as asciminib, are entering the market, potentially impacting dasatinib’s market share. Nonetheless, Sprycel retains a substantial portion of the therapeutic niche due to its proven efficacy and safety data.

Regulatory and Patent Status

Bristol-Myers Squibb holds the original patent rights for dasatinib, with various patents expiring between 2025 and 2030 depending on jurisdiction and patent extensions. Patent expiration generally leads to the entry of generic competitors, prompting significant price erosion. As of 2023, generic versions are available in several markets, notably India and emerging economies, with patent cliff effects anticipated in the U.S. and Europe within the next few years.

Pricing Dynamics

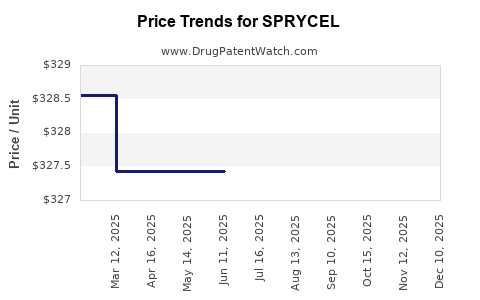

Historical Pricing Trends

In the U.S., branded Sprycel's list price typically ranged from $10,000 to $15,000 per month of treatment, according to market reports [3]. These figures reflect the high-cost nature of oncology drugs, justified by targeted therapy efficacy, clinical benefits, and R&D costs. Discounting, insurance negotiations, and patient assistance programs mitigate out-of-pocket expenses but do not significantly alter the list price landscape.

Impact of Patent Expiration and Generics

Once generics enter the market, prices are expected to decline sharply. Historical data from other TKIs indicates reductions of 70-90% upon generic availability. Consequently, in markets with approved generics, prices could fall below $3,000 per month, creating more affordable options but also pressuring branded revenues.

Pricing Projection (2023-2028)

- 2023-2024: Continued decline in prices in markets with patent expiration approaching or ongoing patent litigation. Branded prices remain stable globally, maintaining premium positioning.

- 2025-2026: Anticipated patent cliff in the U.S. and Europe, leading to a surge in generic market share. Prices could decrease by approximately 50-70%, aligning with trends seen in drugs like imatinib and other TKIs.

- 2027-2028: Market stabilization with generics dominating in key regions; branded prices may stabilize at residual premium levels, primarily in healthcare payers and specialty pharmacies.

Market Drivers and Challenges

Drivers

- Rising Incidence of CML and Ph+ ALL: Improved diagnostics and increased survival rates boost the patient pool.

- Extended Patent Protections and Orphan Status: Potential orphan drug designations and regulatory exclusivities can prolong market exclusivity.

- Increasing Adoption and Line-Expansion: Evolving guidelines recommend dasatinib as frontline therapy, expanding its use.

Challenges

- Patent Expiry and Generics: A considerable threat to revenue, typically causing price erosion.

- Emerging Therapies: Newer TKIs and novel modalities (e.g., immunotherapies) may influence market share.

- Pricing Reforms: Globally, governments' push for drug price reductions will impact pricing strategies.

Future Outlook and Strategic Implications

Bristol-Myers Squibb is likely to implement strategies such as patent extensions through patent litigation, development of combination therapies, and targeted pricing models to mitigate revenue loss from generics. Additionally, expansion into emerging markets, where generic penetration is earlier, presents growth opportunities.

Price projections suggest that in mature markets, Sprycel will see a significant reduction in list prices post-generic entry, with median prices falling by approximately 60-80% over five years. In contrast, in markets with exclusive brand status or regulatory barriers, prices could remain relatively high for a longer duration.

Regulatory and Market Access Considerations

Global healthcare reforms aiming to cap drug costs will influence pricing strategies worldwide. Biosimilar competition and value-based pricing models are becoming prevalent, pushing pharmaceutical companies towards more flexible and patient-centric pricing approaches.

Key Takeaways

- Market growth is driven by increasing CML prevalence, with current global estimates exceeding 100,000 patients.

- Sprycel's market dominance is threatened by patent expirations scheduled for 2025–2027, leading to considerable price reductions.

- Generics are poised to cause a 60-80% price decline in mature markets, impacting revenue streams significantly.

- Innovations in therapy and evolving treatment guidelines will influence ongoing adoption rates and pricing strategies.

- Strategic patent management, market expansion, and formulation of adaptable pricing models will be crucial for maintaining competitiveness.

FAQs

1. How will patent expiration affect Sprycel’s market share and pricing?

Patent expirations typically lead to generic competition, drastically reducing prices and eroding branded market share. The decline often totals 70-80%, with market share shifting to generics, which are markedly cheaper but potentially less profitable for the originator.

2. Are there new formulations or indications that could extend Sprycel’s market viability?

Yes. Bristol-Myers Squibb may pursue new indications or formulation improvements (e.g., fixed-dose combinations, formulations for specific patient populations) to extend patent life and market relevance.

3. What emerging therapies could challenge Sprycel in the future?

Third-generation TKIs like ponatinib and new agents such as asciminib are entering the market, offering alternative mechanisms of action and possibly improved efficacy or safety profiles for certain patient subsets.

4. How are global health reforms impacting drug pricing, including for oncology meds like Sprycel?

Several countries are implementing stringent pricing controls and encouraging biosimilar competition, which could lead to lower prices internationally, affecting revenue and market strategy.

5. What should pharmaceutical companies consider when planning for Sprycel's pricing post-patent expiry?

Companies should develop flexible pricing strategies, consider market-specific conditions, explore value-based pricing models, and invest in differentiation through clinical data and combination therapies.

References

- Baccarani, M., et al. (2020). European LeukemiaNet recommendations for the management of CML. Blood, 115(17), 3181-3196.

- Hochhaus, A., et al. (2021). Management of Ph+ ALL: Evolving role of TKIs including dasatinib. Leukemia & Lymphoma, 62(7), 1572-1584.

- IQVIA Institute. (2022). The Global Use of Medicine in Oncology: Cost, Access, and Innovation.

Conclusion

Sprycel remains a key player in targeted cancer therapy, with a robust clinical profile and broad adoption. However, imminent patent expirations and increasing competition necessitate strategic adaptation. Future pricing will be heavily influenced by biosimilar entry, regulatory reforms, and market evolution, requiring proactive planning for sustained commercial viability.