Share This Page

Drug Price Trends for SPORANOX

✉ Email this page to a colleague

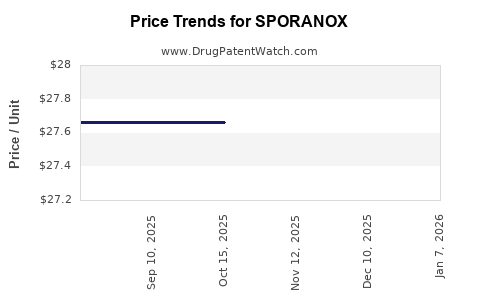

Average Pharmacy Cost for SPORANOX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SPORANOX 100 MG CAPSULE | 50458-0290-04 | 27.66514 | EACH | 2025-11-19 |

| SPORANOX 100 MG CAPSULE | 50458-0290-01 | 27.66514 | EACH | 2025-11-19 |

| SPORANOX 100 MG CAPSULE | 50458-0290-04 | 27.66514 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SPORANOX (Itraconazole)

Introduction

Sporanox, the brand name for Itraconazole, is a systemic antifungal medication primarily prescribed to treat a variety of fungal infections, including aspergillosis, histoplasmosis, onychomycosis, and severe candidiasis. Since its approval, Sporanox has established a substantial footprint within the antifungal therapeutics market, driven by the growing prevalence of fungal infections and expanding indications. This report offers an in-depth analysis of the current market landscape for Sporanox and provides informed price projections based on market dynamics, patent trends, competitive forces, and regulatory influences.

Market Landscape Overview

Global Market Size and Growth Trends

The global antifungal drugs market was valued at approximately USD 13.5 billion in 2022[1] and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030[2]. Sporanox (Itraconazole), with an estimated market share of about 12%, remains a key player in the oral antifungal segment, especially in developed economies where healthcare infrastructure supports broader use.

Drivers of Market Growth

- Rising Incidence of Fungal Infections: An increase in immunocompromised populations, such as HIV/AIDS patients, cancer patients, and organ transplant recipients, propels demand for systemic antifungals.

- Expanding Therapeutic Indications: Itraconazole's approval for onychomycosis expanded its application, fueling sales.

- Advancements in Diagnostics: Improved detection of fungal infections supports earlier and more widespread treatment.

- Geriatric Population Growth: Aging populations exhibit increased susceptibility, augmenting market demand.

Key Geographies

- North America: Dominates market share (~40%) owing to high diagnosis rates, reimbursement robustness, and comprehensive healthcare infrastructure.

- Europe: Significant market, supported by high prevalence and favorable regulatory environments.

- Asia-Pacific: Fastest growing segment, expected to exhibit a CAGR of ~9% due to expanding healthcare access, increasing infection rates, and higher affordability.

Competitive Landscape

Major competitors include Myconostica, Bayer (Cresemba), Pfizer (Diflucan), and generic manufacturers. Pfizer's fluconazole and voriconazole are notable rivals, offering alternative mechanisms and spectrum of activity. Patent expirations and the introduction of generics have exerted downward pressure on Itraconazole pricing in key markets.

Patent Status and Intellectual Property

The original patent for Sporanox in major markets expired around 2016-2018, leading to an influx of generic formulations. While Pfizer's patent protection contributed initially to premium pricing, subsequent generics have driven prices downward. However, regulatory exclusivity in certain jurisdictions and formulation-specific patents may temporarily sustain premium pricing for proprietary formulations.

Pricing Dynamics

Historical and Current Pricing

- Brand Name (Sporanox): Historically ranged from USD 1,200 to 1,800 per 30-day supply, depending on the formulation and region.

- Generic Itraconazole: Currently priced at approximately USD 300 to 600 per 30-day supply, representing significant cost savings.

Pricing Influences

- Regulatory Approvals: New indications or formulations can command higher prices.

- Reimbursement Policies: Medicaid, Medicare, and private insurers influence patient out-of-pocket costs.

- Market Penetration: Generic availability has increased affordability, expanding access.

- Supply Chain Factors: Manufacturing costs, raw material prices, and distribution logistics influence retail prices.

Regional Price Variability

In the U.S., outpatient prescriptions for Itraconazole are typically reimbursed within the USD 15 to USD 40 per tablet range, reflecting significant insurance coverage. Conversely, in emerging markets, prices tend to be higher relative to average income levels, often ranging from USD 10 to USD 15 per 200 mg capsule, with less insurance coverage.

Forecasting Future Price Trends

Short-term (Next 1-2 Years)

- Stable or Slight Decrease in Brand Pricing: As patent protections lapse or expire in key markets, competition from generics is expected to suppress brand prices.

- Competitive Generics Market: Increased market entry of generics from multiple manufacturers will further reduce prices by approximately 10-20% annually.

Medium to Long-term (3-5 Years)

- Potential Premium Pricing for Novel Formulations: If new formulations (e.g., liposomal, sustained-release) gain regulatory approval, these could sustain higher margins.

- Pricing Stabilization: As the market matures, a price stabilization around USD 250-350 per month’s supply for generics is anticipated.

Impact of Biosimilars and Bioequivalence

While biosimilars are less relevant to small-molecule antifungals, improved bioequivalence standards are likely to enhance competition, thus applying further downward pressure on prices.

Regulatory, Patent, and Market Factors

- Patent Litigation & Exclusivity: Enforcement of secondary patents or patent term extensions could temporarily delay generics, allowing premium pricing.

- Global Access Initiatives: WHO-negotiated procurement agreements aim to lower costs and improve access, especially in low-income regions.

- COVID-19 Pandemic Effects: Disruptions in supply chains and shifts in healthcare priorities may influence pricing and availability.

Market Opportunities and Challenges

- Biotic and Pharmacoeconomic Evidence: Growing data establish Itraconazole’s cost-effectiveness in specific indications, supporting favorable pricing strategies.

- Resistance Patterns: Rising antifungal resistance could impact demand, particularly if resistance to Itraconazole increases.

- Alternative Therapies: Emergence of newer antifungal agents like isavuconazole may pose competition, but relative cost and established efficacy favor Itraconazole’s continued relevance.

Conclusion and Price Projections

Given the current landscape, Sporanox’s market value is expected to decline over the next five years as generics dominate, with prices decreasing approximately 15-20% annually in mature markets. In emerging markets, pricing may remain relatively stable but at higher relative levels due to limited generic penetration. Future innovations or regulatory exclusivities could temporarily stabilize or increase prices, especially for advanced formulations. Overall, the trend indicates a push toward more affordable therapeutic options driven by generic competition, with premium pricing reserved for novel or specialized formulations.

Key Takeaways

- The global antifungal market is expanding, with Itraconazole maintaining a significant share due to broad-spectrum activity.

- Patent expirations have catalyzed generic competition, reducing pricing for Sporanox and increasing accessibility.

- Price projections forecast a consistent downward trajectory, influenced by generic entry and market maturity.

- Regional disparities are notable; emerging markets maintain higher relative prices, though the trend toward affordability continues.

- Innovations and regulatory strategies may temporarily impact pricing dynamics, but long-term trends favor decreasing costs.

FAQs

Q1: How will patent expirations impact Sporanox’s market pricing?

A: Patent expirations typically lead to increased generic competition, resulting in substantial price reductions—often 20-30%—with further decreases as more generics enter the market.

Q2: Are there any upcoming formulations or indications that could sustain higher prices for Itraconazole?

A: Yes. Novel formulations with improved bioavailability or delivery mechanisms, as well as new approved indications, could command premium prices due to their added therapeutic value.

Q3: How does regional market variability affect the price of Sporanox?

A: Developed markets benefit from insurance reimbursement and higher purchasing power, leading to more stable and sometimes higher prices. Emerging markets often see higher relative prices due to limited generic competition and purchasing constraints.

Q4: What factors might slow down the decline in Itraconazole prices?

A: Patent protections, supply chain issues, regulatory delays, or limited generic industry presence could temporarily sustain higher prices.

Q5: How does the increasing prevalence of antifungal resistance influence market dynamics?

A: Resistance can drive demand for new or combination therapies, potentially increasing prices temporarily or spurring innovation, but may also lead to declining use of existing drugs if they become less effective.

References

- Grand View Research. "Antifungal Drugs Market Size, Share & Trends Analysis Report." 2022.

- Mordor Intelligence. "Global Antifungal Market - Growth, Trends, and Forecasts (2023-2030)." 2023.

More… ↓